Sell All Your Dogecoin If This Happens, Says Crypto Analyst

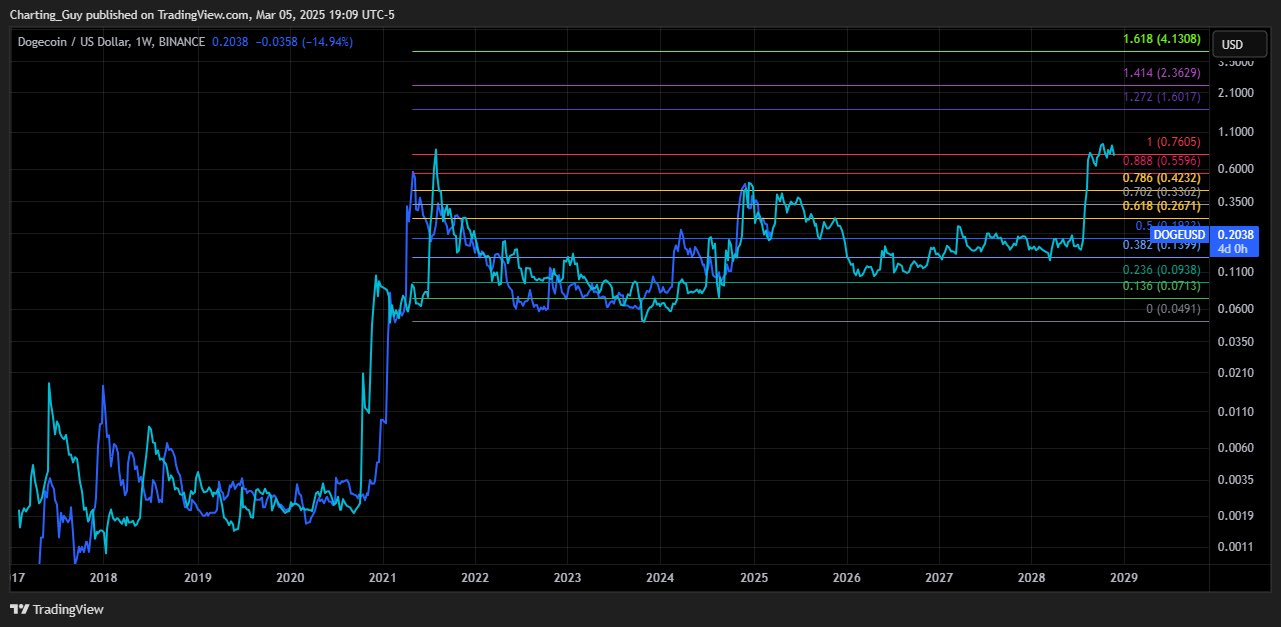

Crypto Analyst Charting Guy (@ChartingGuy) has issued a warning note on Dogecoin that he will sell meme coins if some Fibonacci retracement levels do not break in the next few months. According to TradingView’s shared weekly chart, his statement arrived at the Dogecoin (Doge) trade at about $0.20, showing a weekly change of –14.94%.

When will dogs be sold?

In the accompanying chart, a series of key Fibonacci echoes range from 0.0 to 1.618, which is about $4.13. Notable lines include around 0.382 fib, about $0.1397, about $0.50 FIB is slightly above $0.1997 (close to current price), about $0.618 FIB is close to $0.2677, about $0.702 FIB is about $0.33, about $0.786 fib, about $0.43 for 0.43 for 0.43 for 0.618 fib, about $0.76 for 0.618 fib.

The guy with the chart pressure If Doge comes back in the next few months and hits 0.702 or 0.786 FIB and can’t destroy it, he plans to “sell most votes if not all the bags”. He added that his personal paper calls for major tops in late April or early May, regardless of whether the price reaches $0.30, $0.40, or even $1.00.

“Yes, this invalidates my bullish doe chart, but I will sell it whether it’s $0.30 or $1 in late April,” Charting Guy said. He also highlighted the potential landing of the “critical low” in March 2026, reiterating that he “cannot make up for this.”

