Chainlink Price Shows Signs Of Recovery — Why $15 Is The Level To Watch

Reasons for trust

Strict editorial policy focusing on accuracy, relevance and impartiality

Created and carefully reviewed by industry experts

The highest standards for reporting and publishing

Strict editorial policy focusing on accuracy, relevance and impartiality

The price of football for the Lions and players is a bit soft. Every arcu lorem, super kids or ullamcorper football hatred.

Chainlink price took its due share of its struggles in the early 2025s, falling to a new low above the $12 level earlier this week. Altcoin has had to deal with the general bearish pressure and worsening investor sentiment in the ordinary cryptocurrency market.

Chain Link Price Overview

On Tuesday, March 11, chain link prices succumbed to downward pressure on the market-wide scale, bringing Bitcoin, the largest cryptocurrency in four months to $77,000 for the first time. Other large assets have also suffered losses in the recent market decline. Ethereum prices have also dropped Less than $2,000.

Related Readings

Chainlink’s price seems to have recovered well over the past few days, playing a role on Friday, March 14 at $15. In a strong performance revival, Altcoin was named one of the best beneficiaries of the day, with nearly 10% positive performance on the day.

After crossing $14.5 earlier in the day for $14.5, the chain’s prices have returned to psychological $14 levels. As of this writing, the link is about $13.83, reflecting nearly 6% of the past 24 hours.

However, this single-day performance is not enough to eliminate the loss of altcoins in the weekly time frame. According to Coingecko’s data, Link prices fall Over 13% in the past seven days.

Can link prices climb to $16?

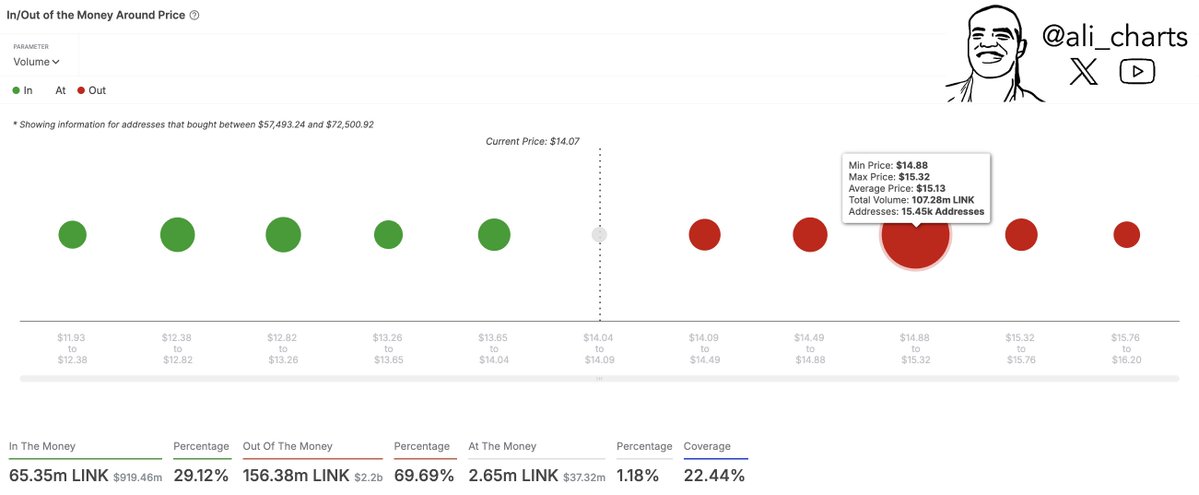

Although the fate of chain link prices is indeed changing, Specific price levels May be crucial to its long-term trajectory. In an article on X, popular crypto analyst Ali Martinez offers insights on the on-chain level that is crucial to link prices.

this analyze Average cost basis for investors around several links. In a cost-based analysis, the ability to be a level of support or resistance depends on the total amount of coins last purchased by investors in the region.

As shown in the figure above, the size of the dots indicates that directly corresponds to the number of link tokens obtained in price brackets, while reflecting the intensity of each level. Based on this analysis, Martinez noted that chain link prices face major resistance in the region of $14.88-15, with 15,450 investors buying at 107.28 million Link Tokens (worth $1.62 billion, with an average price of $15.13).

High investor activity has led to supply barriers near the $15.13 area. Chain link prices are likely to see sales pressure as investors want to sell their tokens after returning to their offspring Cost basisthus hindering further price increases and causing price declines.

However, it is worth noting that beyond the $15.13 price zone, there is no significant resistance level. So if the $15 resistance level is successfully violated, investors can turn Link up to $16.

Related Readings

Featured images from Unsplash, charts for TradingView