Experts Warn Of 6-Month Slump To $73,000

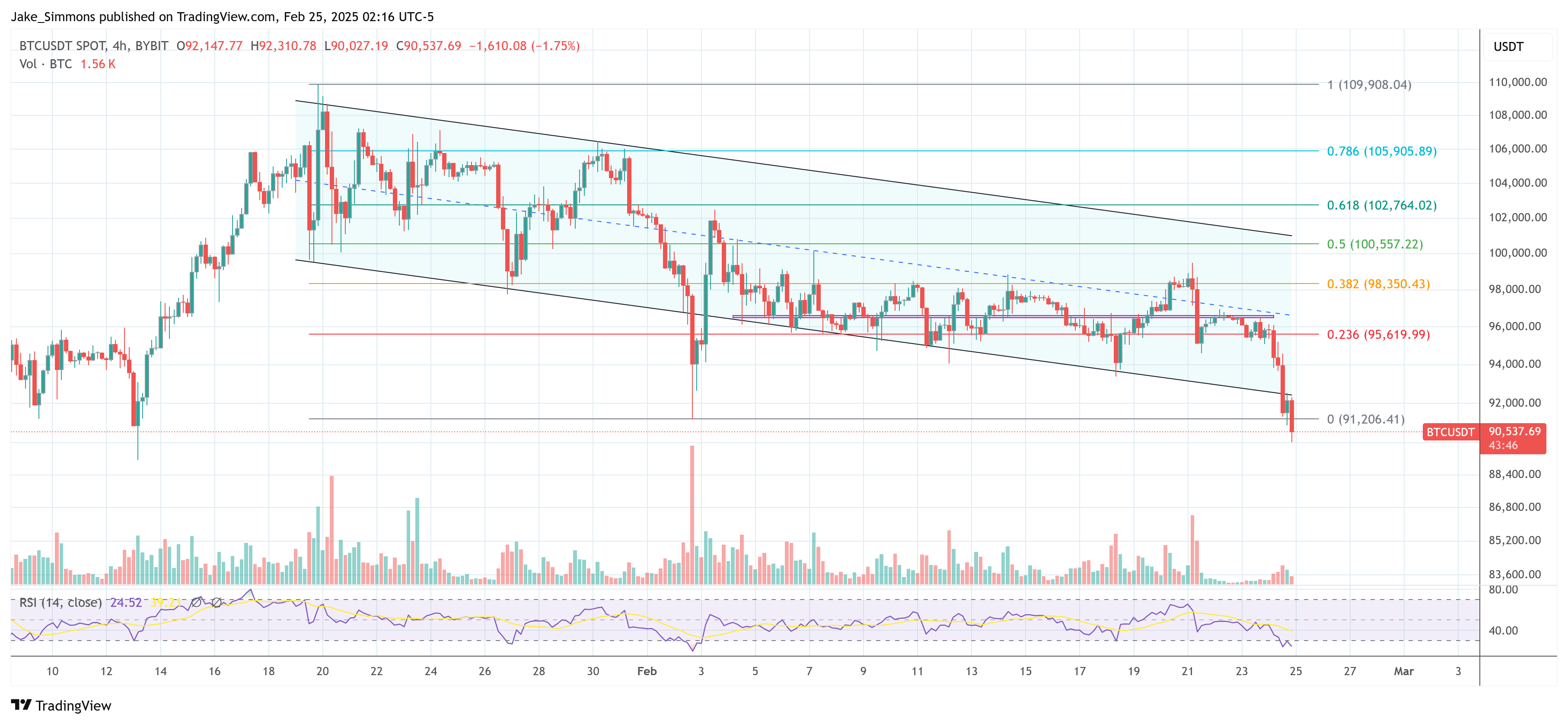

Bitcoin price has fallen by more than -8.8% since Bybit was hit by the largest cryptocurrency hack in history on Friday. The flagship digital assets peaked at $99,493 late last week, retreating to about $91,500 at press time, down -5.5% since Monday. This downturn not only shatters Bitcoin’s attempt to hold more than $95,000, but puts it on the verge of losing its critical 97-day trading range, between $91,000 and $102,000. It is worth noting that since January 20, the price of Bitcoin has been lower than the downtrend channel that is playing.

