Bitcoin Could Retest $93K Soon – ‘Weekend Relief’ Coming?

This week’s market correction has seen Bitcoin (BTC) be the largest cryptocurrency with market capitalization, retesting some of its key support levels. As prices begin to recover from recent lows, some analysts believe the weekend could bring some bullish relief to investors.

Related Readings

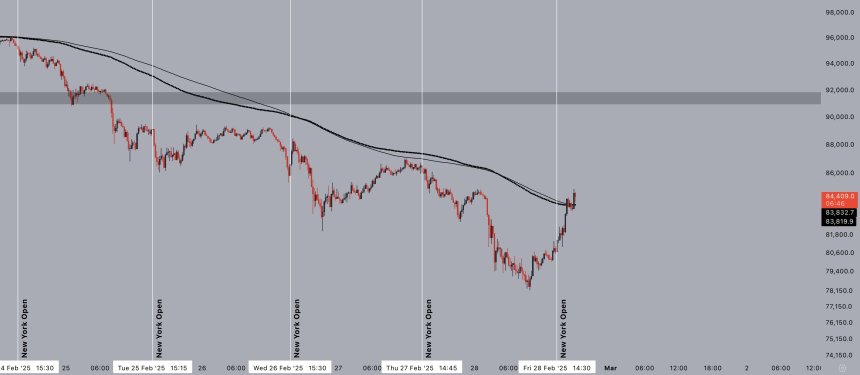

Bitcoin recovers from $78,000 drop

Bitcoin has experienced it Important The pressure on sales last week has raised doubts about the potential top-tier markets. The flagship cryptocurrency rate fell 21% from its $99,000 high last week, down to the $80,000 level for the first time since November.

The correction also dropped BTC by nearly 30% from its all-time high (ATH) in January and was below its trade with a post-US election price range. A week after the market bleeded, Bitcoin hit a new three-month low, retesting $78,000 in support on Friday morning.

Various market observers point to the recent decline in BTC hits the November 2024 CME gap between $78,000 and $80,700. Rekt Capital states Bitcoin is Experience “And against the strong rebound of the partially filled CME gap and rebounded with above-average seller volume.”

Flagship cryptocurrency rates soared about 7% from today’s lows, hovering between the $83,000 and $84,000 support zones over the past few hours.

For analysts, CME gap support and seller number will be two key indicators that can be noted on weekends because the constant, uninterrupted BTC seller pressure is Not sustainableseller fatigue may accelerate in the next few days.

Bitcoin is finally starting to experience the average number of sellers. There are still more sellers selling, but the chances of sellers exhaustion are increasing. Seller fatigue is often before the price reversal.

Is the weekend rebounding coming?

Crypto Analyst Jelle Highlight The Bitcoin went through “three drives” this week and retested the local lows before today’s decline, suggesting that “a relief over the weekend seems likely.”

Analysts say Recycle The $84,500 support is key to the BTC recovery, as “the past two retests have finally led to new lows.”

Nevertheless, he noted that today’s rebound seems to be different as BTC hits its first hit this week as it “touches 200-EMA cluster.” For Jelle, this could mark a “funny weekend” with a new CME gap of $93,000.

Rect Capital Point out The Bitcoin “fills every CME gap established since mid-March” and the newly formed CME gap remains open after this transfer between $92,800 and $94,000. If BTC continues this pattern, prices may see a rebound to fill new voids.

Related Readings

Analysts have Overview Two potential solutions for BTC’s current “downside deviation”. According to reports from the post, if the deviation “ends to become a downside wick,” the price of Bitcoin could revisit $93,500 this weekend.

Meanwhile, if the deviation is “ultimately because the weekly candles are reduced after the deviation ends up closing the re-accumulation range, then the price of BTC may Revisit Over the next two to three weeks, it was $93,500 in the “part of the post-break relief rally.”

As of this writing, Bitcoin is trading at $85,120, an increase of 0.5% on the daily time range.

Featured images from Unsplash.com, charts from TradingView.com