Is The Worst Yet To Come For XRP? Analyst Issues Dire Warning

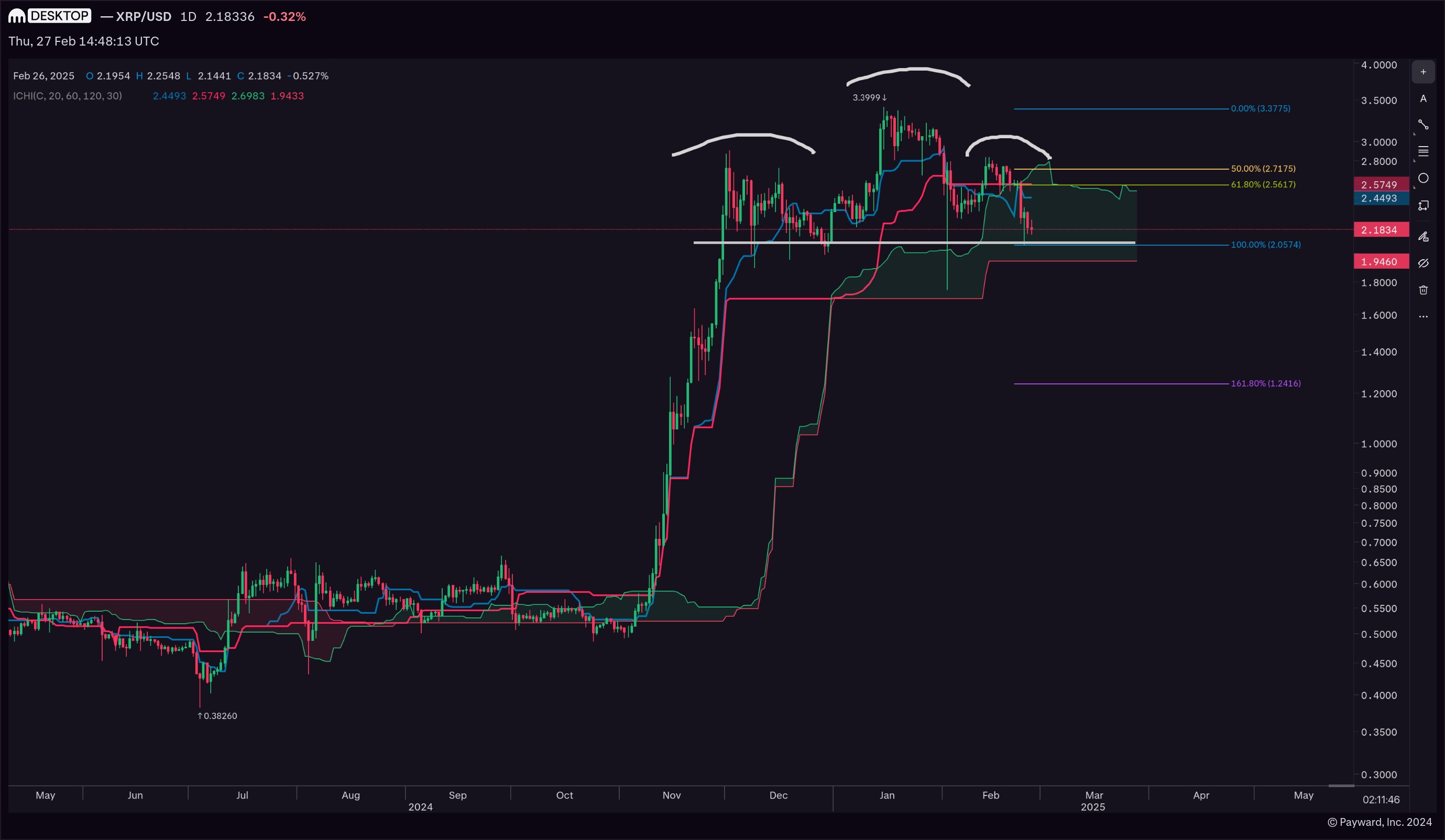

XRP prices have fallen -42% since their peak on January 16, but prominent tech trader Josh Olszewicz (@CarpenoCtom) warns that the next leg may be coming soon. Share his daily chart analysis of X, Olszewicz write a letter“1d XRP: H&S + bearish kumo breakout watch”, suggesting that two important technological developments may drive XRP prices down in the near future.

Is XRP ready to crash towards $1.24?

Reference to “H&S” refers to the head and shoulder patterns formed by reversals well known in technical analysis. This pattern usually occurs after a large upward assembly, including three consecutive peaks with the intermediate peak (“head”) higher than the flanking peak (“shoulder”).

Related Readings

As far as XRP is concerned, Olszewicz’s chart shows that in mid-January, the cost of the central head is about $3.40, while the price of the shoulder appears to be between $2.83-2.90. Technical analysts keep an eye on the “neck”, which usually runs along the key support level below the peak. When the price decisively below this collar, it is considered as confirming sales pressure being overwhelmed Purchase interestoften lead to further disadvantages.

