Dogecoin’s Darkest Hour? Sentiment Tanks, Whales Accumulate

Reasons for trust

Strict editorial policy focusing on accuracy, relevance and impartiality

Created and carefully reviewed by industry experts

The highest standards for reporting and publishing

Strict editorial policy focusing on accuracy, relevance and impartiality

The price of football for the Lions and players is a bit soft. Every arcu lorem, super kids or ullamcorper football hatred.

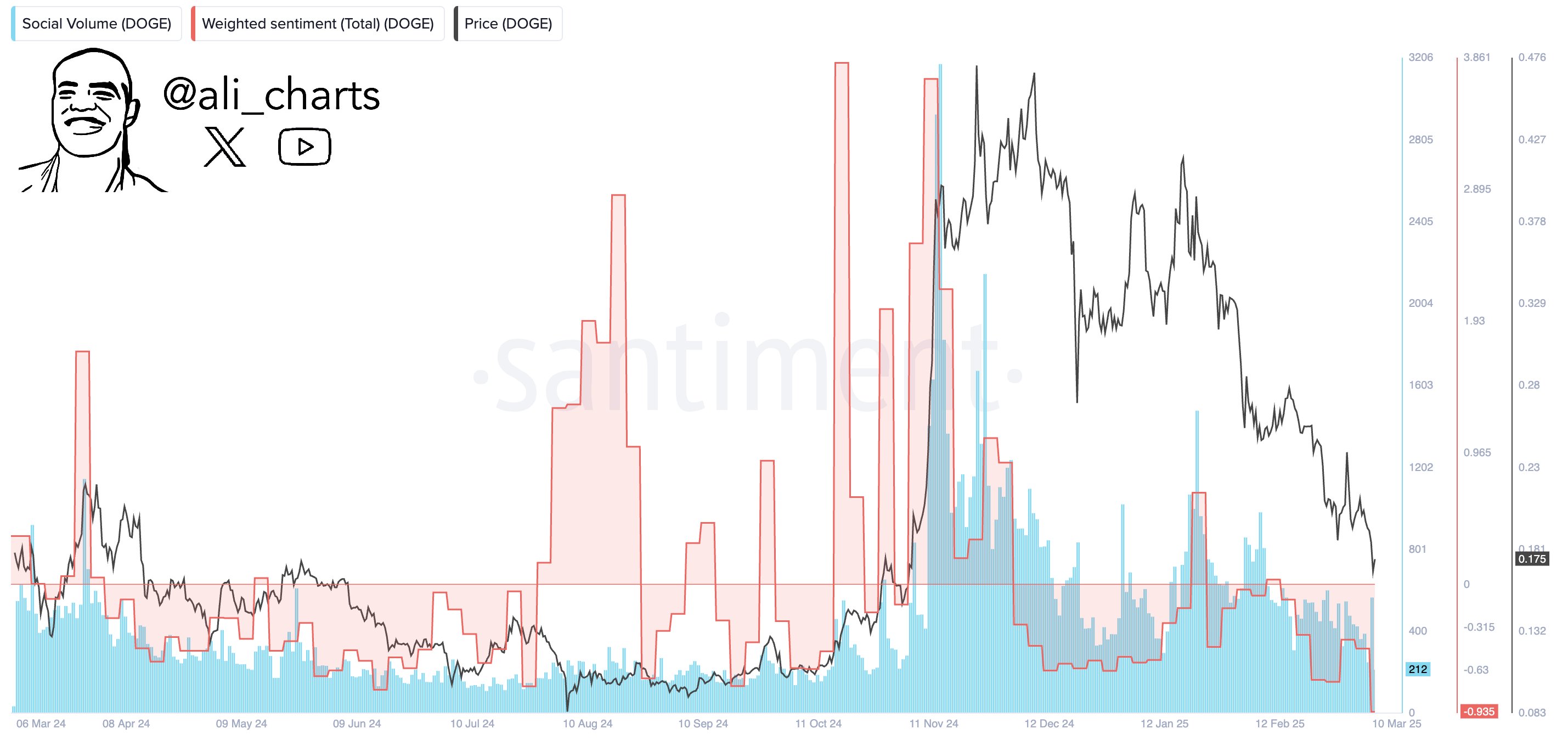

Dogecoin’s sentiment has reportedly reached its most negative level in more than a year. Crypto analyst Ali Martinez (@Ali_Charts) shares the following charts that illustrate the current landscape of Dogecoin’s social sentiment and Famous: “For more than a year, investor sentiment towards Dogecoin has been the most negative. Historically, extreme fear has laid the foundation for a major reversal. This may be a major opportunity to be a counter-trend person.”

What does this mean for dogs

In the chart, the red line (weighted sentiment) is now about -0.93, marking a steep reading over 12 months. Weighted sentiment considers the number of social media mentions (number of social interactions) and the overall polarity of the discussion (positive vs. negative). Spikes above zero generally indicate widespread bullish sentiment (and may coincide with price increases), while sharp declines suggest that market participants are overwhelmingly bearish.

Related Readings

In addition to the negative twists of weighted sentiment, the blue bars (social volume) of the chart show a moderate level compared to the dramatic spikes seen from mid-November to mid-December. During that period, social volume soared over 3,000 mentions, related to very positive weighted sentiment (+3+ on the chart) and a large number of price gatherings.

