Monthly Close Below This Level Could Be Catastrophic

Reasons for trust

Strict editorial policy focusing on accuracy, relevance and impartiality

Created and carefully reviewed by industry experts

The highest standards for reporting and publishing

Strict editorial policy focusing on accuracy, relevance and impartiality

The price of football for the Lions and players is a bit soft. Every arcu lorem, super kids or ullamcorper football hatred.

Ethereum has Work hard to gain motivationresistance that lasts for more than a year is still lower than the key resistance. Despite multiple attempts, the second largest cryptocurrency by market capitalization has been unable to break through key technology levels since the beginning of this year.

Related Readings

Ethereum’s price action over the past two weeks Show more weaknesses. An interesting analysis by analyst Tony “The Bull” Severino shows that cryptocurrencies have recently failed to exceed resistance indicators and now have more risk of catastrophic price declines.

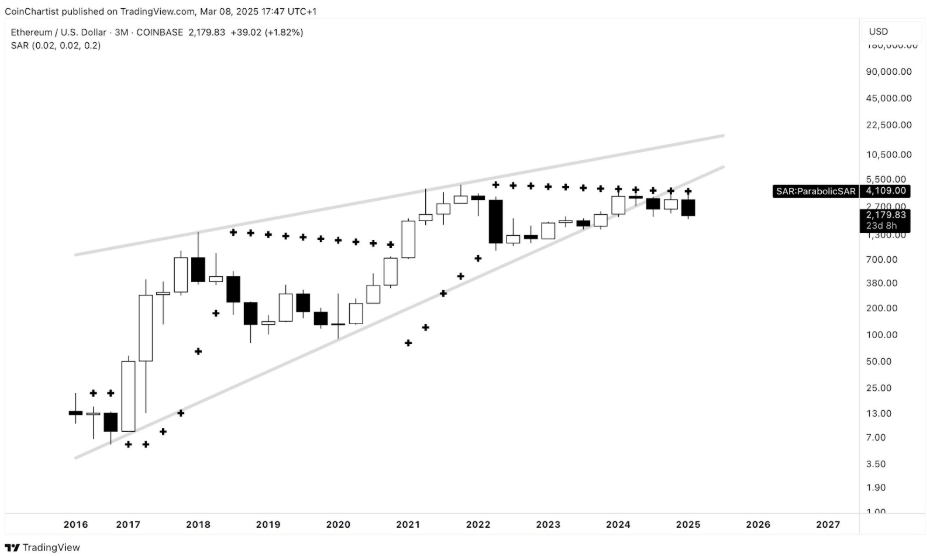

Ethereum fails to violate long-term resistance

Tony “Bull” Sevillino, in technical analysis share Social media platform X highlights the ongoing failure of Ethereum to overcome the main resistance levels. He noted that despite more than a year of attempts, Ethereum still cannot mark the parabolic SAR for the quarterly (three months). This indicator is often used to determine the direction of asset trends, indicating that Ethereum has fought a long struggle against a larger downtrend.

“It feels like it conveys a message – resistance is not broken,” the analyst said.

image From X: Tony “Bull” Sefrino

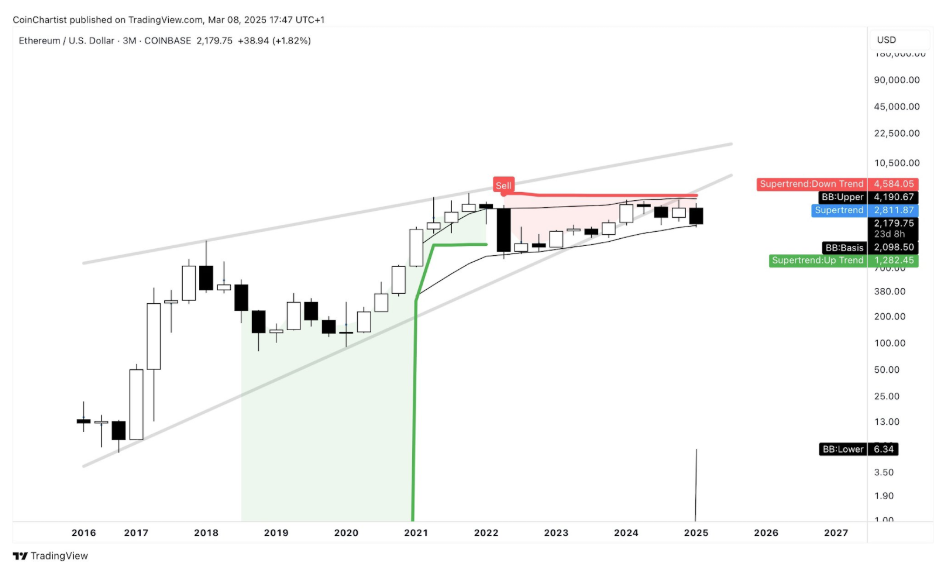

Tony Severino also pointed out in another analysis that Ethereum repeatedly rejected in quarterly (3M) supertrend dynamic resistance, further cementing the case where buyers cannot recover control.

image From X: Tony “Bull” Sefrino

Monthly closings below $2,100 can be disastrous

Ethereum’s inability to maintain key price levels has been the subject of the past six months. Interestingly, this incompetence has been further demonstrated in the past two weeks. After failing to hold more than $2,800, the cryptocurrency has fallen steadily, Lost multiple support zones Along the way.

Currently, Ethereum is trading below $2,200, Dangerously closed Break below the key $2,100 threshold. Drips below this level are particularly worrying, not only because it indicates a loss of another psychological support, but because technical indicators suggest that monthly closures under $2,100 may have serious consequences.

One of the most important warning signs comes from the quarterly Bollinger Band metric, which has been tracking Ethereum’s price action since February 2022. According to the metric, Ethereum has remained within the defined range, while the Upper Glass Band is currently at $4,190 and the lower band is $2,098. The worrying part is that closing prices below $2,100 per month will effectively translate into breaking and canceling long-term support levels under the Bollinger band below.

image From X: Tony “Bull” Sefrino

Related Readings

At the time of writing, Ethereum is trading at $2,178, up 2.2% in the past 24 hours after the start of the day, at $2,120. Ethereum sentiment is Now at its lowest level This year. The next few weeks will be crucial whether Ethereum can regain lost ground and prevent monthly closures of under $2,100.

Featured images from Tech Magazine, Charts from TradingView