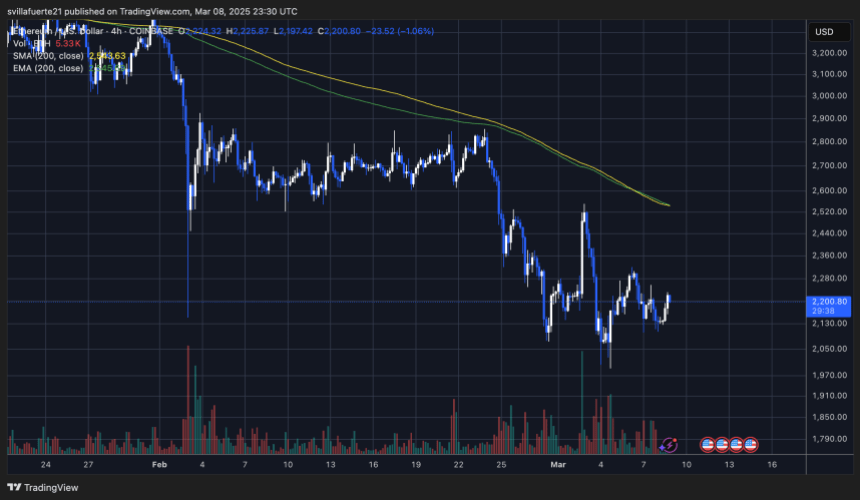

Ethereum Breaks Out Of Descending Triangle Pattern – Fakeout Or Recovery Rally?

Reasons for trust

Strict editorial policy focusing on accuracy, relevance and impartiality

Created and carefully reviewed by industry experts

The highest standards for reporting and publishing

Strict editorial policy focusing on accuracy, relevance and impartiality

The price of football for the Lions and players is a bit soft. Every arcu lorem, super kids or ullamcorper football hatred.

Ethereum (ETH) has been struggling with the $2,200 level and despite multiple attempts, the Bulls are unable to recover the higher prices. Even after the announcement of the U.S. strategic bitcoin reserves on Thursday, ETH will continue to face sales pressures, and market sentiment remains bearish, which many expect will increase overall confidence in the cryptocurrency space.

Related Readings

As ETH hovers near critical levels, analysts believe next week is crucial to identifying its short-term direction. If the Bulls can defend the major support zones, Ethereum may have a chance to recover momentum. However, failure to maintain these levels may lead to further downward pressure.

Top analyst Carl Unlefelt shared a technical analysis on X, highlighting that Ethereum is breaking into a pattern that usually marks a potential breakthrough. If ETH follows this setting, it may enter a higher resistance area, and Recover key price levels More than $2,500. However, as market volatility remains high, this breakthrough needs to be confirmed.

Ethereum Bulls Hope to Recover

Ethereum has suffered a sharp decline since late December, losing more than 50% of its value, triggering fear and panic sales across the market. Once a leader in the previous bull cycle, ETH is now working to regain momentum, leading many analysts to question whether the long-awaited alternative season will happen this year. As Ethereum and most Altcoins fail to recover their rough structure, the market remains under bearish control, keeping investors cautious.

Despite negative sentiment, there is hope for recovery as Ethereum moves toward a critical level of technology that can determine its next move. Rune’s speech Revealing that ETH breaks on the downward triangular mode, this setting usually marks a trend reversal. However, confirmation is crucial, as many past breakthroughs have turned into fake pit stops, pulling traders into further downward moves.

In order for Ethereum to consolidate a bullish breakthrough, it must exceed $2,300 and close. This level is a key resistance zone, flipping it into support will indicate new buying strength, potentially opening the door to heading towards a $2,500 selling price and higher target targets.

Related Readings

Before this confirmation occurs, Ethereum is still in danger of further decline if the seller resumes control. Traders and investors are watching closely whether ETH can sustain its breakthrough attempt or will face another rejection, extending its bearish trend into the coming weeks.

ETH key level to watch

Ethereum is currently trading above the $2,000 support level, the Bulls’ last line of defense and hopes to see a strong performance this year. Staying at this level is essential, as a segment below $2,000 may trigger more shortcomings, enhancing bearish sentiment in the market.

Still, the Bulls struggled to recoup higher prices, frustrating investors with the lack of momentum in ETH. Recent price action has been intermittent and indecisive, and every attempt to break through has quickly reached sales pressure. This put ETH in a dilemma and prevented obvious changes in market sentiment.

Related Readings

However, the decisive retraction of $2,300 could mark a turning point. If ETH pushes up and maintains this level, it could open the door to a transfer to $2,500, strengthening cases of resuming rally. Prior to that, traders remained cautious as Ethereum’s efforts to seek appeal continued to hit the wider altcoin market.

Featured images from DALL-E, charts from TradingView