Olszewicz’s comment also highlights the term “bearish Kumo Breakout”, which refers to the Ichimoku Cloud System, another prominent tool for drawing and forecasting price momentum. Ichimoku Cloud Analytics casts multiple moving averages on the chart and creates a “cloud” of support or resistance levels.

When the price action drops significantly under the Ichimoku cloud, and the future cloud itself changes in a weaker way, a bearish kumo breakout occurs. Bullish momentum. The core idea is that once the asset’s price drops under the cloud, it will drop further, as the cloud previously supported no longer provides mats.

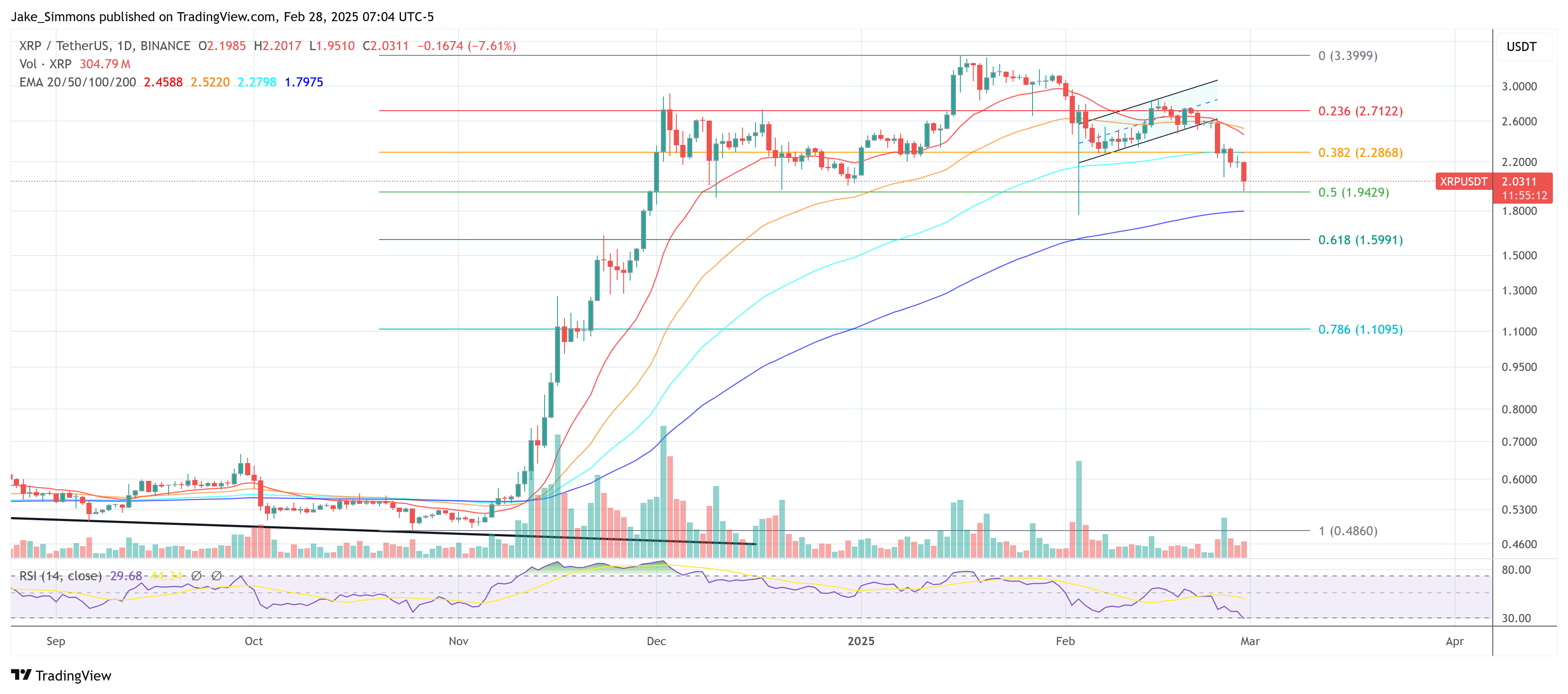

From the chart provided by Olszewicz, the current price action is about $2.18, located in the significant support area of the $2.00 area at $2.00, which he interprets as a neckline for the head and shoulder patterns. If the area concessions, the bears could dominate the market, with the Fibonacci level on the chart pointing to a possible first stop, close to $1.94, and then a steeper target.

Related Readings

The chart appears to focus the 161.8% Fibonacci expansion level at around $1.24, which may work if the sale accelerates. The existence of these Fibonacci levels does not guarantee a breakdown of these lows, but especially typical break down More doom can be said from H&S mode.

The profit target for this model is usually the price difference between the head and the low point of the shoulder. Then subtract this difference from the neckline, which can even position the XRP price below $1.00.

Although warnings about the impending “massive” price crash are raised, it is crucial to note that Olshevich’s comment “1d XRP: H&S + BERISH KUMO Breakthrough Watch” should be seen as an alert to traders, rather than an irreversible prediction. The technical setup may fail if bullish momentum returns or broader market fundamentals change, but for the moment, the entire cryptocurrency market seems to be driven by extreme fear.

At press time, XRP traded at $2.03

Featured Images created with dall.e, Charts for TradingView.com