Solana Faces Make-Or-Break Moment With $1.77 Billion Unlock

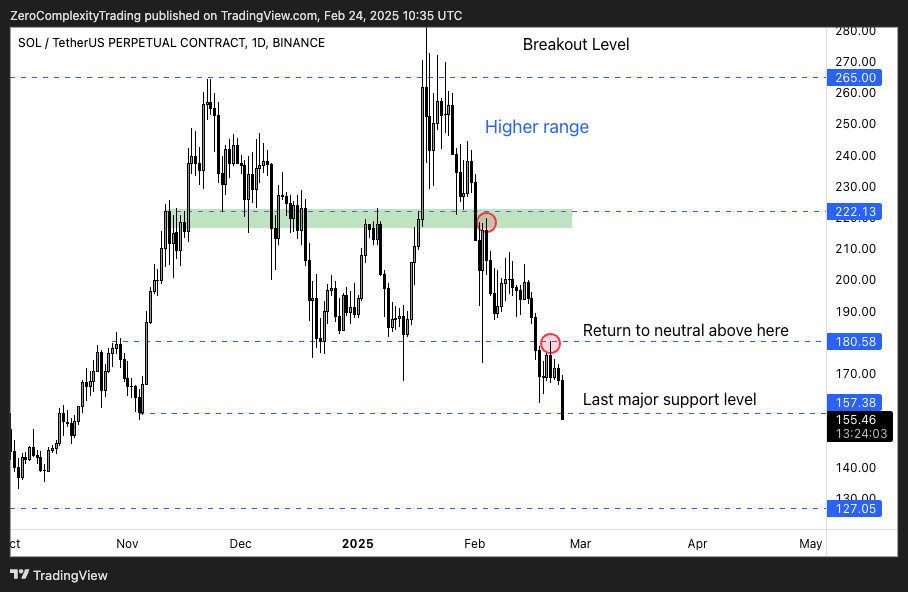

In the technical chart shared today, crypto analyst Korfh Khaneghah, founder of Zero Complexity Trading, highlights Solana’s continued downward trend, highlighting key support and resistance levels for the Sol/USDT Perpetual (Binance) daily schedule. According to the chart, Solana has lost several key areas and is currently hovering around the $157 area, with Khaneghah tagged as the “last major support level.”

Solana’s bearish argument

“As SOL was rejected by another S/R flip and dropped to the $150 level, the downward trend continued. The emotion was at an all-time low. The assumption continued until other facts proved to be” write a letter By X.

A prominent feature of this analysis is the support/resistance (S/R) flip of approximately $180.58. In early February, Solana tried to recoup this level but suffered huge sales pressure. Failed to ensure a daily closing price above $180.58 (now resistor) signature Downward momentum.

After the drop, Solana settled below the $157 price, marked on the chart as “the last major support level”. Prices briefly fell below the region, indicating that the market’s current position is fragile. Failure to hold $157 at the daily close increases the likelihood of further decline to the next important level to $127.05, visible at the lower end of the chart.

Related Readings

KOUFH’s notes also indicate that those returning to above $180.58 will shift market bias from bearish to “neutral”. Before this happens, analysts warn that the seller appears to be in control. Negative emotions of meme coins Strengthen the ongoing downward trend.

