Stablecoins Supply Up By $20 Billion

Reasons for trust

Strict editorial policy focusing on accuracy, relevance and impartiality

Created and carefully reviewed by industry experts

The highest standards for reporting and publishing

Strict editorial policy focusing on accuracy, relevance and impartiality

The price of football for the Lions and players is a bit soft. Every arcu lorem, super kids or ullamcorper football hatred.

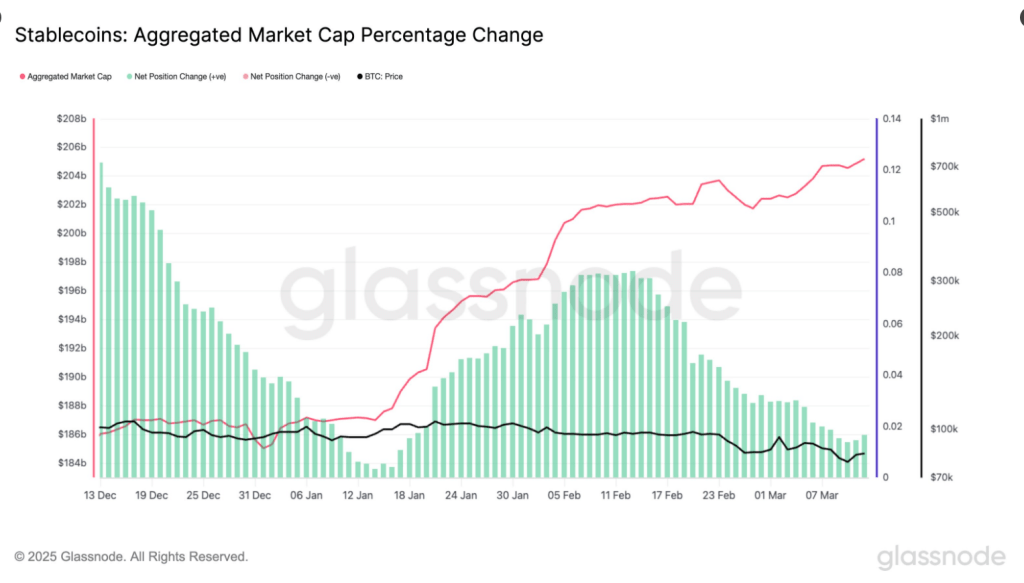

In early 2025, the Stablecoin market grew sharply, with total supply increasing by $20 billion. It has increased by 10% from January, and the total supply is currently close to $205 billion. According to Glass nodeAfter the decline in late 2024, the stable stable volume fell from $187 billion to $185 billion.

Related Readings

Stablecoins sees a strong rebound

Used to trade cryptocurrencies, stablecoins – USDT and USDC– Usually the reserve of investors who expect the right time to buy assets like Bitcoin. Recent growth shows a surge in investor interest, especially given the slowdown last year.

Since January 1 #stablecoin Supply has increased by $2.017 billion (+10.9%) and is now above $205B.

For comparison, December peaked at $187B, but supply actually contracted in the last two weeks of 2024, down to $185B by January 2025. pic.twitter.com/gqbdmedisb

– Glass Node (@GlassNode) March 13, 2025

This comeback is particularly noteworthy given the last fall. The market has been losing money for most of 2024 Stable;However, this trend has reversed recently. While past patterns suggest that Bitcoin’s price may be affected, it is unclear whether this increase will lead to an increase in cryptocurrency purchases.

Bitcoin investors pay close attention

Growing Stablecoin supply is often seen as a bullish sign Bitcoin. Historically, the price of Bitcoin matches the Stablecoin quantity. The reasoning is simple: more stabilizers mean more potential capital is waiting to enter the market.

Some analysts believe this fresh injection may boost Bitcoin. However, not all stabilizers are used in trading. Many people are held for remittances, payments, or hedging against inflation, especially in countries where local currencies are unstable.

As of today, the market cap of cryptocurrencies stood at $2.65 trillion. Chart: TradingView

Stablecoin Exchange Holtings drops 21%

While total supply is rising, only 21% of stablecoins are currently sitting on the exchange. GlassNode disclosed that this was a significant drop from 2021, when more than 50% of the supply was available for immediate trading. This shift suggests that when new coins are issued, they are not immediately deployed to the cryptocurrency market.

Related Readings

This may point to one of two possibilities: either the frequent use of Stablecoins outside of the exchange, or investors are still waiting for the right moment. If the latter proves to be correct, the impact on Bitcoin may not be as expected.

What does this mean for the future of Bitcoin

The Stablecoin market is currently experiencing a revival, which is often a favorable development for the cryptocurrency industry. However, it is not yet certain whether this will lead to a short-term increase in Bitcoin prices. Stablecoin utilization fluctuates, and other economic variables will contribute to this development.

At the time of writing, Bitcoin trades at 82,264. 1.1% and 6.9% In daily and weekly frameworks.

Featured images of Warwick Business School, TradingView’s charts