Bitcoin Once Again Arrives At This Bear-Bull Boundary—Will A Break Happen?

Data on the chain shows that the Bitcoin indicator is currently retesting a level that has historically been the boundary between bearish and bearish momentum.

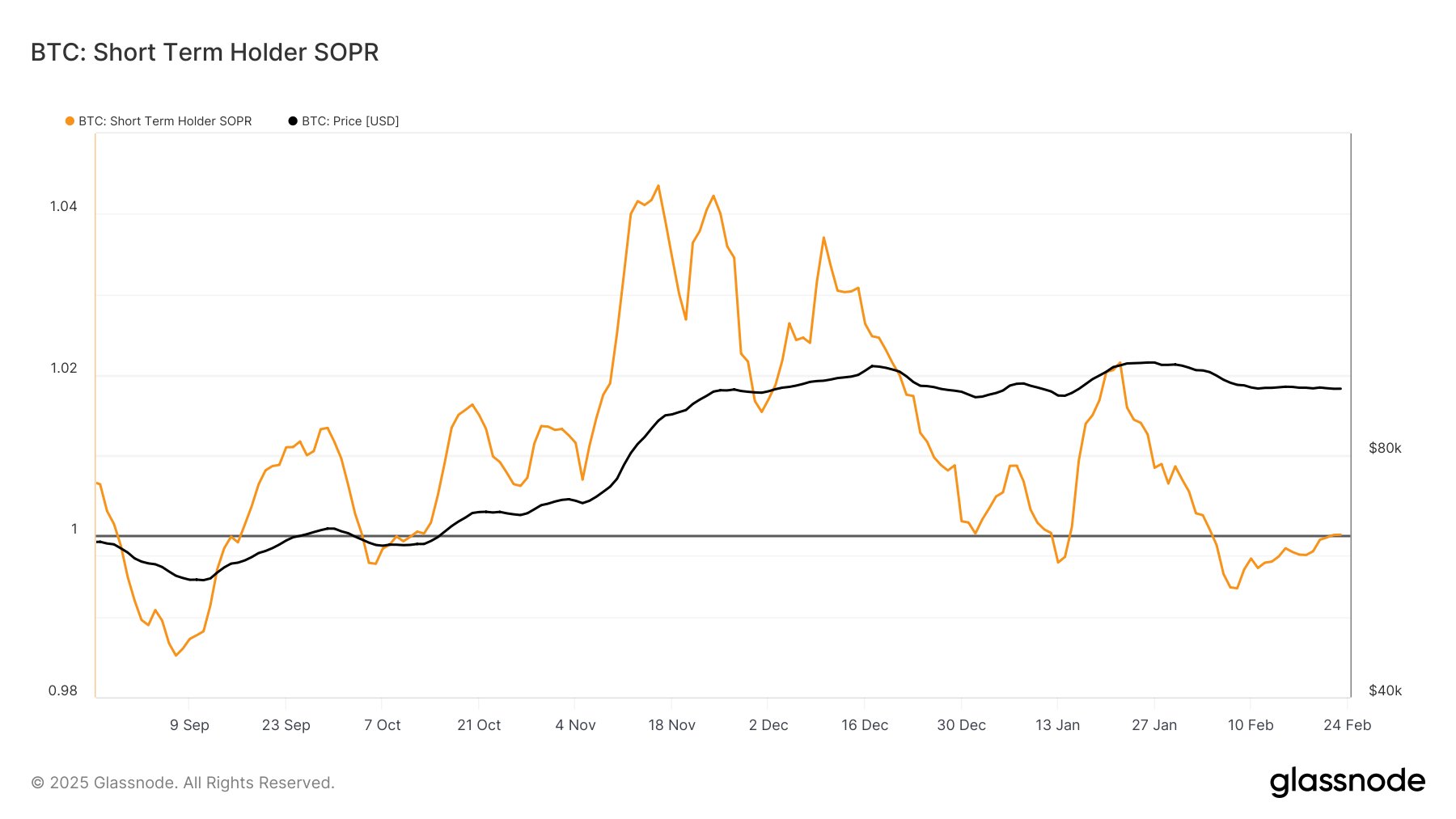

Bitcoin Short-term Holder SOPR is now retesting 1.0

In the new postal On X, on-chain analytics firm GlassNode discusses the latest trends in short-term holders’ BTC spending margin (SOPR).

Related Readings

this”soprano“Here is an indicator on a chain that tells us whether the entire Bitcoin investor is selling or transferring its coins for profit or loss or loss.

When the value of the indicator is greater than 1, this means that the average holder of the asset is sold in net profit. On the other hand, it shows that the entire market is achieving net losses.

Naturally, SOPR is completely equal to level 1, which means that the profits that investors are realizing are being lost, so it can be considered that the average holder is losing only in the transaction.

In the context of the current topic, only the names of specific investor groups are of interest: Short-term holder (STHS). STH includes Bitcoin investors who purchased their tokens in the past 155 days.

Now, here is a chart shared by analytics companies that show the trend of Bitcoin STH SOPR’s 7-day moving average (MA) over the past few months:

As can be seen in the above image, Bitcoin STH SOPR fell below 1 point earlier this year, meaning STH suffered losses as the price of cryptocurrencies moves Bearish Trajectory.

However, lately, the indicator has been recovering and is now back to breakeven. “Historically, breaking over 1.0 confirmed the shift in momentum, and things that don’t do often lead to selling pressure,” GlassNode explained.

However, breaking through the level is not an easy task as it is the main psychological level of STH. By definition, these investors are new to the market, or are just determined not to be enough to maintain for a long time, so they are easily abandoned by panic.

When STH SOPR rises to 1 mark, it means these investors are forced to sell losses earlier and can explode again. When this happens, selling pressure may soar as STH is eager to “return” their money.

Related Readings

Bitcoin saw the last time the indicator retested this level. From the chart, it is obviously successful in finding a breakthrough, although it is only brief.

Now, it remains to be seen whether the indicator can also enter the profit zone this time.

BTC price

Bitcoin has dropped to $94,500 in the past few days.

Dall-E, Featured Images of GlassNode.com, Charts of TradingView.com