Crypto Looks Like July 2024—Here’s What Happened Next

In a memorandum released on February 25, 2025, Matt Hougan, who is located at Asset Management’s Chief Investment Officer (CIO), was in today’s cryptocurrency market and he observed in July 2024 There are amazing similarities between things. (Redux),” Hougan’s latest analysis shows that despite the decline at present, the rationale for the industry remains as compelling as ever.

Encrypted echo in July 2024

Hougan opened a memo when he recalled the environment in July 2024, when he wrote an earlier work titled “Short-term Pain, Long-term Profits.” At the time, the cryptocurrency market was rolling up: “Bitcoin peaked above $73,000 in March 2024, falling to about $55,000 with a pullback of 24%. Ethereum fell 27% during the same period.”

At the time, Hougan noted: “The crypto market is now facing a weird dynamic. All short-term news is bad, all long-term news is good.” He also cites catalysts such as potential ETF inflows, which are coming soon Bitcoin halving and more supportive policy developments in Washington, D.C. compare them to the Immendiate risks at the time Mountain gox distribution and the government’s Bitcoin sales.

Related Readings

This analysis proves timely. “Short after I wrote the memo, Bitcoin bottomed out and then torn to $100,000.” In his latest note, he saw a similar duality: negative short-term development on the one hand , on the other hand, there are strong long-term headwinds.

