Time To Turn Bullish On Ethereum? CryptoQuant CEO Thinks So

Ethereum (ETH) has plummeted 11.4% in the past 24 hours, reflecting a broader market downturn, with Bitcoin (BTC) down 8%, XRP down 13.6%, Solana (Sol) down 12.9% . Despite the ocean of red, several leading voices, including Crypto CEO Ki Young Ju, call for a more optimistic view of ETH.

It’s time to be optimistic about Ethereum

Through X, Ki Young Ju shares his “views on ETH” debate Despite the recent bybit hack, there is “no huge selling pressure”, pointing out that both chain and market data remain neutral. “Exchange sales take time, and OTC offloading has little impact on price,” he added.

He also highlighted the main share of Ethereum in stable market capitalization, currently at about 56%, and pointed out how the potential regulatory shift under the company Trump administrationIt is reportedly “relieving cryptocurrency regulations” and may further adopt ETH-based Stablecoins and Smart contracts in 2025.

Related Readings

Ju mentioned other catalysts, reminding followers that the ETH ETF “has been approved”, suggesting that the “big hat ETF Altseasan” may be the horizon of Ethereum. He added:Black Stone ETH spot ETF holdings have increased by 124% over the past three months. ”

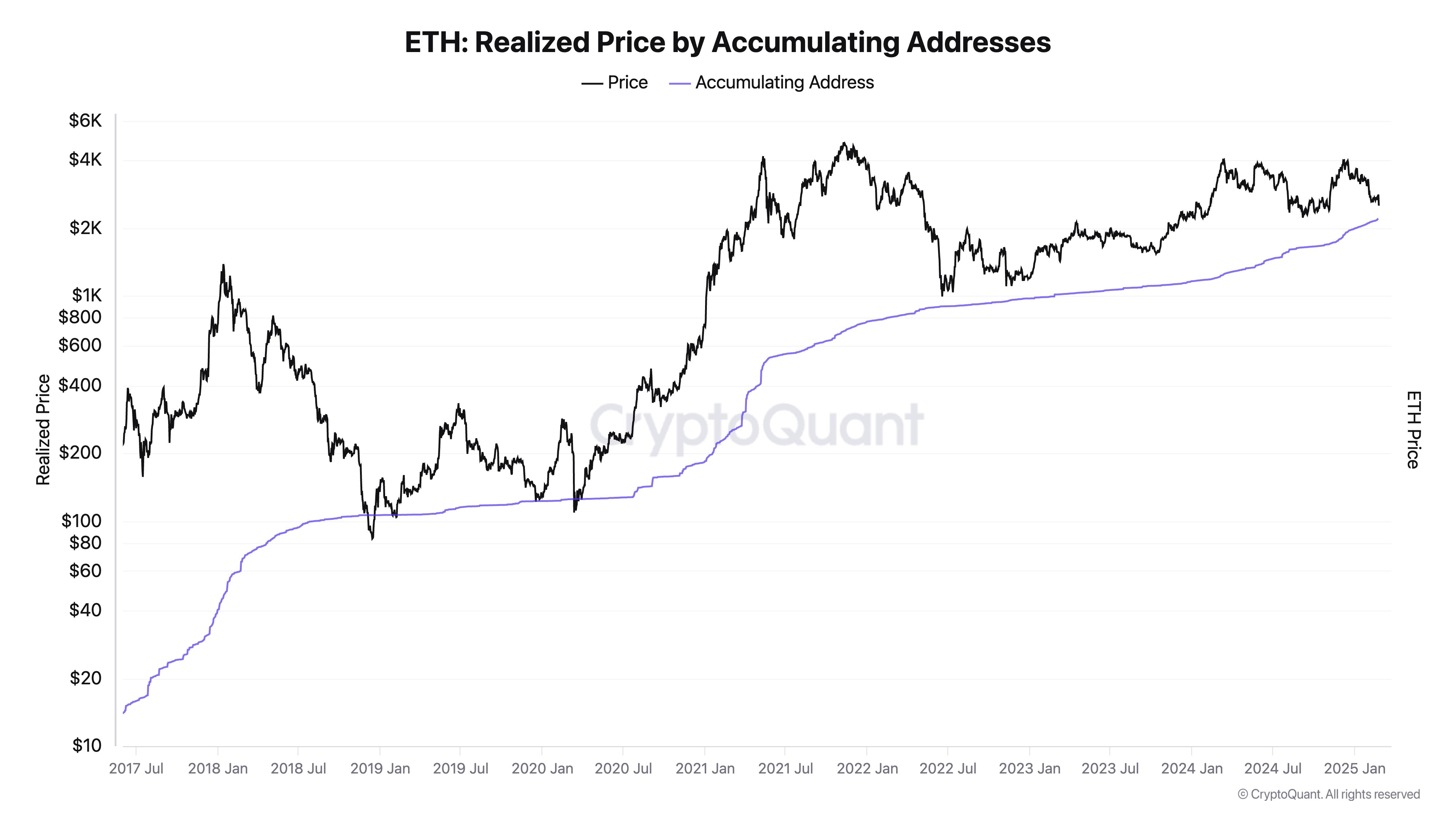

Finally, Ju emphasizes growth Whale accumulation: Addresses holding 10,000 to 100,000 ETH have increased their balance by 24% over the past year, and the current price is “close to the cost basis of cumulative addresses”.

However, Zhu admits he was “surprised” at the overwhelming bearish mood on crypto Twitter.

