Litecoin Retreat? A Drop Below $100 Still A Possibility—Analyst

Litecoin (LTC) is currently trying to maintain its position above the key threshold of $120, which has attracted investors’ attention.

The cryptocurrency is currently worth $112, reflecting a 9% decline in the past 24 hours, making its trajectory a topic of interest to investors, which has led to more than $250 million in cryptocurrencies amid a wider market decline Exchange clearing. Given the escalating sales pressure, this is reasonable LTC Escape to lower support levels in the near future?

Network growth violates price action

Despite this, Litecoin’s basic network metrics are a different story despite the unfavorable price volatility. Above the 30-day average of 8.15 million days, the total number of addresses exceeds 8 million.

Meanwhile, the figure has risen from $3.7 billion to $113 billion over the past six months. These basic indicators show strong adoption rates, contrasting sharply with the current price decline, thus creating an interesting solution for market observers.

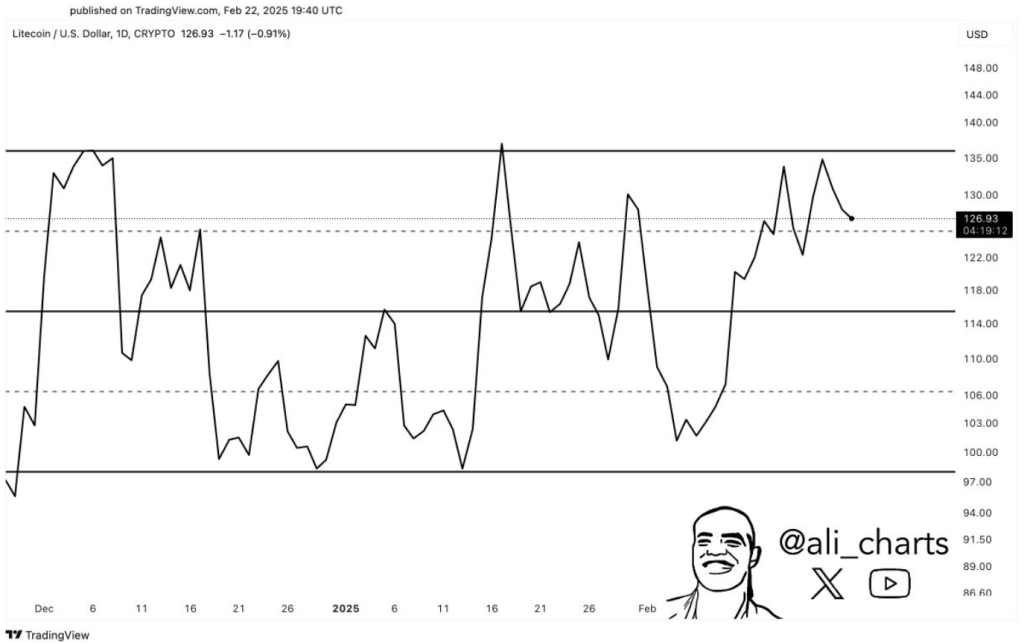

#litecoin $ LTC Facing a resistance of $135, facing rejection, which could lead to a retreat for support at $98! pic.twitter.com/uchvwgc6g8

– ali (@ali_charts) February 23, 2025

Technical model indicates potential recession

Ali Martinez, a known crypto analyst, found parallel channels related to him on Litecoin’s daily chart. This technical structure is used in conjunction with the double top reversal pattern at the upper boundary, indicating that there is a constant downward pressure that may cause LTC to enter the midline of the channel, at about $115.

The lower band of parallel channels is about $98 threshold. If the drop reaches the midline at $115, the bear may test the lower boundary line. This will be the second drop in Litecoin’s milestone below the $100.

Derivative data show mixed emotions

Different signals about Litecoin’s future abound with the derivatives market. Although the general long-term ratio is 0.90, which indicates that more holdings are held than optimistic, the ratio of important communications is like this binance Okexchange is more active.

This difference shows that while the uncertainty in the market is wider, prominent traders with larger accounts are still confident. The liquidation data further illustrates market volatility over the past 24 hours, indicating that the Bulls suffered $2.7 million in losses while the Bears received a $440 hit rate.

Strategic opportunities come from fluctuations

The current status of the Litecoin market is a key turning point for investors. If you are looking at a bigger situation, then the $98 support level may be withdrawn whenever this happens. If the price significantly exceeds $135, it may begin a larger rebound phase and indicate that the price has risen again.

Featured images by Gemini Imagen, charts by TradingView