$75,500? Analyst Reveals Historical ‘Magnet’ Level

An analyst noted how Bitcoin’s 50-week moving average (MA) historically acts as a magnet for asset prices.

50 Weeks MA Current Bitcoin is $75,500

In the new postal On X, analyst Ali Martinez discusses 50 weeks of Bitcoin MA. one”horse” is a technical analysis indicator that calculates the average value of any asset price in a given time period and, as the name implies, moves in time, updating its value according to changes in the price itself.

Related Readings

MAS can be a useful tool for studying medium- and long-term trends in assets, as they can smooth the price curve to eliminate any local bias. The MA can be removed at any time window, but there are some particularly popular options, such as 200 days.

In the context of the current theme, the time range of focus is 50 weeks. Here is a chart shared by analysts that shows the MA trends of Bitcoin over the past decade or so:

As can be seen in the picture above, Bitcoin has been approaching this line after the latest market decline. Over the years, the asset has previously shown several retests of this level.

“The historical 50-week moving average has been a magnet for Bitcoin $BTC during the trend shift,” Martinez explained. So far, the line has been a support for cryptocurrencies in the current cycle, helping to prevent bulls from running out of steam.

Currently, the 50-week MA is priced at $75,500. Given the current trajectory of the asset, the retesting level may eventually occur. However, whether the level will support Bitcoin again or will introduce it, it remains to be seen Bear market.

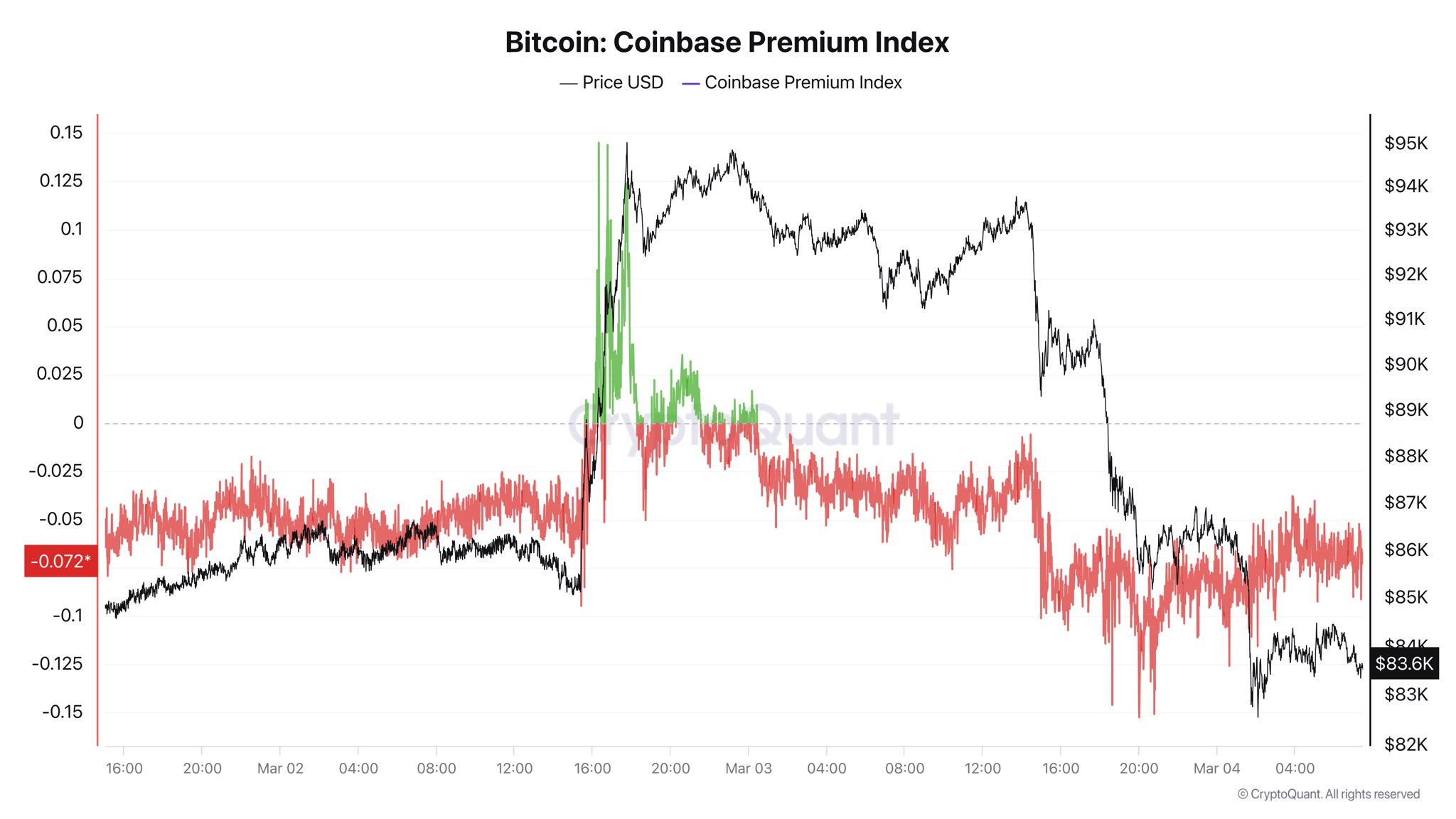

In some other news, sentiment among U.S. investors has plunged recently as crypto literacy founder and CEO Ki Young Ju revealed in X postal.

In the chart,Coinbase Premium Index“Show. This indicator measures the difference between the Bitcoin price and Binance (USDT pair) listed on Coinbase (USD pair).

The former platform is primarily used by U.S. investors, while the latter serves global traffic, so the value of this indicator essentially tells us the behavioral differences between the two demographics.

During an earlier rally, Bitcoin’s coin-based premium index soared to positive levels, indicating that American whales are buying. However, it fell back to negative soon after, and then fell into a deeper situation, which means that users in the exchange are making some heavy allocations.

Related Readings

The crypto-literacy founder noted: “Bitcoin markets may remain slow until the US sentiment improves.”

BTC price

At the time of writing, Bitcoin has floated around $85,700 in the past 24 hours, down more than 4%.

Featured images from dall-e, charts from cryptoquant.com, tradingview.com