Is The Bitcoin Price Manipulated? Expert Exposes The Truth

In a new research note shared by X, HEAA’s growth head Joe Consorti eliminated ongoing rumors that Bitcoin prices are being artificially lowered. Consorti has conducted a comprehensive examination of on-chain data, which shows that the normal cyclical behavior of long-term holders (LTHS) and their profit patterns are key drivers of Bitcoin’s current trading dynamics.

Is the price of Bitcoin currently being manipulated?

One of the core debate The Consorti address is a skeptic that the “boring merger period” may have been designed through hidden market forces. In his words: “The claim of artificial price suppression is a golden age argument that it does not work in Bitcoin, and the ledger of Bitcoin is auditable in real time, meaning we can see exactly who is on the network Buy and sell through your own nodes. Transparent

Consorti stressed that chain observers can see any consistent effort to artificially hat bitcoin for artificial hat bitcoin. Instead, the data points to a good pattern: after accumulating BTC at a lower price (between $15,000 and $25,000), it sells some of its holdings to a higher price, reallocating the coins. Give new market participants to continue bidding upward for Bitcoin. “This is normal. Those who have started unloading for years when prices rise, transfer coins to new buyers to bid for higher prices.”

Related Readings

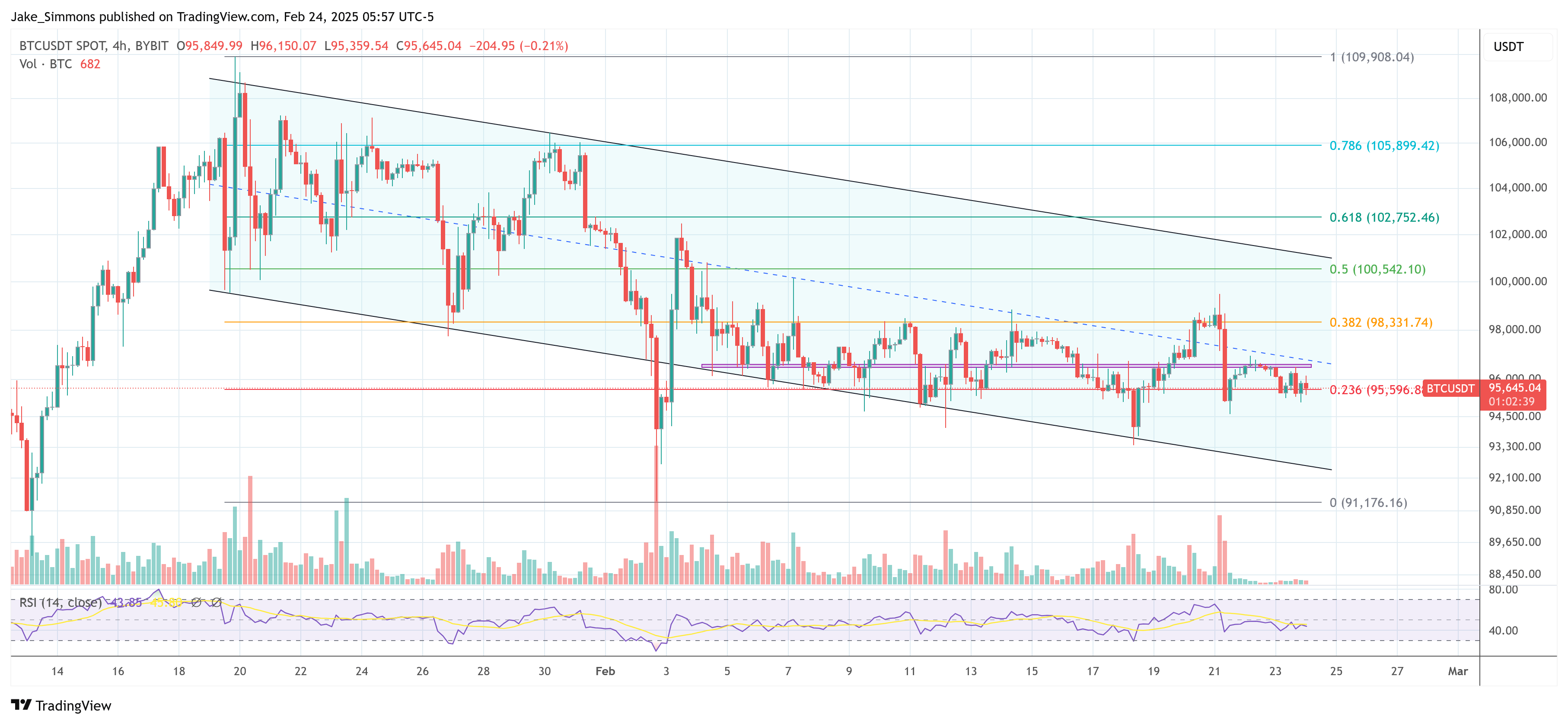

According to Consorti, Bitcoin is now entering a 100-day merger range of about $95,000, which he finally resolved in a major price increase compared to previous multiple-month mergers.

This study provides a retrospective study exploring previous price increases in LTHS: “LTHS accumulates BTC from $15,000 to $25,000 and then sells to new market participants (short-term holders) until the next “step “, their price bids were bidding. They ranged from $40K to $65,000 from $65,000 to $95,000 from $65,000 to the $95,000 range we find ourselves now.”

Consorti noted that LTHS has recently turned it to a net accumulator. Although this shift is small, he believes that this behavior usually marks a merger tail before another breakthrough.

Researchers also point to the latest $1.4 billion Ethereum Hackers on bybit– The biggest in crypto history is that it is the factor that temporarily knocks on Bitcoin, trying to get rid of its wedge pattern that it dropped. Despite the market disruption, Bitcoin fell by only 1.75% on the day, which Consorti said was a testament to BTC’s leading “full strength” and reduced relevance to the wider crypto assets.

