Dogecoin Network Activity Surges 47% In A Month – What’s Next for DOGE?

Reasons for trust

Strict editorial policy focusing on accuracy, relevance and impartiality

Created and carefully reviewed by industry experts

The highest standards for reporting and publishing

Strict editorial policy focusing on accuracy, relevance and impartiality

The price of football for the Lions and players is a bit soft. Every arcu lorem, super kids or ullamcorper football hatred.

Dogecoin (Doge) faces a critical moment, losing more than 40% of its value since early March. The entire crypto market is facing huge sales pressure, which is due to increased macroeconomic uncertainty and volatility. However, meme coins like Doge took the biggest hit as bears continued to actively shorten them, thus lowering prices with no signs of relief.

Related Readings

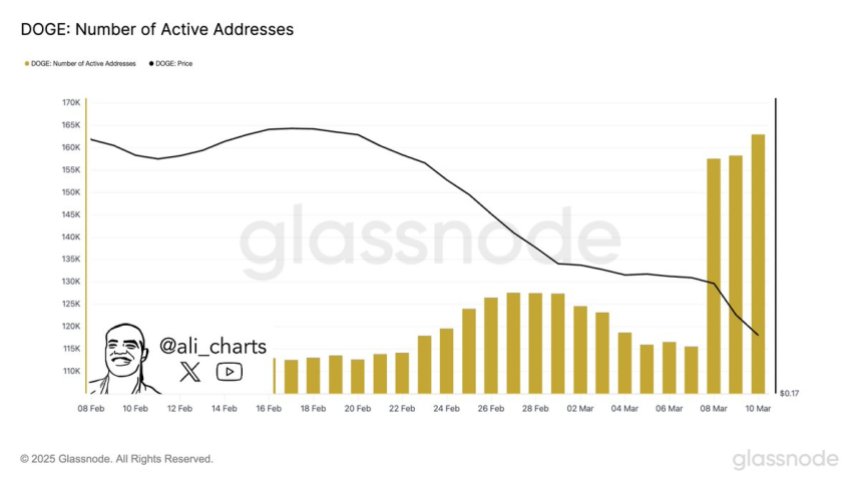

Despite the downturn, the data on the chain shows potential signs of recovery. Glass Festival indicators show that dog network activity is surging, with activity addresses increasing by 47% in the past month. Historically, increased network usage and trading activity can indicate new interests and potential accumulation of long-term holders.

If this trend continues The Governor can see the rebound Once the market conditions begin to improve. However, the Bulls still have a lot of work to do to restore the lost ground and regain Dogecoin’s bullish trend. The days ahead will be crucial as traders keep an eye on whether network growth can translate into price stability or further disadvantages for Doge and the wider Meme coin sector.

Dogecoin fell 70% as network activity showed growth

Dogecoin suffered a brutal sell-off, and the pressure to sell is still unremitting, now below its December high of 70%. In general, Meme coins have been the most affected asset in the market, as fear and speculation keep investors away from high-risk assets. As Doge failed to find strong support, the Bulls had to do a lot of work before any meaningful recovery.

Related Readings

A wider crypto market downturn will only increase the struggle. Bitcoin (BTC) has been on a downward trend since late January, and as fear continues to spread, investors are lowering their expectations and setting lower targets. If this does mark the end of the BTC bull cycle, meme coins like Dogecoin will be one of the worst hits, as speculative assets tend to be the biggest in bearish conditions.

However, not all signals are negative. Analyst Ali Martinez shares chain data on xreveals that Dogecoin’s network activity is increasing. Active addresses have soared 47% over the past month, from 110,000 to 163,000. Historically, rising cyber activity is often before the price recovery, as it demonstrates new interest and engagement in the ecosystem.

Although Doge still faces obvious resistance, this surge in activity may be an early sign that buyers are returning. If Bitcoin is stable, the meme coin industry may see a bounce, which could cause Dogecoin to return to key resistance levels. At the moment, Doge is still under pressure, but its growing network activity brings a glimmer of hope to bullish businessmen watching turnover.

Dogecoin’s struggle is $0.17 as the bears stay in control

Dogecoin is currently trading at $0.17 after suffering huge sales pressure and a huge shift in market sentiment to fear. The decline of the wider cryptocurrency market has made the Meme coins the hardest hit, while Doge struggles to find stability in a ruthless sell-off.

For potential recovery, Doge must remain above the critical $0.15 support level. If the Bulls manage to defend this area, they can try to push towards the psychological resistance of $0.20. Recovering $0.20 will indicate a possible reversal, providing the momentum needed to maintain the recovery of the rally.

However, if sales pressure continues and loses the $0.15 level, the situation may become more bearish. Rests below this support could result in a further drop of $0.10, a level that has not been tested since early 2023.

Related Readings

With market sentiment still fragile, traders are paying close attention to whether Doge can maintain its current range or whether it has more disadvantages. The next few trading sessions will be crucial as the Bulls must step in quickly to prevent another major investment.

Featured images from DALL-E, charts from TradingView