US To Buy 1 Million Bitcoin For Reserves, Hints Michael Saylor

MicroStrategy founder and executive chairman Michael Saylor suggested that the United States may purchase a strategic reserve of one million bitcoins. His remarks came in a speech in an interview with Fox Business ahead of Friday’s White House crypto summit, hosted by U.S. President Donald Trump.

Saylor’s company is known for its important bitcoin holdings MicroStrategy has about 500,000 Among digital tokens, “produces about 2.4% of global supply.” He is one of several crypto industry figures expected to join the presidential roundtable, which will advise the government on digital asset policies.

Will Trump buy 1 million bitcoins?

Asked how the government would finance such a vast crypto protected area, Saylor pointed to a deliberate, multi-year schedule and referred to the “six-month process” proposed by the recent executive order. He added: “The Presidential Working Committee has 12 members. The industry will be involved. The Senate and the House will be involved, and my salary rating is higher than my salary rating.”

Related Readings

Says Says: “The longest Bill (Senator Loomis) The idea of strategically buying Bitcoin within four years has been proposed, just a consistent day to reach a million Bitcoin targets. “Currently, the U.S. government is believed to hold 200,000 BTC, with an estimated price of $17 billion today.

If it continues to make additional large-scale purchases, the impact on Bitcoin prices may be quite large. However, Sailer believes that the most “responsible” approach is to “make a slow, stable and intentional way with clear telegram and transparency” rather than a sudden acquisition, making the market more sudden.

The core of Saylor’s position is the classification of Bitcoin as a “digital property”, an asset without a central issuer.

“The real key about Bitcoin is to let people know that this is a digital attribute. It’s a savings account that gives every American the ability to save their own wealth and save over time,” Saylor explained. He stressed that if the U.S. government provides clear clarity about this identity, confidence in citizens can be instilled into savings that treat cryptocurrencies as legal.

Related Readings

When discussing whether taxpayer funds should be used to purchase Bitcoin, Saylor distinguishes between different digital assets. In his opinion, Bitcoin (as a “digital commodity”) is well suited for strategic reserves, but he also acknowledges the importance of digital currencies (Stablecoins), labeled securities (for capital efficiency), and token-based utility projects. Still, he picked Bitcoin as a leading candidate for the national reserve, calling it “a base asset generally agreed to throughout the crypto economy.”

🇺🇸Michael Saylor hints that the United States will buy 1 million #bitcoin Because of its reserves

It’s happening 🚀

pic.twitter.com/jr73pipfny-vivek⚡ze (@vivek4real_) March 5, 2025

Sailer also raises skeptics about the reasoning of the state’s Bitcoin reserves, compared to more traditional strategic reserves, such as oil or medical supplies. He compared Bitcoin to property, citing a historical analogy: “We bought 75% of the country for about $40 million (…) We bought Louisiana. We bought California. We bought Texas. We bought Alaska. It is property. If you think of Bitcoin as property in cyberspace and where do you say all the money in the world is? Well, it comes from a foreign country (…) and it wants to move from the physical world to the digital world.”

For those concerned about the basic spirit of Bitcoin as a decentralized asset without government involvement, Sailer insists that official adoption does not have to contradict the original design of the cryptocurrency. “Satoshi gives us a process, which is a prospering protocol. That’s what we call Bitcoin,” he said. While early adopters may favor the least regulation, Sailer believes Nation-state “Interested in economic empowerment and prosperity” will inevitably follow individuals and companies into the digital realm.

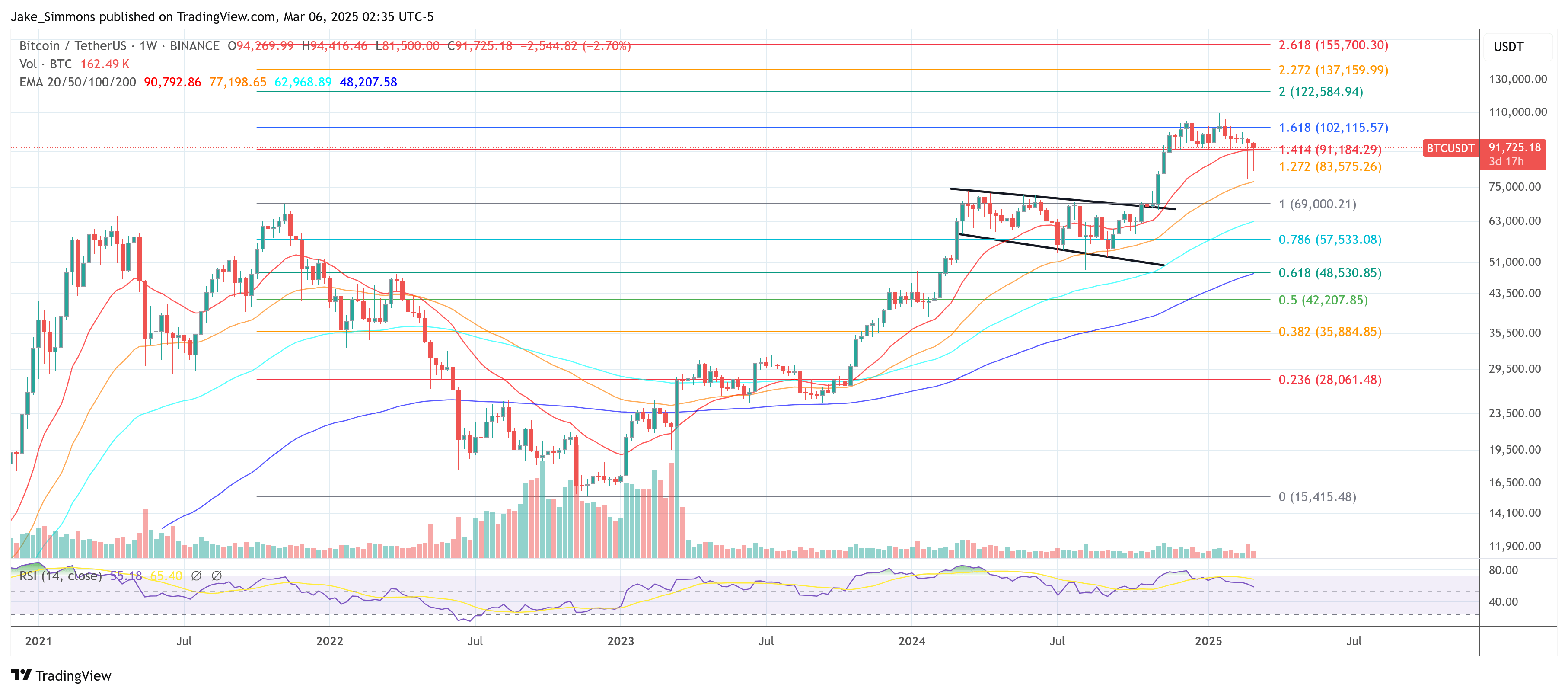

At press time, BTC was trading at $91,725.

Featured images from YouTube, charts from TradingView.com