Crypto Bull Run Isn’t Over—It’s Just Changing, Says Analyst

Reasons for trust

Strict editorial policy focusing on accuracy, relevance and impartiality

Created and carefully reviewed by industry experts

The highest standards for reporting and publishing

Strict editorial policy focusing on accuracy, relevance and impartiality

The price of football for the Lions and players is a bit soft. Every arcu lorem, super kids or ullamcorper football hatred.

During a period marked by extraordinary polarization, market participants find themselves ripped apart between two opposite camps: one firmly predicts that the current dip is merely the setting of the coming Altcoin Rally, while the other firm, broader crypto bull run has reached the conclusion. exist postal On X, Korfh Khaneghah, founder of Zero Complexity Trading, said: “Now is the most separate timeline I’ve ever seen. The Bulls think it’s the last drop before the playoffs. The Bears think the Bulls’ run is over.”

According to Khaneghah, “the “predictive” cycle phase becomes increasingly challenging as cryptocurrencies mature.” He highlighted developments that did not appear in previous cycles, including the transition from traditional altseason to Memecoin season, Ethereum (ETH) still hasn’t broken its all-time highs, Bitcoin (BTC) surpassed its ATH and exceeded 100k+ (no results in early cycles)

Two situations of encryption

1. This cycle is different from other cycles

Khaneghah points to growing institutional participation, an element that is clearly lacking in the early bull market. He cites data to show Black Stone Currently holding nearly $52 billion worth of BTC (via Arkham). He believes this greatly increases the long-term buying pressure on Bitcoin, resulting in a shallow pullback because “institutions will continue to buy.”

Related Readings

Khaneghah expects BTC’s dominance to continue to rise due to increased institutional interests. This dynamic could change the way capital rotates to altcoins: “In this cycle, altcoins have seen capital dispersion. Meaning, there are more assets in the market, liquidity is distributed across multiple sectors, preventing any sector from trying to pump water.”

He compared the Memecoin market with Defi. In the last cycle, the commemorative market was about half that of DEFI. During this cycle, Memecoin market value is equal to Defi.

If this happens, Khaneghah believes BTC will remain the focus of the main move, while Altcoins has experienced a more dispersed Micro Bull run. “This means the previous Bulls running books will not work, you just need to trade rotations,” he said.

