Will Bitcoin Drop Even Lower? Here’s What Experts Predict

Bitcoin has experienced a severe recession over the past few days. Its price fell to $80,000 for the first time since November 11 after trading above $96,000 on Monday. This rapid decline has been nearly 18% since the beginning of this week. Starting from its all-time high of $109,588 on January 20, Bitcoin now accounts for 27% of its value.

Several factors have been fused to put downward pressure on cryptocurrencies. These include newly imposed Trump tariffs, large-scale outflow of spot BTC ETFs and very high liquidation levels in futures markets. While the index of fear and greed for the 16-year-old is clearly hit (“extreme fear”), some analysts point out that these conditions may also lay the foundation for the next major action – whether it is further shortcomings or potential rebound.

Related Readings

How low can Bitcoin go?

Scott Melker, a well-known crypto analyst, also known as the “Wolf of All Streets” Highlights Bullish differences developing across multiple timetables. Melker wrote in a post on X: “BTC 4 hours: Bullish I’ve been following the hidden bearish divergence. Obviously, this may fail, but the RSI is doing well. If you’ve been following me for years, this is my favorite signal when confirming. RSI is outstripping RSI on multiple schedules using bullish Divs.”

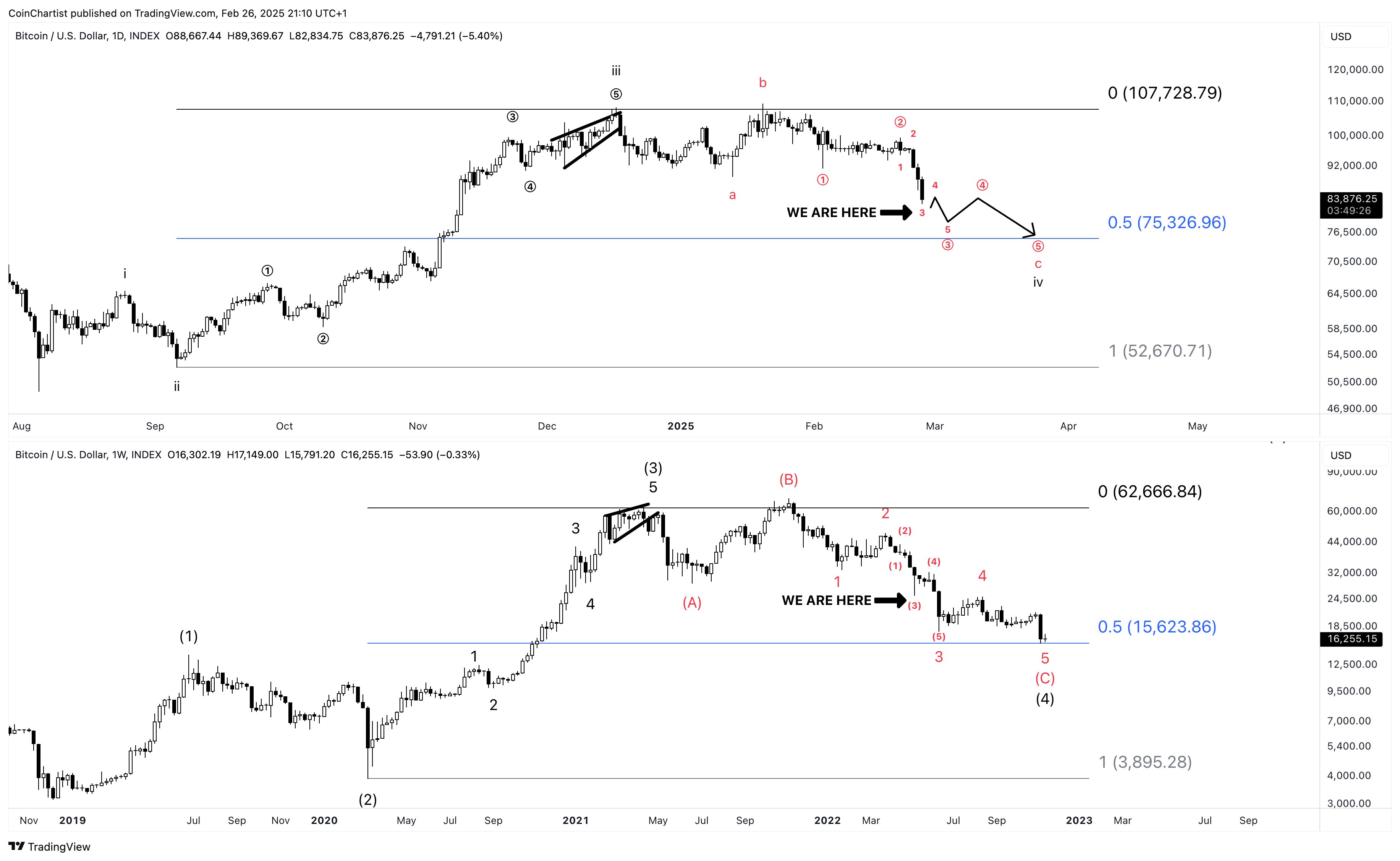

Technical analyst Tony “The Bull” Severino, CMT (@TonyTheBullBTC) believe The market may be tracking familiar correction patterns similar to those in 2021 and 2022. He suggested that the pattern “maybe a fifth of the fifth case in the second half of 2025.” He added: “This does mean it may be much lower than many people expect, about $75,000 if the higher fractals recovered at 0.5 fib are followed.”

Severino also warned that traders “don’t want to see the Bitcoin marker currently at $75,742 monthly parabolic SAR” because violations of that level could mark a deeper correction. He expects parabolic SAR to rise slightly at close range per month and has the potential to push the key support zone toward a low price of $80,000.

