Bitcoin Headed For $72,000? These Metrics Could Hint So

Bitcoin has hit $87,000 in the past day’s crash, but it could get deeper if you want to go through the chain data.

Bitcoin loses important support levels when it crashes

In the new postal On X, on-chain analytics firm GlassNode discusses changes in certain bitcoin indicators after the price of cryptocurrencies falls.

Related Readings

The first indicator shared by the analysis company is the realized price of short-term holders. this”Achieved price” Track the cost basis of ordinary investors or addresses on the BTC network.

When the spot price of an asset exceeds this indicator, this means that the entire investor can be considered as profit. On the other hand, it is under the metric system, which means dominance in market losses.

In the context of the current theme, the implementation price of a portion of the user base is interesting: Short-term holder (STHS)they refer to investors who have purchased coins in the past 155 days.

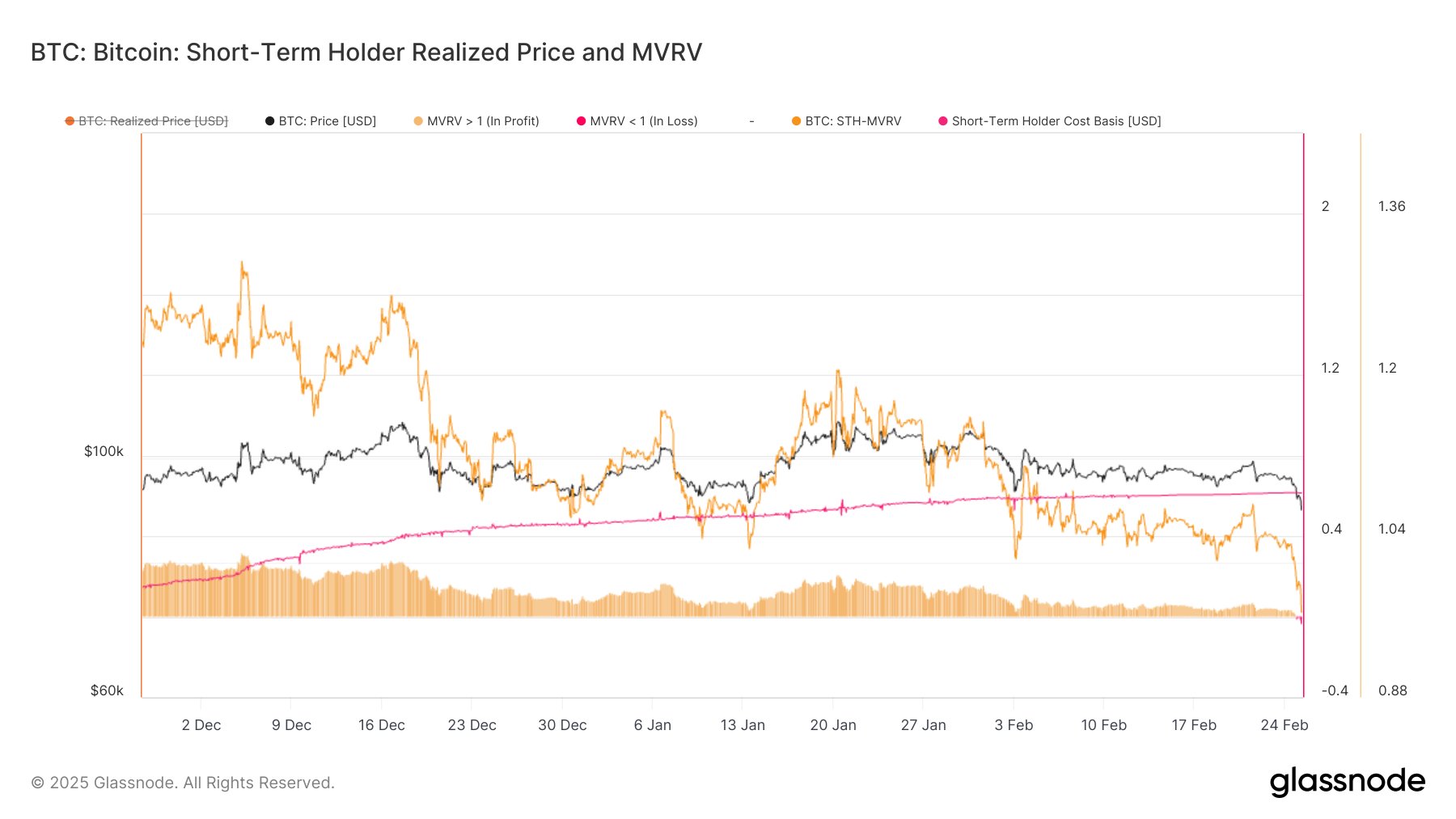

Now, here is a chart showing the trend of Bitcoin STH realizing prices in the past few months:

As shown in the above chart, Bitcoin’s STH implementation price over the past few months is higher than the STH implementation price, which means STH enjoys profits, but with the latest crash, the situation has turned around.

STH realizes that the price is equal to $92,500, so at the current spot price the average loss of members of the queue will exceed 6%. “The failure to recover the STH cost base may mean the continued selling pressure from buyers recently,” GlassNode noted.

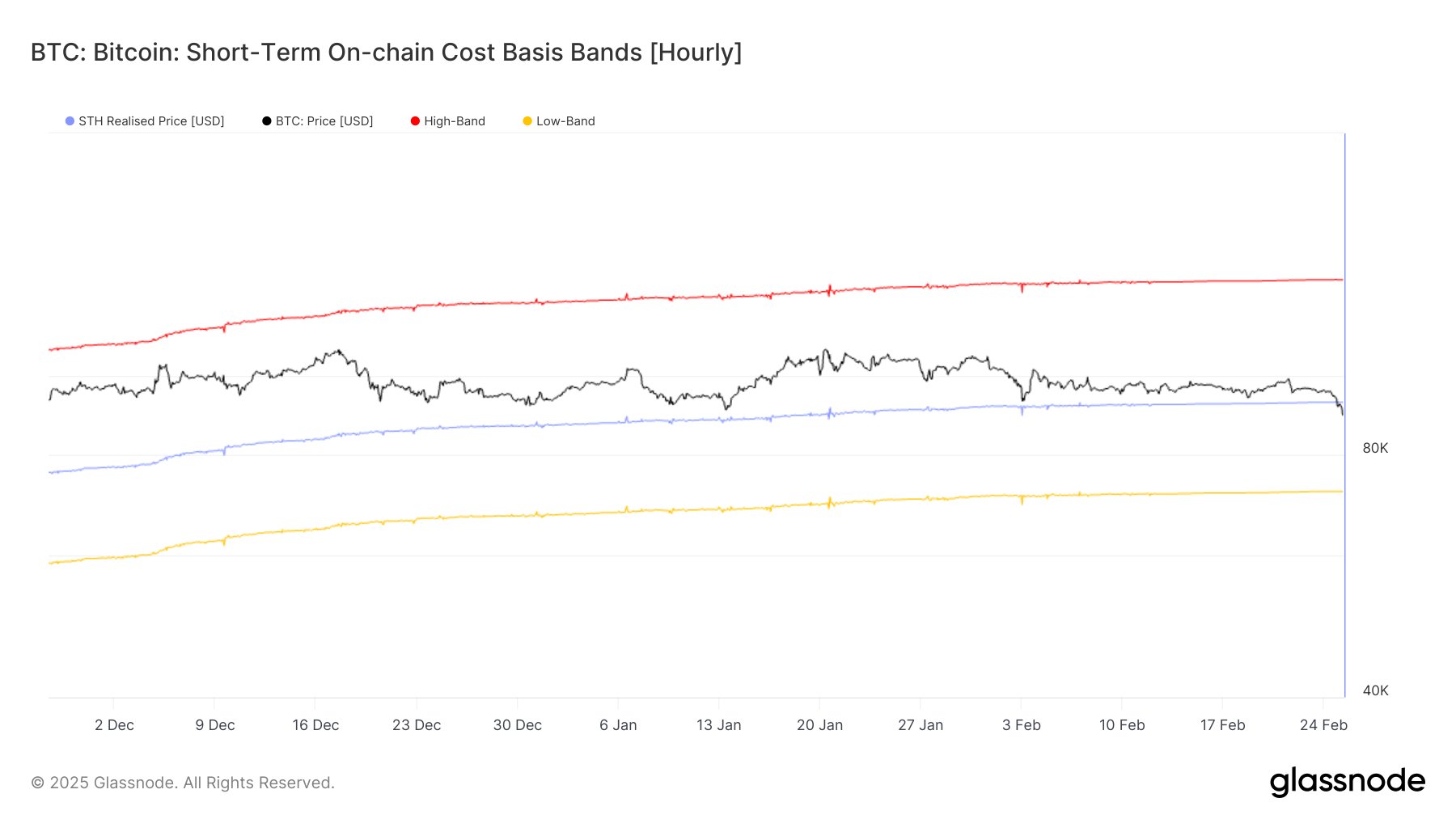

As for how far BTC is here, maybe the historical pattern may have hints. According to data from the analysis company, after corrections in May 2021, November 2021 and April 2024, the standard deviation of BTC is lower than the price realized by STH.