2. The cow run is not over yet

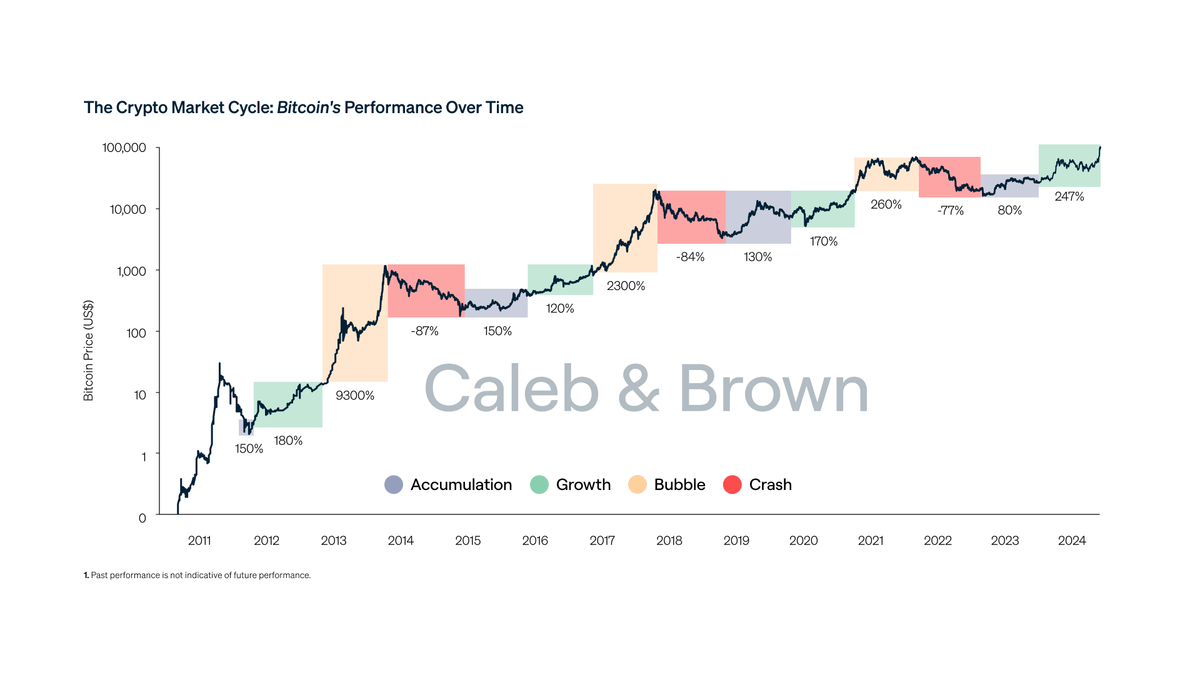

Khaneghah observed that BTC was only 1.6 times higher than the previous cycle before pulling backwards, calling it “not the normal top/bubble look.” From a historical perspective, BTC often withdraws 40-50% from its ATH before rising. In the current cycle, BTC only has About 26% is recovered from its peakif past patterns are repeated, it means that there is a possibility of higher space.

According to many analysts, a common bull trigger is surpassing its previous cycle highs – not yet happening given that ETH has not violated a $4,000 loss. Khaneghah believes this lag may indicate Delay substitution The overall cycle is much longer than expected.

Related Readings

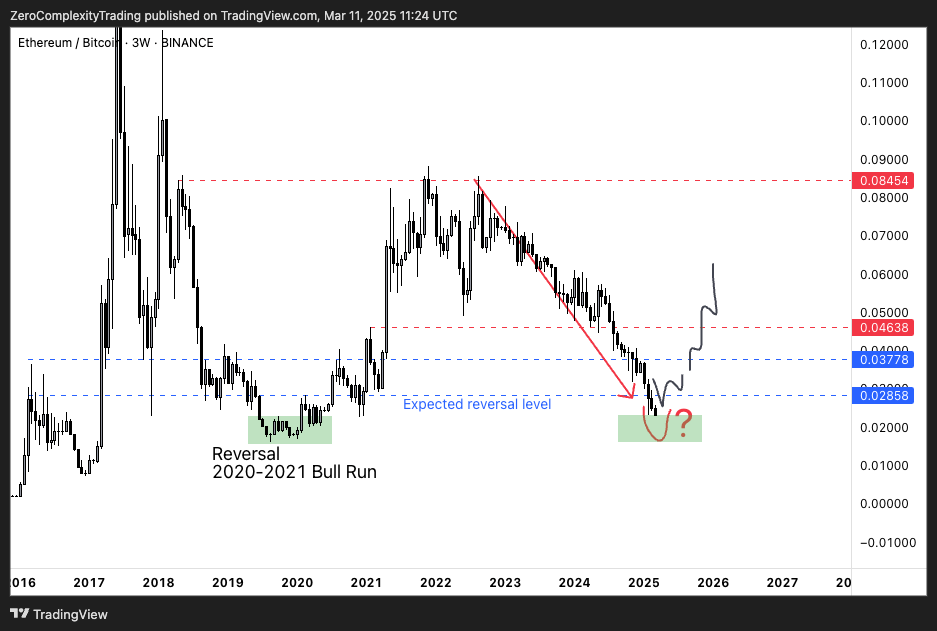

To restore momentum to AltCoins, Khaneghah regards the ETH/BTC pair as a key indicator. The bottom of ETH/BTC, coupled with the rotation from members to other utilities such as DEFI and RWA (real-world assets), can reignite the Altcoin rally.

Khaneghah concluded that traders don’t have to be fixed on bulls or bears: “If you are a trader, you don’t have to marry prejudice or promise attitudes to scenario 1 or 2. If BTC’s dominance continues, trade BTC, trade BTC by craving strength and short-lived weaknesses. – If Alts starts from the lowest point, transfer capital there and buy the strongest coins.”

At press time, BTC traded at $81,786.

Featured Images created with dall.e, Charts for TradingView.com