What’s next for Bitcoin?

Ari Paul, co-founder and chief investment officer of Blocktower Capital, offers a broad view of the trajectory of Bitcoin and the broader macroeconomic environment. exist postal On X, Paul talks about the potential of sustained stock market weaknesses and its ripple effect on digital assets: “My market occupies: the pain of stocks for 4-15 months (9 months, I guess) policy (tariff and quality layoffs are mainly). Then, it’s a political question – will Trump administrators “submission” and become severely inflationary? In most cases in history, the answer is yes, but the confidence in me is currently low. ”

Related Readings

Paul shifted his focus to cryptocurrencies, stressing that while cryptocurrencies may still show short-term correlations with stocks, they are essentially at different cyclical rhythms: “What does this mean for cryptocurrencies? I continue to think of cryptocurrencies And stocks are starting Different cycle rhythmsbut this does not negate the shorter term correlation. Alts may drop stocks at least initially (but they have already dropped a lot, and even at 2021 prices, they may be fast before the stocks are available.)”

Paul predicted that leading cryptocurrencies will be “like a mixture of gold and the S&P 500” when talking about Bitcoin, adding: “If gold is still strong, this is more than that suggests that Bitcoin will outperform the loss of stocks, but Maybe not a lot. Looking back at $73K-$77K seems reasonable, I might add it there.”

Despite recent volatility, Paul remains optimistic: “I still have confidence in cryptocurrencies The bull market is not over yetbut this looks increasingly different from previous cycles and may be slower. My basic case is that cryptocurrencies will lead the general macro inflation turn, so maybe recovering the crypto bull run in 6 months, while stocks appear in 9. The given date is just my guess. I have no weight in the exact time frame. ”

Bitmex founder Arthur Hayes will also warn It will be pushing downward soon. He pointed out that the mechanisms of Bitcoin exchange-traded funds (ETFs) and futures market arbitrage are potential drivers of increased sales pressure.

“The coming of Bitcoin Goblin Town: Many IBIT holders are hedge funds, and ETFs have long been short-term CME future, yielding more than they funded in the short-term U.S. Treasury bonds. If that base falls as BTC falls , then these funds will sell IBIT and buy back CME futures. These funds are profitable and based on the basis of the US yield, they will relax and realize their profits in the US time. $70,000 I see you Mofo,” he wrote.

Related Readings

It is worth noting that the research company 10 times the research publishing Monday’s analysis shows that while Bitcoin ETF (led by BlackRock’s IBIT products) has reached $38.6 billion in net inflows since its launch in January 2024, much of this capital may not represent an increase in BTC prices. Direct bet, consistent with Hayes’ statement.

“Although the Bitcoin ETF has attracted a net inflow of $38.6 billion since its release in January 2024, our analysis shows that only $17.5 billion (44%) represents a true long-term purchase. The company notes that most people (56) %) may be related to arbitrage strategies, and the position of short-coin futures offsets inflows.

