Data Shows Bitcoin’s 15% Drop Is Still ‘Modest’—Here’s Why

Bitcoin is the world’s largest cryptocurrency Crush Its all-time high of 11%. While some investors may find this price depreciation shocking, historical data suggests that it is indeed small for other market cycles of cryptocurrencies.

Bitcoin’s past price trends show several sudden declines and rises. Volatility always exists. The context of this latest decline must be considered to evaluate its future process.

Related Readings

Historical background of Bitcoin correction

Bitcoin has seen many corrections since its inception. For example, between January 2012 and December 2017, the value of Alpha Coin dropped by more than 10% at least at least 13 times. Before making good rebounds, some corrections resulted in billions of dollars in market value loss; some even reached 20% or more.

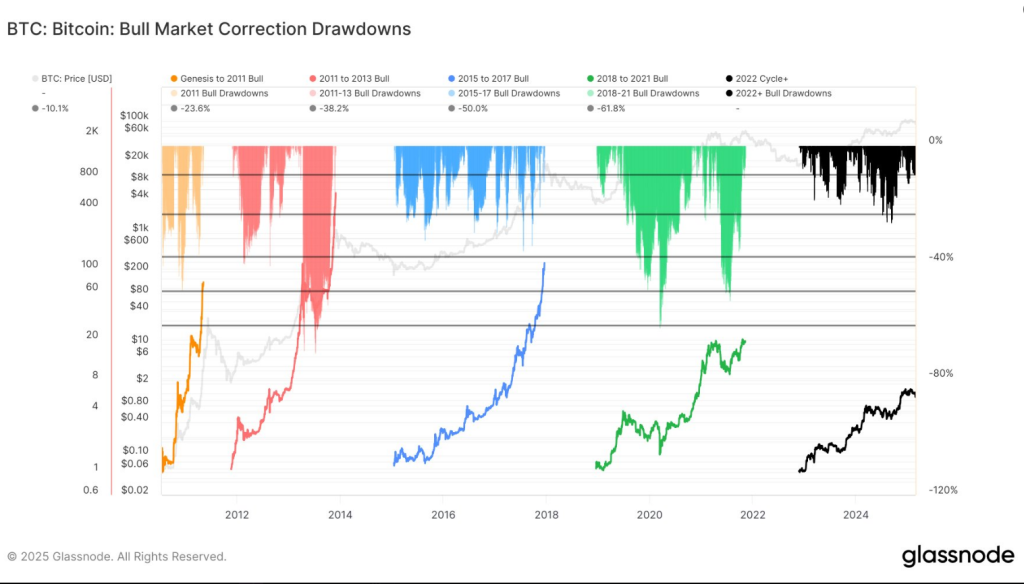

The fact that the current Bitcoin market cycle is smaller than the previous bull runs is one of its most notable features. the following AG draw mode Seen in the historical data of previous cycles:

This cycle is still the least volatile for everyone:

2011-2013: AVG. -19.19%, the largest. -49.45%

🔹2015-2017: Fairness. -11.49%, the largest. -36.01%

🔹2018-2021: AVG. -20.41%, the largest. -62.62%https://t.co/iszhpa3cas pic.twitter.com/jfhma5j3kv– Glass Node (@GlassNode) February 26, 2025

Over time, Bitcoin has shown its ability to recover and set new record highs. These volatility is inevitable in the nature of market action. Even in a bull market, Bitcoin often experiences a brief decline, which helps to sway before weak trajectories recover.

Current market conditions

On February 27, 2025, Bitcoin was trading at $85,800, down 4% from the end of the previous day. The intraday high was $89,230 and the intraday low was $82,460. The latest decline in recent weekly frameworks exceeded the average of the cycle by 8.50%, but significantly less than the 26% decline in previous cycles.

This is very moderate compared to other corrections that lasted for months. Many analysts believe this is not a sign of deeper market concerns, but a natural part of the Bitcoin cycle.

Meanwhile, according to the chain analysis, unless Bitcoin A quick rebound to the $92,000 level is likely to continue to decline in the near future.

This barrier is crucial because it represents the juncture when most short-term traders achieve profitability. Additionally, Bitcoin may look back to $70,000, or $71K due to the loss mitigation.

Factors that affect recent declines

Bitcoin’s price has fallen for a variety of reasons. As always, emotion is an important factor in the Bitcoin market, and even small changes in investor trust can lead to large price fluctuations.

Due to concerns about safety, especially in Bybit Hackwhich cost cryptocurrency exchanges $1.5 billion.

Fear of inflation, central bank policies and global economic uncertainty have also made investors more cautious about risky assets. These external pressures often drive Bitcoin’s volatility, making its price highly reactive to changing financial conditions.

Related Readings

Based on past performance, Bitcoin’s growth cycle appears to include inclinations, even though it is currently declining. After years of losses, it gradually got better and reached its highest point after consolidation.

Featured image from Reuters, charts from TradingView