Currently, this price band costs between $71,000 and $72,000. If past patterns are to be passed, this correction may also bring Bitcoin to the nearer the band.

Related Readings

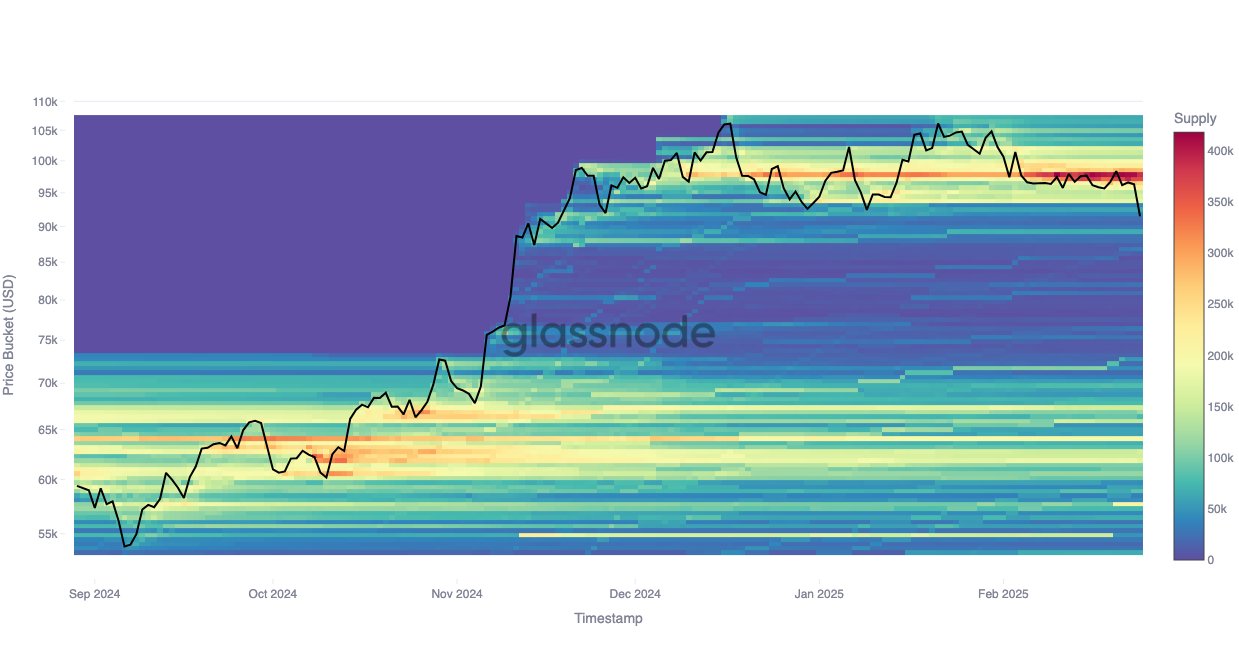

this Cost base distributionanother indicator related to the investor cost basis also emphasizes the level of importance to cryptocurrencies.

From the chart, it is clear that a large number of investors have their cost bases in each region above $87,000. However, under this mark, few addresses purchased coins until the same band of $71,000 to $72,000. “This could mean weaker support within this range, allowing bears to gain more control,” the analysis firm explained.

BTC price

At the time of writing, Bitcoin’s rise was about $87,200, down more than 7% from last week.

Dall-E, Featured Images of GlassNode.com, Charts of TradingView.com