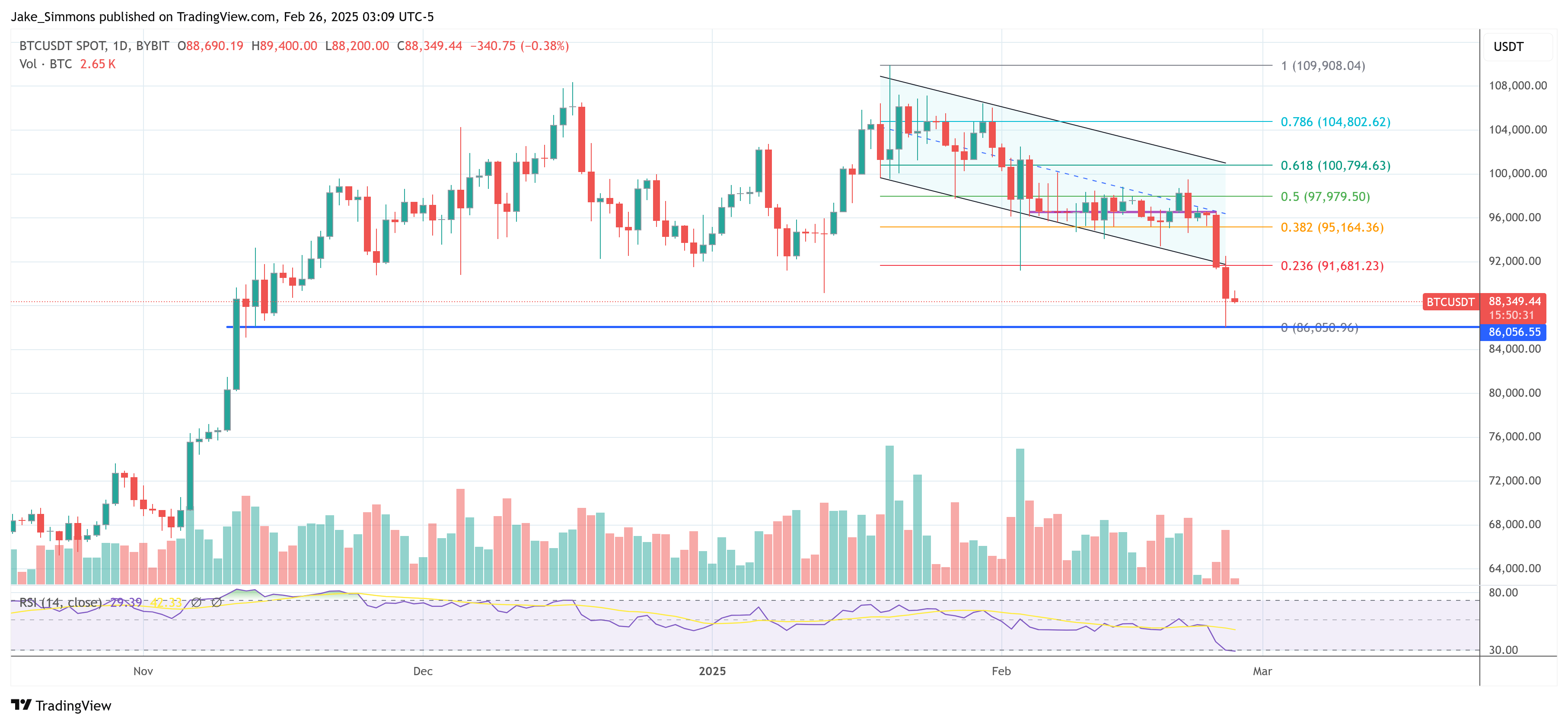

Yesterday, the cryptocurrency market was under significant pressure: Bitcoin was above 10%, as low as $86,050, Ethereum fell 18%, while Solana fell 21%. Direct trigger: Last weekend bybit’s hackerIt is a Singapore-based exchange that suffered $1.5 billion in Ethereum theft through a phishing scam.

Although Bybit has been immersed in its reserves to keep customers as a whole, this violation echoes across the industry. The following hackers followed a series of Memecoin scams, including Libra, endorsed by the Argentine president, and pointed to cryptocurrency supporter Javier Milei. The commemorative factor cost investors billions of dollars, which Hougan described as a “billion dollar scam.”

In addition, Melania, a project related to First Lady Melania Trump, also collapsed, causing huge losses to token holders. Trump is a memorial related to US President Donald Trump, and it couldn’t be better.

“To sum up, these events may be spelled at the end of the recent Memecoin boom,” Hogan commented. Although many institutions and long-term crypto players may doubt the monumental sector, its transaction volume and buzz have facilitated Overall market activity, especially in the Solana ecosystem.

Related Readings

Despite the negative headlines, Hougan points to the next strong foundation for the cryptocurrency market. First, Hougan highlighted the pro-Crypto regulations under the Trump administration. “We are in the early stages of Washington’s attitude towards cryptocurrencies,” he argued, citing the SEC’s recent decision to file lawsuits against companies such as Coinbase and legislative efforts around Stablecoins and the market structure. He believes that these developments will help cryptocurrencies integrate into mainstream finance.

Second, institutional adoption is still growing. Large-scale buyers (including asset managers, companies and even governments) can accumulate Bitcoin. Hougan noted that so far this year, “investors have cultivated $4.3 billion for Bitcoin ETFs,” he predicts that by the end of the year, that number will reach $50 billion.

Hougan also expects a stable prosperity. In management, Stablecoin assets have climbed to a record $2.22 billion, a 50% increase from last year. With favorable legislation passing Congress, Hogan believes the industry can grow to $1 trillion by 2027.

Finally, Bitwise CIO predicts the rebirth of Defi and tokenization. Loans, trade, forecast markets and derivatives use have increased. Meanwhile, the tokenization of assets in the real world continues to reach historically high levels of managed assets, suggesting that representations of traditional securities and commodities based on blockchain may be rising.

Hougan returns to his July 2024 paper to highlight today’s opportunity. On the negative side, the market has to be out of Bybit’s massive hacking and multiple Memecoin projects. On the positive side, regulatory clarity, inflows of institutions, Stablecoin expansion and Defi Innovation continue.

“That’s what I say is effortless,” Hogan wrote, emphasizing his position that the majority of long-term serious factors outweigh short-term setbacks. He did provide a measure of warning, noting that such a callback could be more noticeable than the decline last summer: Memecoin Prosperity A big one, a hangover may be more important. It may take several days, weeks or months to work to solve it. ”

Yet his conclusion remains firm: the long-term growth narrative remains intact. “I love my money when this happens,” he said, reaffirming patience can be rewarded in markets that are often volatile swings driven by titles.

At press time, BTC traded at $88,349.

Featured Images created with dall.e, Charts for TradingView.com