Bitcoin Could Rally Above ATH To $128K – On-Chain Indicator Signals Potential Recovery

Reasons for trust

Strict editorial policy focusing on accuracy, relevance and impartiality

Created and carefully reviewed by industry experts

The highest standards for reporting and publishing

Strict editorial policy focusing on accuracy, relevance and impartiality

The price of football for the Lions and players is a bit soft. Every arcu lorem, super kids or ullamcorper football hatred.

Bitcoin (BTC) continues to face huge sales pressure, with prices falling below $85,000, down 12% since last Friday. The recent downturn has promoted panic sales and intensified fears, leading many investors to speculate on the potential start of a bear market. As uncertainty captures the market, traders are cautious about Bitcoin’s next major move.

Related Readings

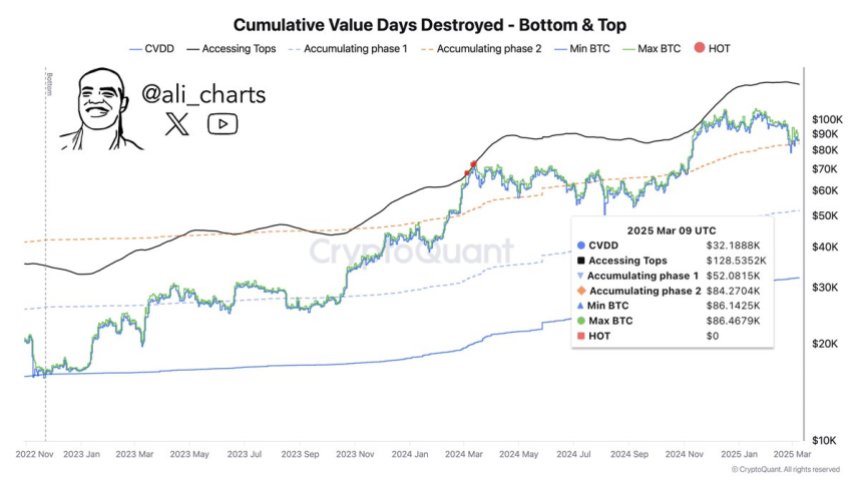

But despite the ongoing sell-off, key chain chain data from crypto literacy suggests that Bitcoin may be setting up a recovery rally. The cumulative value day destroyed (CVDD) indicator, which is an indicator that tracks long-term holder behavior and capital inflows, suggests that BTC may soon enter a new uptrend. If Bitcoin stabilizes and retracts key support levels, it can pave the way for a new all-time high of $128,000.

and Bitcoin at a critical inflection pointthe next few trading sessions are crucial to determine whether BTC can recover momentum or whether it is further low. Now, investors are paying close attention to whether sales pressure continues or whether long-term holders are involved in accumulating, indicating a potential market rebound.

Bitcoin’s insights bring hope to the Bulls

Bitcoin is at a critical moment, facing serious risks of continuous correction as bearish sentiment captures the market. Now, many analysts believe that the Bitcoin bull cycle may be over as BTC struggles below $85,000, and almost no more than $80,000. As sales pressures intensify, investors expect another leg to be lowered, potentially pushing BTC to areas with lower demand.

Despite the negative outlook, some analysts believe that if Bitcoin can recover the key level, it can still be restored. Top Analysts Ali Martinez shares insights on Xnoted that if BTC recovers $84,000 in support, it could open for a new all-time high of $128,000. This shows that although the market remains fragile, Bitcoin still has the potential to recover if the Bulls step in at a critical price.

The next few weeks are crucial to identifying the advantages of this cycle. If BTC continues to work below the key resistance level, deeper corrections can be made, thereby enhancing bearish sentiment. However, if the Bulls manage to delay BTC to above 8.4K $84K, it indicates a change in momentum and may re-click on the uptrend.

Related Readings

As uncertainty dominated the market, traders are closely watching BTC’s next move, as its ability to maintain or retract support levels will determine whether the cycle is truly over, or another rally remains within range.

BTC struggles with $85K

Bitcoin faces enormous sales pressure, and the most important decline occurred on Sunday, when the price dropped from $86,000 to $80,000, down 7% in just a few hours. This sharp decline caused panic sales due to investors’ uncertainty about the short-term direction of Bitcoin.

To regain control of the Bulls, BTC must regain the $86,000 level and push up $90,000 to confirm a potential recovery rally. Strong moves above these key resistance levels can restore confidence in the market, suggesting that Bitcoin’s correction phase may be nearing the end.

However, the failure to exceed $86K may put Bitcoin under bearish control, increasing the risk of the other leg. If BTC drops below $80,000, it could test the $78,000 low, which could lead to further downward pressure if violated.

Related Readings

With Bitcoin at a critical turning point, the next few trading sessions will determine whether the Bulls can recoup critical levels or whether the bears will continue to dominate the market, pushing BTC into deeper corrections.

Featured images from dall-e, charts for TradingView