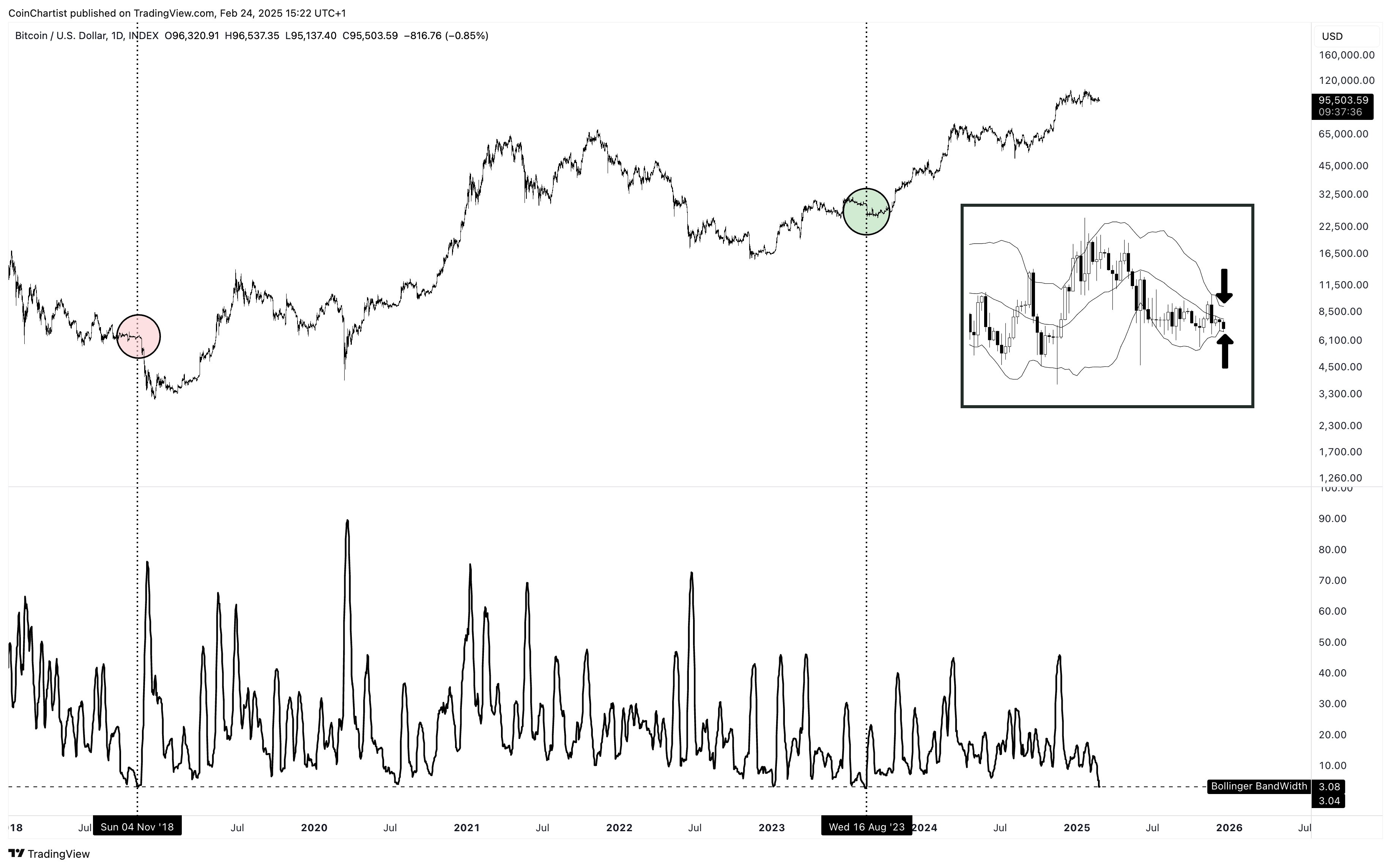

Before the ongoing price decline, market technician Tony “The Bull” Severino, warn The looming volatility in Bitcoin points to the extreme tightness of the Bollinger bands every day – a pattern that often follows a large price: “With the Daily Bollinger bands since 2018 The third reading will soon make a decision in Bitcoin In late 2018, record tightness dropped by 50% in more than a month. In mid-2023, record tightness led to 200 % or more than 200 days of climbing. Which direction does volatility release?”

Bitcoin is shaky, slightly above $91,000, and the market is still from Bybitt’s Historic Hackerthe market is at a critical point. Chart signals, macroeconomic uncertainty and relaxation of complex trading strategies have attracted a cloud-filled outlook that could expand the depression to the $73,000-77,000 range in the coming months.

At the same time, this does not need to indicate the beginning of a bear market. Chris Burniske, partner of placeholder VC, Comment By X: “In the mid-2021: BTC fell 56%, ETH fell 61%, Sol fell 67%, and many others 70-80%++. You can figure out all the reasons why this cycle is different, but The middle reset we are experiencing is not unprecedented. Those who demand a full blown bear are misled.”

At press time, BTC was trading at $90,537.

Featured Images created with dall.e, Charts for TradingView.com