Bitcoin Posts Modest Gains After February CPI Inflation Comes In Cooler Than Expected

Reasons for trust

Strict editorial policy focusing on accuracy, relevance and impartiality

Created and carefully reviewed by industry experts

The highest standards for reporting and publishing

Strict editorial policy focusing on accuracy, relevance and impartiality

The price of football for the Lions and players is a bit soft. Every arcu lorem, super kids or ullamcorper football hatred.

Bitcoin (BTC) recorded a slight gain as consumer price index (CPI) inflation rate in February reduce Exceed expectations. The U.S. Federal Reserve (Fed) lowers the soft inflation rate, which boosts hope, could benefit risk-persistent assets.

Bitcoin jumps when inflation cools

In February, CPI increased by 0.2% on a seasonal basis, reducing annual inflation to 2.8%, according to the Bureau of Labor Statistics. Not only is this number lower than economists’ forecasts of 2.9%, it also marks a monthly increase of 0.5%.

Related Readings

Additionally, CORE CPI (excluding inflation values that exclude food and energy prices) rose 0.2% in the month, with most underperforming forecasts being 0.3%. Each year, Core CPI accounts for 3.1%, slightly below the consensus of 3.2%.

The inflation data that exceeded expectations rekindled investors’ optimism, hoping that the Fed could move more difficult monetary policies to poorer monetary policies by lowering interest rates. Lower interest rates usually favor risky assets such as stocks and cryptocurrencies.

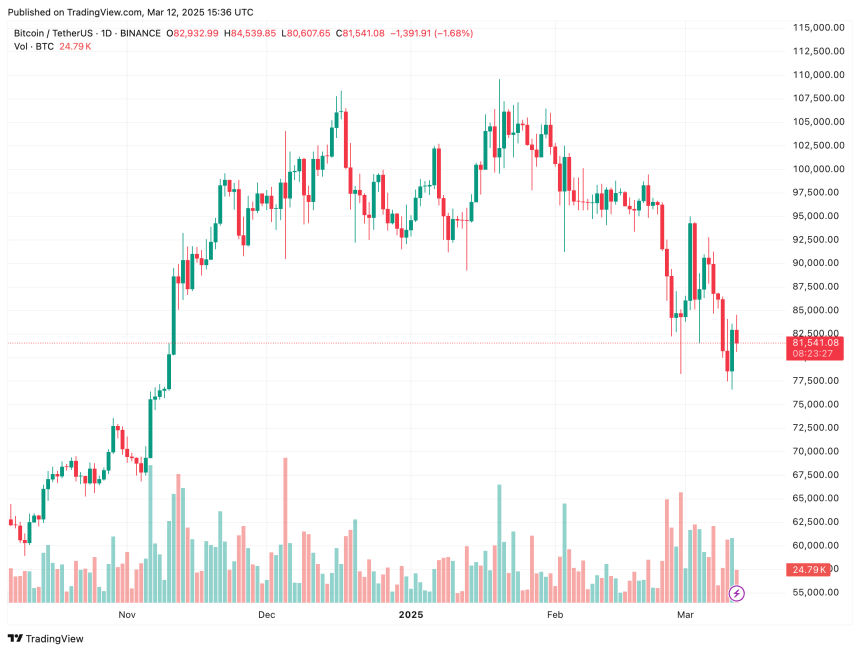

After the data was released, BTC released modest gains, climbing from about $81,000 to $84,500. The leading Memecoin Dogecoin (Doge) has also grown 2.9% in the past 24 hours.

It is worth noting that last month, BTC reject After the CPI data, the data is hotter than expected. Since then, U.S. President Donald Trump’s economic policies, especially high trade tariffs in countries such as Canada, Mexico and China, have further hindered the bullish digital asset momentum.

Earlier this month, BTC experienced one of its most dramatic declines, falling from $94,700 on March 2 to as low as $76,800 on March 11. During the same period, the total market value of crypto fell from $320 million to $320 million, and from $320 million to about $26,000.

BTC prices are expected to recover

While the current bearish trend has dragged BTC and other cryptocurrencies to multiple month lows, industry experts believe digital assets are likely to rebound in late 2025.

Related Readings

For example, crypto entrepreneur Arthur Hayes suggestion While BTC may drop further in the near term, central banks may resort to quantifying the stock market—a move that could also help risky assets recover their losses.

Similarly, the latest analysis by crypto contributor ibrahimcosar predict Despite the current economic downturn, BTC is poised to reach $180,000 in 2026. Trend Price recovery. At press time, BTC traded at $81,541, reflecting a 0.6% increase in the past 24 hours.

Featured images created by Unplash, charts for TradingView.com