Related Readings

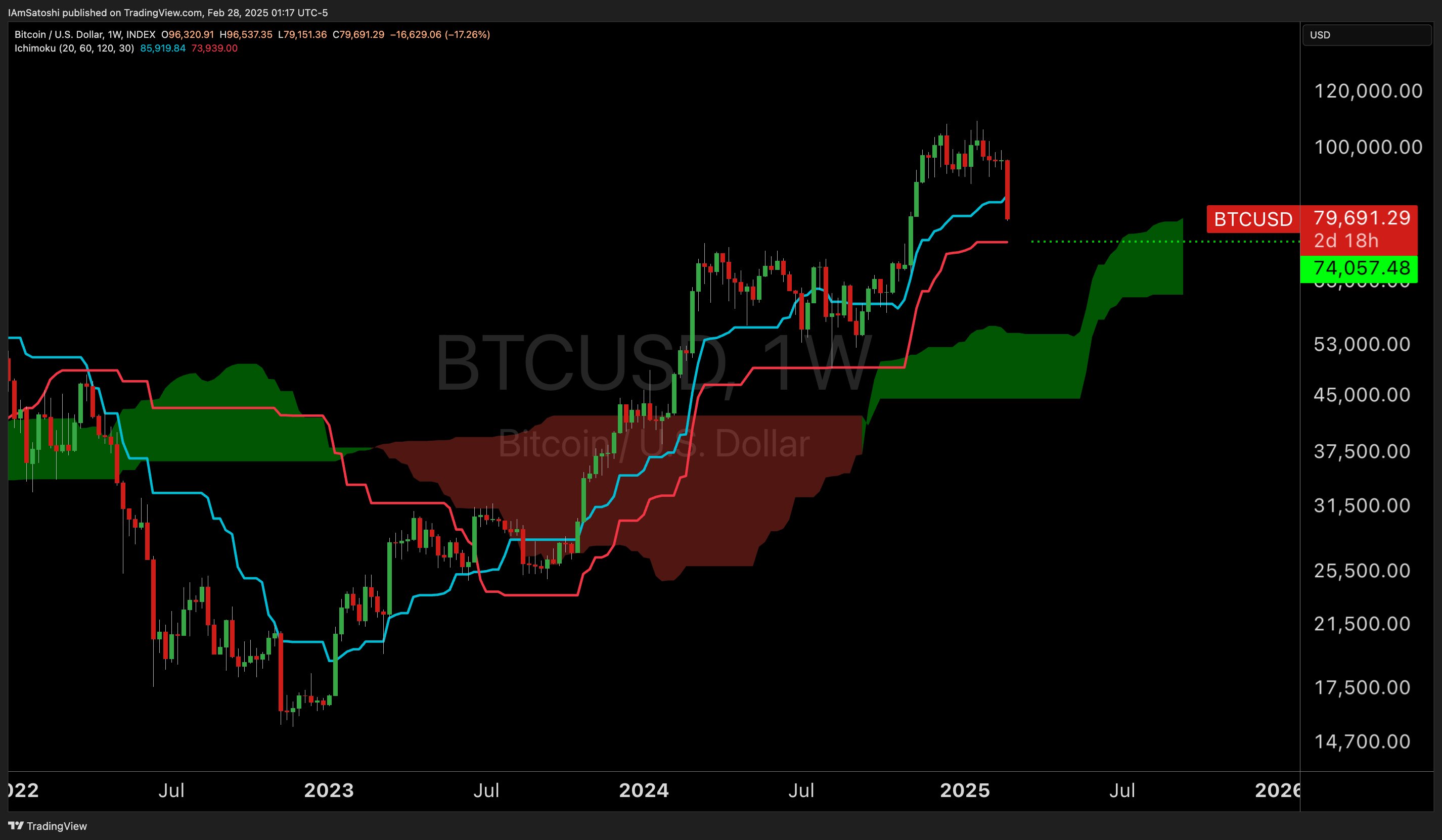

Famous trader Josh Olszewicz (@carpenoctom) tracks key insights on Ichimoku Cloud. he point Bitcoin’s weekly Kijun may be retested and noted that “weekly Kijun support is in support in 74K if we keep moving forward.” Olszewicz noted that Bitcoin last conducted a weekly Kijun during the yen-carrying trade in August 2024, an event that boosted volatility in global markets.

Analyst Daan Crypto Trades (@daancrypto) painting Similar to previous market cycles, when Bitcoin’s daily RSI dropped to level 20: “BTC last time was “oversold” (20) of the daily RSI, when it returned to the $25,000 deal in August 2023. The time before that was FTX Intra Explosion At the bottom of the bear market at the end of 2022. Short term means very little, but you should start to reach your interests. ”

He also found a big buy order about binary futures: “BTC has about $1.8 billion bids on Binance Futures Pair. These bids are priced between $70k-$79k. What happens when such bids appear. Sometimes the price never moves to them, and when it does start hitting them, it usually fills a lot before (soon) inversion. Remember, these bids are easily pulled apart. Emphasizing that this is a crazy quantity, which you rarely see.”

CryptoQuant CEO Ki Young Ju stressed Liquidity When determining the trajectory of Bitcoin. He noted that spot volumes were “highly active at around $100,000,” but explained, “price drops when new liquidity drys up.” For JU, the key question is: Where will fresh liquidity come from if the market is already in the distribution stage?

He foresees a potential extended merger between “75k-$100k”, similar to Bitcoin’s price action in early 2024. This range can continue Fresh catalyst Appear. “We’re likely to see extended mergers in large ranges (e.g., $75K-100K), similar to IMO in early 2024. This could continue until Bitcoin brings new liquidity good news.”

At press time, BTC traded at $78,856.

Featured Images created with dall.e, Charts for TradingView.com