Bitcoin Bear Market Is Below This Level, Analyst Reveals

An analyst explains how the moving average (MA) historically sits at that level as the boundary of bear markets.

Bitcoin’s 50-week MA is currently $75,195

In the new postal On X, analyst James van Straten shared several important MAS related to Bitcoin. A “horse” is Technical Analysis (TA) Computes the average value of any given quantity and conforms to the tool that its name implies, which moves with the quantity and updates its value accordingly.

MAS can be taken up on any time window, whether it is only 10 minutes or 10 years. The main purpose of this indicator is to study long-term trends, as it helps filter out any short-term biases in the chart.

Here is a chart shared by analysts showing the trends of 50-week and 200-day MAS for Bitcoin prices over the past year:

As can be seen in the picture above, the price of Bitcoin has dropped below the last 200 days Market downturnwhich means that the current asset value is lower than the average of the past 200 days.

In TA, 200-day MA is often regarded as a boundary line between bearish and bearish trends, and its level is considered a bad signal. Therefore, it seems that BTC’s latest plunge has lost this important level.

However, another level that may divide the macro trend is the 50-week MA, which is still above that cryptocurrency. “Below 50wma is a bear market.” Currently, the level is at about $75,195.

If BTC’s current bearish trajectory continues, a test may be conducted. However, analysts noted that the coin dropped several times 200 days ago and managed to recover its 50-week MA. Now, it remains to be seen whether similar models will work this time.

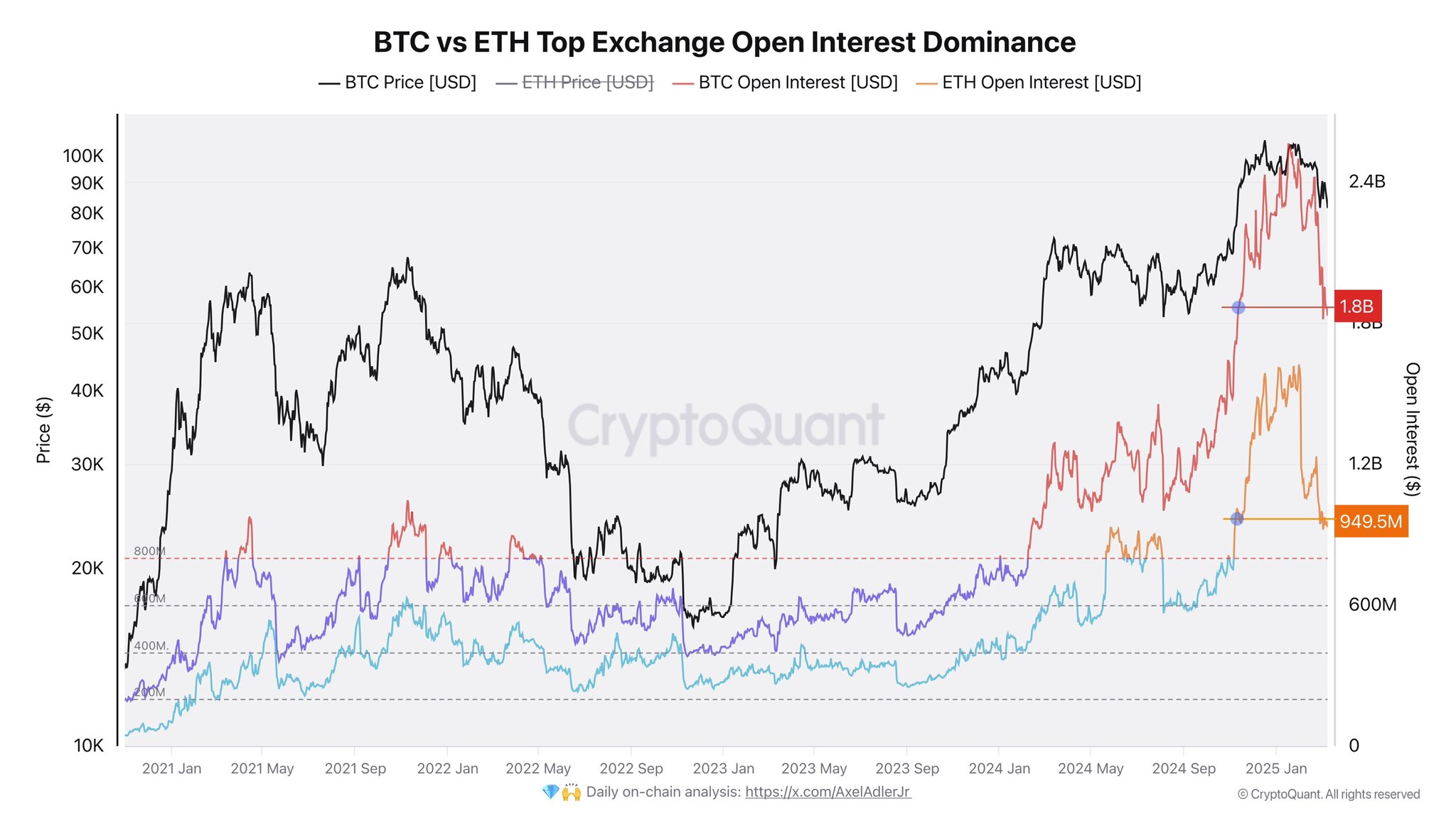

In some other news, the downward trajectory of the market means a leverage flush occurred on the derivatives side of the industry, as cryptographer Axel Adler JR shared in X postal.

In the chart, the analyst has attached “Open interest,” an indicator that measures the total number of derivative positions related to a given asset, which is currently open on all centralized exchanges.

It seems that the metric has fallen to $668 million in Bitcoin and $700 million in Ethereum.

BTC price

Bitcoin’s price has risen 7% to $83,000 in the past 24 hours.