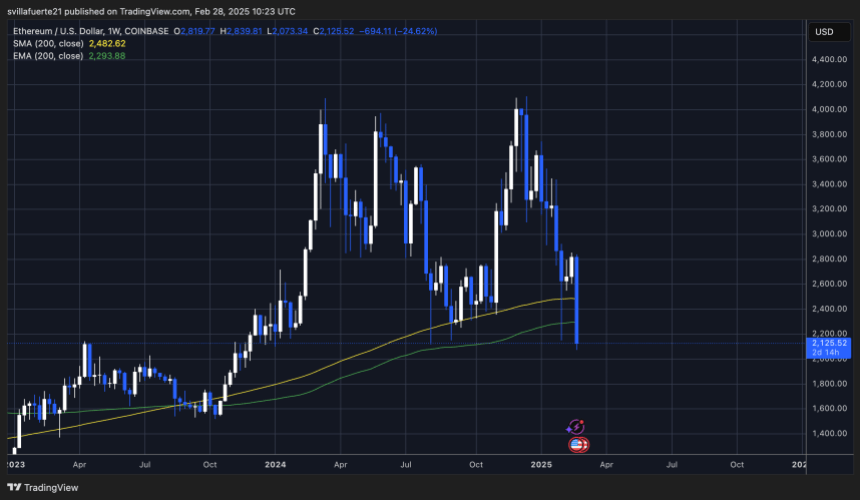

Ethereum Retraces To Critical Monthly Demand Level – Can ETH Hold Selling Pressure?

Ethereum has experienced a huge decline, losing more than 27% of its value in less than five days as the market faces extreme fear and uncertainty. The rapid sell-off has sparked speculation that a bear market could emerge, with many analysts asking for further downsides in the coming months.

Related Readings

But despite the overwhelming bearish sentiment, Ethereum still has a chance to recover as prices are testing critical demand levels. If the Bulls manage to occupy this area, ETH can rebound strongly and turn the movement to support the buyer.

Top analyst BigCheds shared technical analysis with X and noted that ETH is reproviding key monthly demand levels, which could define Ethereum’s next major move. Historically, price reactions at this level have resulted in a strong rebound or further surrender, making Current market conditions A critical moment in the long-term trajectory of Ethereum.

The next few days will be crucial as Ethereum tries to stabilize and recoup critical price levels. If buyers actively intervene further, ETH may start to resume rally, but failure to hold support may lead to further downside risks.

Ethereum struggles under $2,200

Ethereum is trading below $2,200, working to restore momentum after a serious market correction. The Altcoin industry has continued to bleed since mid-December, and ETH has now lost nearly 50% of its value 50%. The Bulls face important tests as they must defend critical demand levels to prevent further sales pressure and generate strong buying interest.

Related Readings

This situation is very volatile and market sentiment turns to extreme fear. Investors are worried that Ethereum may continue to decline if the Bulls cannot hold support and initiate a meaningful recovery. Many analysts remain cautious, warning that if ETH fails to recover its lost stance, it can enter a long merger phase.

Bigched’s insights on X Emphasizing that Ethereum is now re-closing a critical advanced demand zone, at about $2,000. According to Cheds, this is a level that must be held – losing the area could trigger deeper corrections, and a strong defense could pave the way for potential recovery rally.

The next few days will be crucial for Ethereum. If the Bulls manage to recover $2,200 and sell it to $2,500, a reversal could occur. However, not holding $2,000 could lead to further drops in ETH and could test lower demand areas in the coming weeks.

Price testing requirements – Can the Bulls recover control?

After days of persistent sales pressure, Ethereum was trading at $2,120, pushing the price to its lowest level in months. ETH currently has a level of demand above $2,000, which is a crucial area that must be defended to avoid further disadvantages. However, sentiment remains fragile and if Ethereum fails to maintain this level, it could trigger a huge sell-off that leads to lower prices.

The Bulls face the pressing challenge of re-controlling prices. Now, the $2,200 level is the first key resistance, and a breakout that exceeds this mark will be the first step to stability. In addition, ETH must push the trend above $2,500 as soon as possible to confirm the potential trend reversal and indicate the beginning of the recovery rally.

Related Readings

If the Bulls don’t hold $2,000 support, Ethereum may face increased volatility and a sharp decline, potentially testing areas with lower demand. The next few trading sessions will be crucial, as the ability of ETH to stay above the critical level will determine whether the market is stable or enters a deeper correction phase in the next few weeks.

Featured images from DALL-E, charts from TradingView