Global M2 Tightens Grip On Bitcoin—What’s Next?

Reasons for trust

Strict editorial policy focusing on accuracy, relevance and impartiality

Created and carefully reviewed by industry experts

The highest standards for reporting and publishing

Strict editorial policy focusing on accuracy, relevance and impartiality

The price of football for the Lions and players is a bit soft. Every arcu lorem, super kids or ullamcorper football hatred.

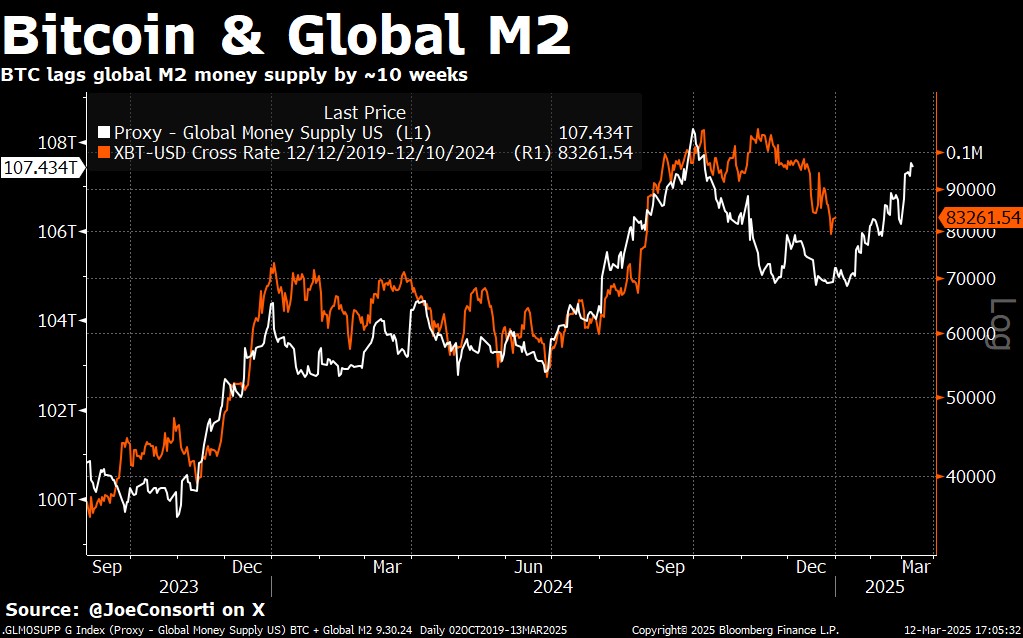

Bitcoin’s close correlation with global M2 has risen again, suggesting that the broader monetary situation remains a key force behind the cryptocurrency market trajectory. Recent price action shows that Bitcoin merges with the downward drift of M2, which is about a 70-day lag. This cyclical movement underscores Bitcoin’s continued responsiveness to liquidity fluctuations, although other fundamental factors such as the newly announced U.S. Strategic Bitcoin Reserve (SBR) continue to take over the headlines.

Global M2 correlation and inefficiency in Bitcoin market

In his latest research notesAnalyst Joe Consorti stressed: “Bitcoin’s directional correlation with global M2 tightened again”, indicating that prices are still severely affected by the trend of money supply. After months of divergence (partially with strong dollars), Bitcoin fell to $78,000, down to within $8,000 of the M2 projected road.

worldwide M2 index It has softened, partly reflecting the strong performance of the US dollar. Despite this resistance, Bitcoin appears to be following the general liquidity blueprint it tracks throughout the cycle, suggesting that Bitcoin’s price remains dependent on major macro forces such as central bank expansion and contractions. “Although this relationship is not a direct causal mechanism, it continues to provide a useful macro framework,” Consorti wrote.

He added: “The point? In a world where money supply, balance sheet capacity and credit are eternally expanded, Bitcoin remains the ultimate monetary asset. As the global money supply expands, Bitcoin tends to follow it at least in the direction. But this cycle is seeing other variables that make M2 a less reliable independent indicator, such as the strong historically strong US dollar, which puts resistance to the global M2 denominated in US dollars and measures the measures of money supply and liquidity more accurately.”

Related Readings

Although macro conditions are putting familiar pressures, the market is SBR Announcement Always confusing. Prices fell 8.5% in less than a week after U.S. President Donald Trump officially announced plans to accumulate Bitcoin through a “budget neutral” mechanism. Consorti described the sell-off as an “irrational reaction that underlines the main inefficiency of Bitcoin’s geopolitical importance.”

Executive Order 14233 requires Treasury and business officials to develop BTC holdings in the U.S. without new taxpayer costs or congressional oversight (currently 198,109 BTC). This is in stark contrast to the adoption of the former government level, e.g. El SalvadorThe statutory bidding coincides with the rise in Bitcoin prices. Counsorti attributes the gap to short-term profit-making and “selling new” mentality, adding: “The extent of the sell-off shows that the long-term meaning is completely unpriced.”

Despite the DIP associated with SBR, Bitcoin’s technical signals suggest that a local bottom may be formed. The cryptocurrency fell to $77,000 and then bounced back, filling the low-capacity gap between $76,000 and $86,000. The buyer grabbed the backtrack and created two hammer candlesticks on the weekly chart.

Related Readings

Hammer candlesticks usually point to reversals, especially when they appear at the level of support defined by the bike. According to Consorti, “historical precedents show that Bitcoin forms these patterns at cycle turning points… The last time we saw this exact price structure was when the end of the Bitcoin summer 2024 merger surged from $57,000 to $108,000 in two months.”

One significant trend in these price volatility is Bitcoin’s dominance, even during market contractions. ETH/BTC recently sunk to 0.0227, the lowest since May 2020, suggesting increased suspicion about Altcoins. Meanwhile, institutional demand for Ethereum has also collapsed, proving that Ethereum’s managed assets (AUM) ratio has dropped by 56.8%.

“This cycle belongs to Bitcoin, and all future cycles will only further consolidate this reality,” Consorti asserted. He suggested that Altcoins is fighting an uphill battle as Bitcoin-centric narrative gains global appeal.

At press time, BTC was trading at $82,875.

Featured Images created with dall.e, Charts for TradingView.com