Now, social volume is hovering in nearly 200 mentions, highlighting the relatively low frequency of overall conversations about Doki, despite the dominance of negative sentiment.

Related Readings

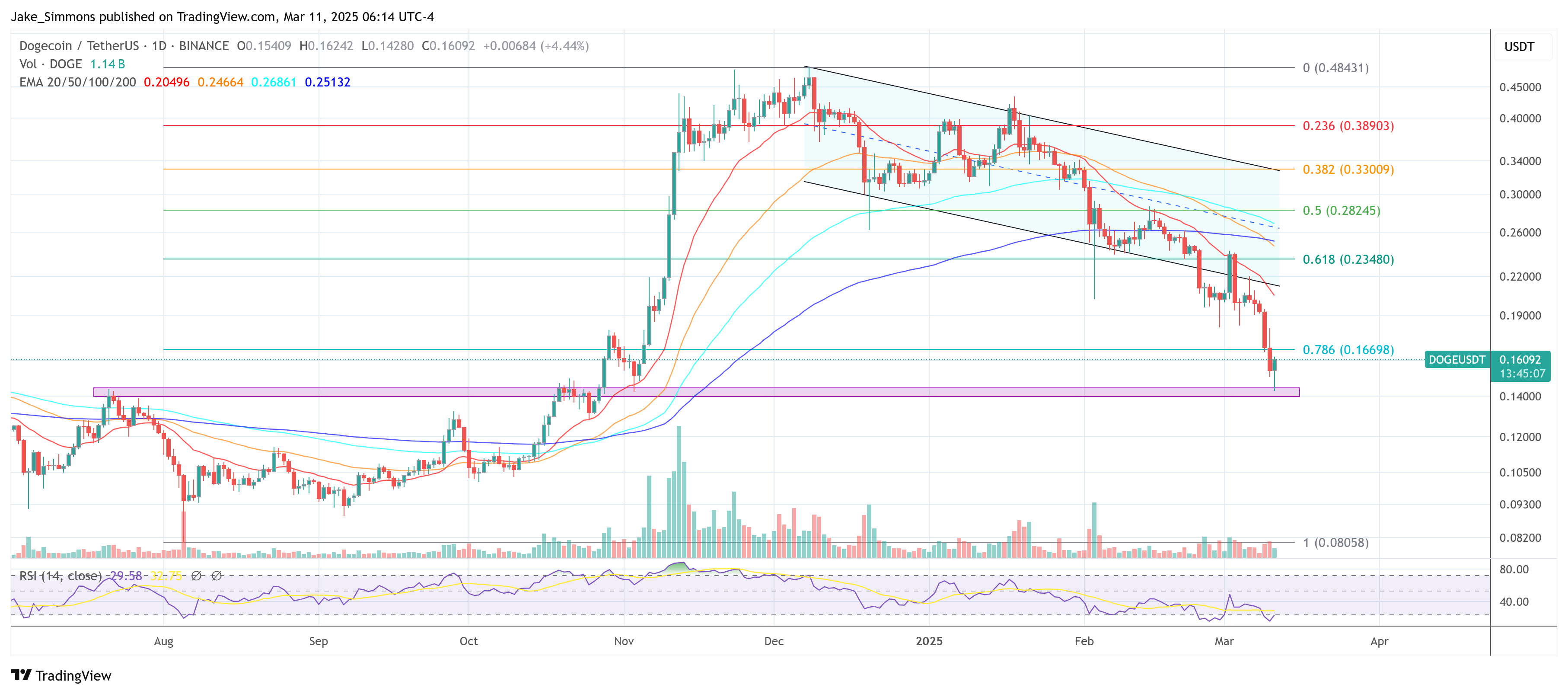

Another popular analyst Lumen (@Lumen0x), Point out The dog fell 20% in a week, from $0.22 to $0.17. Despite the decline, the whale address reportedly scalded 1.7 billion (about $298 million) in the past 72 hours, suggesting that larger players may be targeting Final rebound.

The lumen also speculates on potential Dogecoin ETF approval Can act as a bullish catalyst. According to him, if Dogecoin’s price recovers $0.20 before an ETF-related announcement, it could pave the way for a waste of $0.50, citing the liquidity that these investment vehicles could bring and the possibility of renewing social media excitement.

According to Lumen, the price of instant support is around $0.17-0.18, reflecting the lowest low on the chart. The psychological pivot point is $0.20, and the level that analysts often mention is The bullish continues. If an important market catalyst (e.g., ETF) is achieved, the potential upward target for the medium term is $0.50, according to the outlook for lumens.

Overall, Dogecoin’s outbreak in social sentiment highlights the inherent fluctuations of meme-based cryptocurrencies. Deep diving of emotion-weighted metrics suggests that most social media comments have taken a noticeable pessimistic shift. However, some analysts and analysts such as Lumen believe that this extreme negative sentiment can mark the beginning of the rebound, especially given the obvious whale accumulation and potential ETF catalysts

At press time, Doge traded at $0.16.

Featured Images created with dall.e, Charts for TradingView.com