“Wow, CT (Crypto Twitter) is very bearish on ETH. Let me know if you have any data-driven analytics to support your bearish paper. Most bears seem to have price cuts themselves as the reason for their sale. Very interesting,” Zhu said.

On his alternative X account – below @kate_young_ju, he reiterated “Whales are stacking ETH”, pointing out that the current cost base for these cumulative addresses is about $2,199, while the spot price hovered over a price close to $2,505.

JU is not alone in challenging doom and the narrative of circular markets. ETH community member Adrianoferia.eth (@adrianoferia), assertion This “market is all in the gas”, but investors are urged to focus on top institutions and political signals that benefit Ethereum.

Related Readings

He specifically cites the report that the U.S. president and family bought “hundreds of millions of dollars worth of ETH”, which is BlackRock’s recognized tokenization CEO (and BlackRock’s own USD experiment on BlackRock’s own Ethereum), and Bybit needs to buy a lot of ETH’s people mask their hacks – potentially exacerbating more demand.

Feria also mentioned that Citadel CEO Ken Griffin believes Ethereum can replace Bitcoin. For this community member, the fact that “everyone on CT is still terrible on ETH” only reinforces the counter-trend bullish stance.

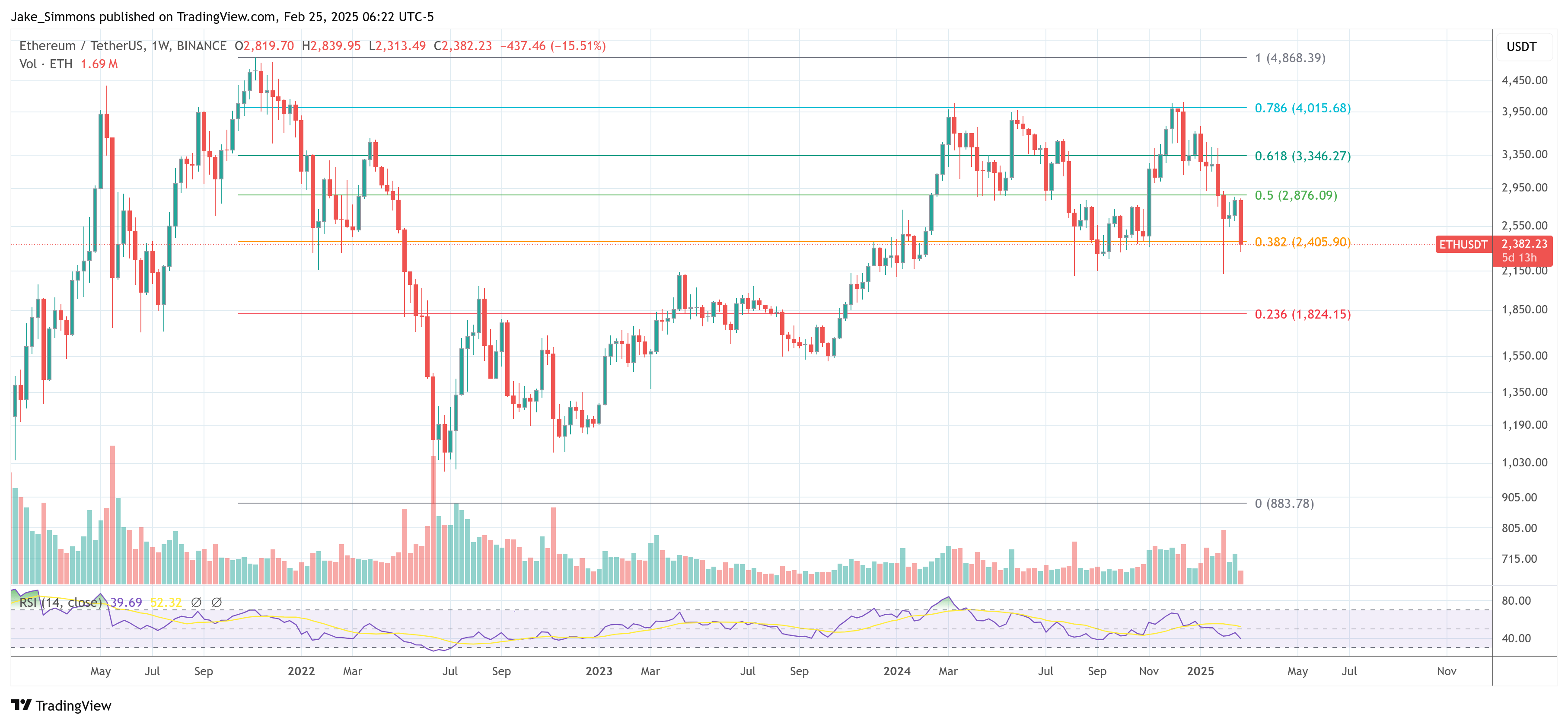

Popular crypto analyst Incomesharks (@incomesharks) showed another “red scary candle” by publishing a chart, but said the purchase area is more than $2,400.

Meanwhile, Chris Burniske, partner of Placeholder VC propose Historical perspective, reminding followers of the shrinking cycle in mid-2021: BTC fell 56%, ETH 61%, SOL 67%, and many other assets 70-80%. According to Burniske, “You can come up with all the reasons why this cycle is different, but the middle reset we are going through is not unprecedented. Those who demand a full bear blowout are misled.”

At press time, ETH traded at $2.382.

Featured Images created with dall.e, Charts for TradingView.com