Bitcoin Sellers Incur Loss As SOPR Drops To 0.95 – A Sign Of Market Bottom?

According to recent QuickTake postal By crypto analyst Abramchart, short-term Bitcoin (BTC) investors are causing losses, suggesting that the cryptocurrency market may have reached its lowest point and a trend reversal may occur.

Has Bitcoin bottomed out?

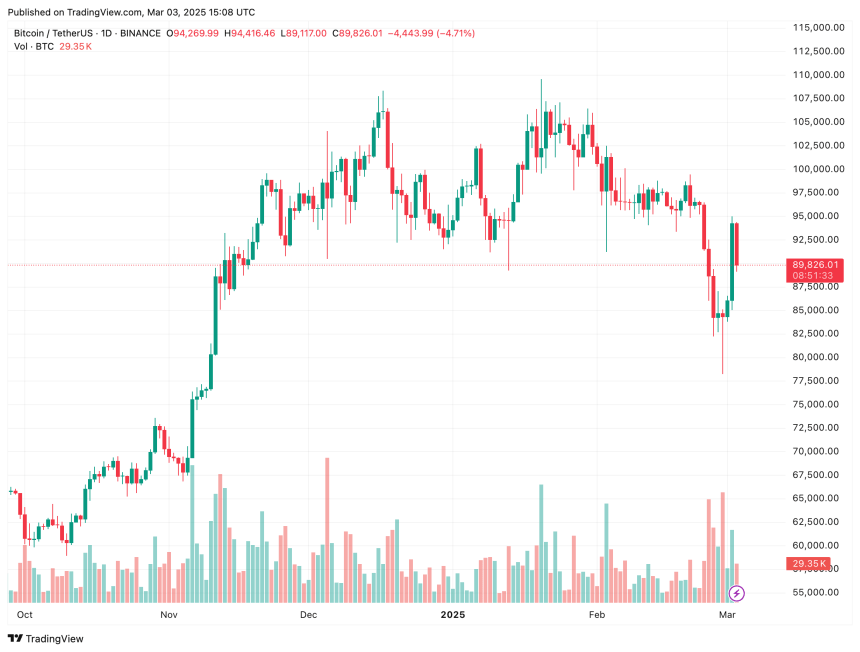

Bitcoin has experienced significant volatility over the past week, falling from $96,000 on February 23 to $78,258 on February 27. However, it recovered most of its losses yesterday, rebounding to as much as $95,000.

Related Readings

In QuickTake post, Abramchart highlighted the decline in consumer profit margins (SOPR) for BTC holders. For those unfamiliar, SOPR measures the proportion of BTC wallets that keep cryptocurrencies for more than an hour but less than 155 days.

According to SOPR, any value greater than 1 indicates that short-term investors are selling on profit. Instead, a value below 1 indicates that short-term investors are causing losses.

While the value under 1 may indicate bearish sentiment, it can also be seen as a sign of market capitulation, often a potential trend reversal. Yesterday, the crypto municipal cap swept over $200 billion, with the announcement of the creation of crypto reserves announced by U.S. President Donald Trump.

As of today, Sopr is sitting 0.95This is the lowest level since BTC’s consolidated intra-zone trading in the $50,000 interim range in August 2024. The post concluded:

We may have reached the good accumulation area of Bitcoin and are close to the bottom of the current wave.

BTC shows signs of a trend reversal

While it may be difficult to predict the cryptocurrency market, there are some signs that Bitcoin may be on the verge of a trend reversal after extended sales in the past month.

Related Readings

For example, at its potential local bottom of $78,258, the BTC part full The long-standing CME gap is between $78,000 and $80,000. The CME gap usually acts as a price magnet, and once filled, the BTC will usually move in the opposite direction.

Additionally, experienced crypto analyst Ali Martinez tip BTC has reached its highest level since August 2024. Martinez suggests that high sales pressure on BTC may be about to end, which could indicate a trend reversal.

In related news, Andre Dragosch, head of European research at Bitwise, Famous Despite the market decline, BTC is still flashing with huge counter-trend buying signals, with attractive risk reward opportunities at current prices.

On the other hand, Geoff Kendrick of the standard charter flight predict BTC may still encounter further disadvantages before resuming its bullish momentum. At press time, BTC traded at $89,826, up 5.3% in the past 24 hours.

Featured images from Unsplash, charts from CryptoQuant and TradingView.com