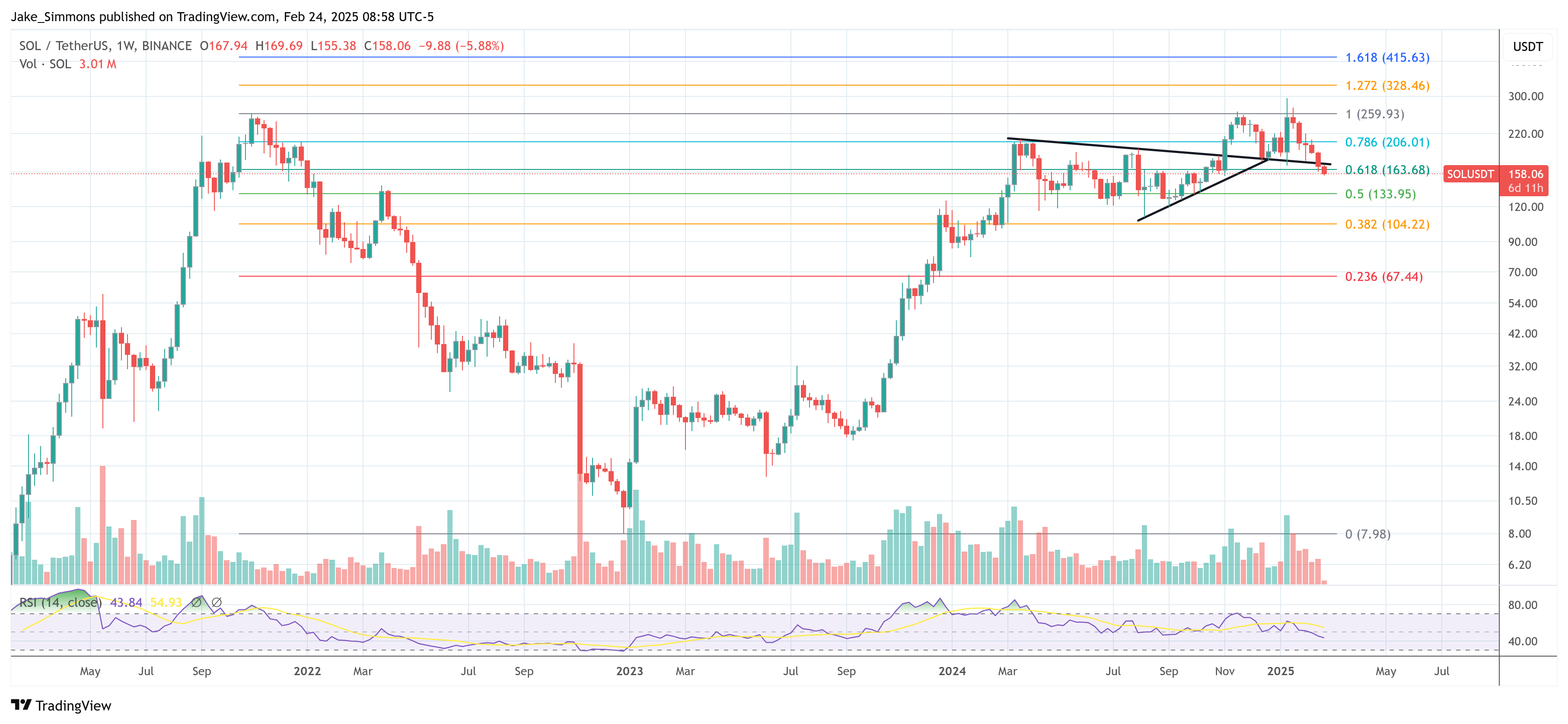

Bullish arguments for SOL

Meanwhile, crypto analyst RunnerXBT (@runnerxbt) has shared Order flow analysis of Solana (SOL) futures chart (binary time range 2 hours). The chart highlights significant price points, clearing and positioning changes Unlocked on March 1– Plans to release 11.2 million Sol (worth approximately US$1.77 billion).

In the annotated chart, the price peaked at $295 in mid-January, before starting a steady decline, and recently saw Sol hover in the mid-$150. The chart shows that from early January to late January, the price drops sharply, and the cumulative quantity of Delta (CVD) shows that this ends mainly by long positions. RunnerXBT’s comment attributes it to Sol Bealness moving in concatenation (1:1) in large part with Bitcoin.

By late January, after a more significant decline, prices and OI had reached lower levels. The OI rebounded briefly in early February, although the chart showed that the initial long positions were quickly covered briefly as traders hubs could make profits or closed lost positions. Despite such activities, Sol’s price still fails to achieve a sustained upward trend, enhancing a broader sense of hesitation among traders.

Related Readings

Around mid-February (February 16-18), on February 24, the chart highlights the stage of “active short circuits and on-site sales”, which leads to continued price decline pressure. Despite some short coverage (especially around February 21, CVD has a slight ticking effect), the overall momentum remains soft with few new signs of long-term accumulation.

On the right side of the chart, RunnerXBT marked a vertical red line on March 1 as the date of what he called the “maximum Sol known to humans”. Many market participants seem to have flooded by selling new tokens, which seems to be a “leading” activity. This has the potential to increase volatility.

However, in his post, RunnerXBT warned that when Times traded less than $200, he initially began monitoring the situation and was seeking scalp for a long time after the unlocking took place. He noted that attempting to drop 5-10% per day is dangerous, while traders who do so often stop or clear.

“I don’t think it’s wise “new” for Sol. I’m starting to post a situation about JUS under $200. I’m looking for a scalp and long after unlocking people “fronttrund” it’s stopped or Liquidation. You are not the hero of falling knife every day -5% to -10%. (…) TLDR: Looking for desire (not locked for the first 5 days). Not shorts. If people don’t understand, I won’t be able to help you,” he passed X wrote.

At press time, Sol traded for $158.

Featured images from Shutterstock, charts from TradingView.com