Solana Transfer Volume Crashes To $14.5M – What’s Next for SOL?

Solana is facing increasing sales pressure, with the lowest level since September 2024 after yesterday’s range correction. Extreme fear continues to capture the market as SOL fails to gain strong support, as bears remain in control since cryptocurrencies played their all-time highs in January. Solana has since traced more than 55%, leaving investors uncertain about its short-term outlook.

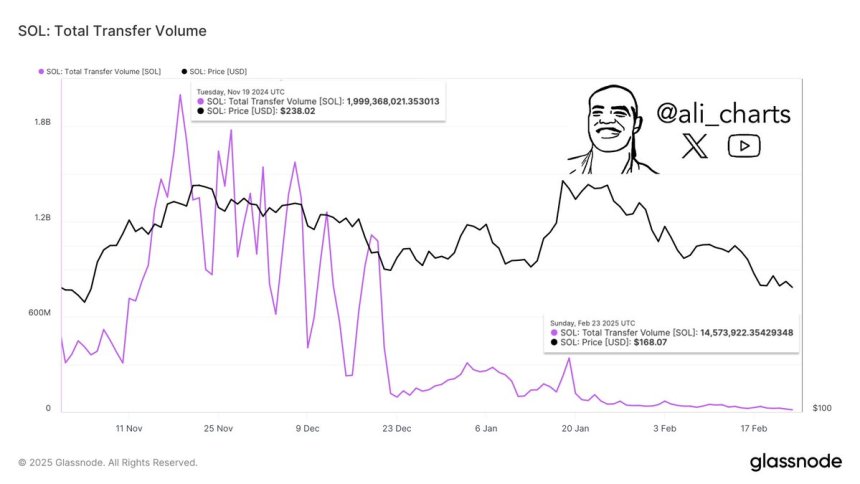

The wider cryptocurrency market remains under pressure, with altcoins struggling to resume bullish momentum. Analysts warn that if SOL fails to maintain critical levels, it may drop further. Crypto expert Ali Martinez shared on-chain metrics on X, indicating that Solana’s transfers have dropped sharply. According to the data, Solana’s transfer volume has dropped from $1.99 billion in November 2024 to $14.57 million today. This significant decline indicates a sharp decline in cyber activity and interest, raising concerns about the current state of the Solana ecosystem.

As bearish sentiment dominated the slowdown in market and on-chain activity, the coming days will be crucial for SOL. If the Bulls can’t defend the critical support level, Solana may see further downsides. However, a strong recovery in quantitative and price action may indicate interest and potential for reversals.

Solana’s struggles are under $150 as the bear remains in control

Solana faces enormous sales pressure, struggling to surpass the $150 mark as bears dominate. The wider market sell-off has caused huge losses to SOL, with some sharp declines in Meme coins. Solana, who previously benefited from the meme coin hype cycle, now sees the main callback as speculation fading.

Price action remains weak as Solana trades below key demand levels and once maintained its long-term bullish structure. The Bulls lost momentum and failed to build a strong recovery, while the Bears continued to delay the entire market. If SOL cannot maintain the current demand level, it can drop further in the short term.

Martinez’s chain data Highlighting the disturbing trends in Solana’s network activity. According to GlassNode, Solana’s transfer volume fell from $1.99 billion in November 2024 to $14.57 million today. This dramatic decline indicates a sharp decline in network usage and trading activity, further reflecting the cooldown period of meme coin speculation.

The days that follow are crucial to Solana. If the SOL can be kept above the critical demand level, the recovery phase can be started. However, continued weakness in volume and price action could lead to further declines, which is crucial for the Bulls to quickly regain momentum.

Selling pressure price struggles at $140

Solana (SOL) has experienced huge sales pressure, trading at $141, struggling with most Altcoins with a current market downturn. The wider cryptocurrency market is facing extreme volatility, with many assets declining sharply. However, Solana remains one of the worst hits, failing to build strong support or momentum for a potential rebound.

If the Bulls can defend the $140 level, a short-term recovery is possible. Holding above this critical area of demand can provide the basis for the push-up key resistance level. However, sentiment is still weak, and any further disadvantages of Bitcoin or the broader market can make SOL more deeply corrected.

If Solana can’t maintain its current support, the next key level to watch is $130 and buyers may try to step in again. However, continued decomposition below this trademark will increase the risk of further declines in demand areas. The next few days will be crucial for Solana’s price action as investors wait for whether the bulls can recover their momentum or whether the bears will continue to push prices downward.

Featured images from DALL-E, charts from TradingView