Related Readings

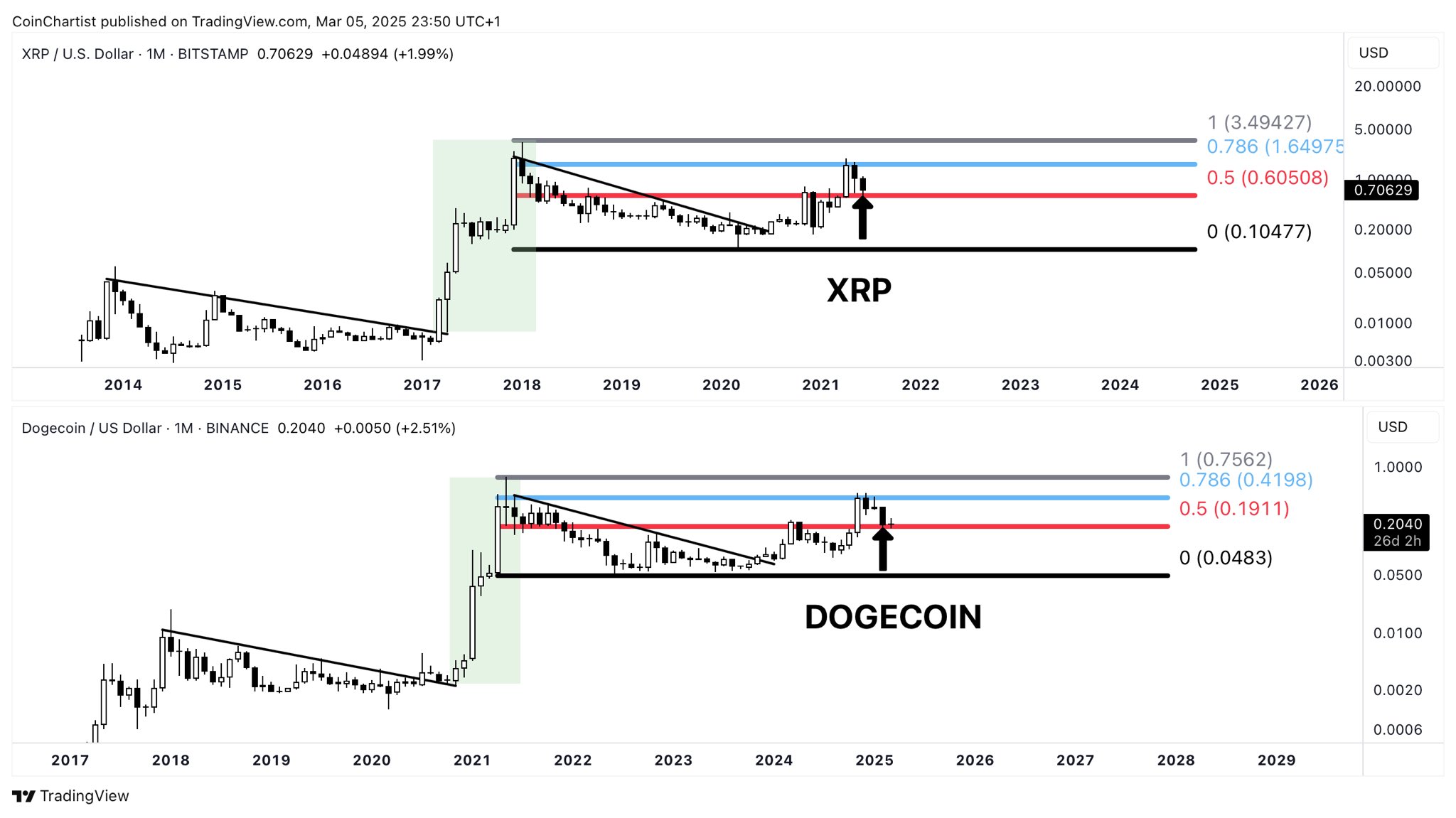

Part of this analysis involves potential duplications of Tony “The Bull” Severino (@TonyTheBullBTC).XRP 2021 XRP maintains range to a large extent at its new all-time high in its specific cycle phase.

According to Severino, “Dogecoin continues to follow the XRP 2021 fractal.” He initially attracted similarities last October, warning that Doge could “pull XRP in this cycle,” showing how XRP trades almost sideways at similar points in its market cycle.

However, analyst Sun (@Sunfire1126) disagrees with Dogecoin’s moves and does not specifically imitate XRP. Sun noted that “most coins have done this move,” and quoted other altcoins such as ADA and HBAR, which both stopped at 0.618 fibonacci withdrawal or lower

Related Readings

Chart Guy replied that he was still “open to the idea of breaking” but also open to “another rejection.” If the price is between $0.33 (0.702 fib) or $0.43 (0.786 FIB) in late April, he confirms his plan to exit the market.

When a user suggests that he turns completely Bearishchart Guy clarified: “No, if you learn to read, I intend to sell this situation at the end of April, regardless of which case it can play and only hit 0.30/$0.40, or if my bullish scenario comes into play, it will make the higher high.”

The chart’s tone shift is particularly noteworthy, as he still remains only two months ago To a large extent On the door. In early January, he highlighted a wick drop to $0.26 (0.618 Fib), an ideal buying opportunity.

At that time, he thought Doge would avoid revisiting the area and “finally ready” the next leg, with $1 being the “lowest target” and a maximum of $4. But since then, Doge’s stagnant price is below $0.30, and the ranking Guy now relies on the Fibonacci barrier ($0.33 and $0.43), which is a decisive factor in whether he will exit the position in late April or early May.

At press time, Doge traded at $0.20.

Featured Images created with dall.e, Charts for TradingView.com