Ethereum Key Support: Cost Basis Data Points To $1,890 As Make-Or-Break Level

Consistent with significant losses across the cryptocurrency market, Ethereum (ETH) fell 17.08% over the past week to as low as $2,104. Although the famous Altcoin has shown some smaller gains over the past 12 hours, overall market sentiment remains bearish.

ETH correction may reach $1,890 – That’s why

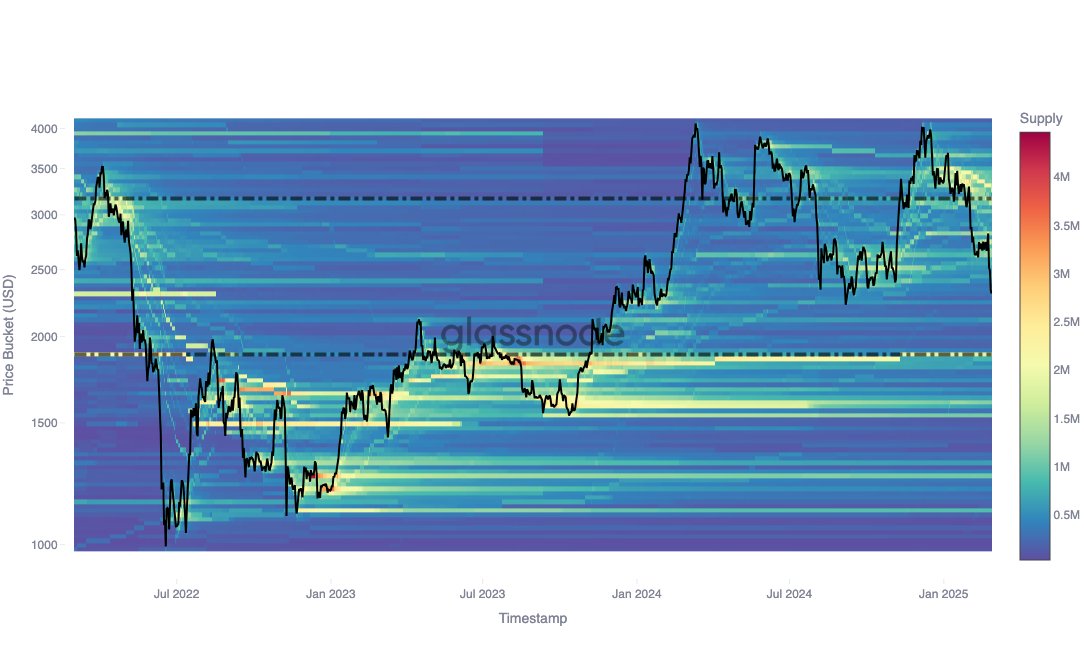

The ETH market is currently correcting through a strong market correction with several analysts now gazing at potential key support levels. According to data from the well-known chain analysis company Glass Festival, data from the Cost Base Distribution (CBD) metrics suggest that Ethereum is expected to drop to $1,890, representing its next major accumulation zone.

For context, CBD is used to determine the important level of accumulation or distribution of assets. These identified areas often act as support or resistance and have an impact on price action. Glass Festival analyst state The main ETH accumulation zone below its current price is $1,890, and in August 2023, investors acquired about 1.82 million ETHs.

Interestingly, a two-year analysis of Ethereum’s CBD shows that some of these investors who accumulated ETH in August 2023 are still active. It is worth noting that in the crypto market in November 2024, the cost base was greatly increased while the allocation was not executed at the range highs – this behavior suggests confidence in long-term price appreciation.

However, it is worth mentioning that $1,890 is not a direct support area for the ETH market. GlassNode noted that if Ethereum correction continues, the CBD data also highlights $2,100 as the next support zone.

This support level only accommodates approximately 500,000 ETH IE, above the $1,890 accumulation. Although it can be expected that $2,100 can provide some short-term support before the ETH experience deepens to $1,890.

Did ETH accumulate when the price fell?

In further analysis of the Ethereum market, GlassNode also shows that the six-month perspective of cost-based trends shows strong investor activity, with a cost-based level that is much higher than the current market price, especially around $3,500.

It is worth noting that this cost basis shows a gradual decline while increasing concentration. This development shows that investors did not initiate a sell-off, but actively absorbed market supply. Price drops Expected long-term returns.

At the time of writing, Ethereum has traded at $2,250 after earning 3.84% in the past few days. Meanwhile, a sharp drop in the past week shifted its monthly losses to around 30.48%. However, its market activity grew 7.74%, and is now worth $29.91 billion.