Overall, Counsorti expects the troubled wedge to “resolve before the first week of March” and ban other black swan activities. He also observed that Bitcoin’s current merger zone could last longer than 101 days, warning that “the biggest pain in the market” could be extended to 236 days, reflecting the protracted consolidation period last summer.

Consorti also quotes possible The impact of President Trump’s task force On Bitcoin, the Bitcoin will determine the survivability of strategic Bitcoin reserves by the end of June. If the final decision is faster, he suggests it could bring a significant spark to the market, whether bullish or bearish, depending on the outcome.

Spotted ETF inflows, once considered Main propeller Bitcoin’s price has fallen since early January. Although they still show a daily inflow of 7-8, they are significantly lower than the 9-10 digital levels that occurred last spring and fall, suggesting that other market forces, such as institutional and chain dynamics, may be more influential. Price changes in this cycle.

Another topic is the dislocation of Bitcoin Global M2 currency supplytracked prices with incredible accuracy in the past 18 months. This correlation broke down when Global M2 proposed a deeper recession in Bitcoin, but BTC continued to hover around $95,000. Now that M2 is driving upwards again with a weaker dollar, research shows that Bitcoin’s chances of bringing its next leg higher remains consistent.

Comparing Bitcoin with gold with 50-day lead also means that gold’s recent trajectory may “point upward resolution”, albeit less relevant than M2. If you do this, a push towards $120,000 seems reasonable.

Related Readings

Consorti ends attention to the evolving landscape of the U.S. Treasury (UST) demand. Major foreign holders such as China and Japan have gradually lowered or dominated their position – China’s shares reached $759 million in 2009, while Russia’s shares have completely withdrawn, and Japan has maintained its 13-year stake for 13 years $1.06 trillion. “It’s not just China. Russia has completely withdrawn from UST. Japan is the largest foreign holder, which has been flat for $1.06 trillion in 13 years.”

Meanwhile, the U.S. Federal Reserve’s share of unsold USTS has soared from 22% in 2008 to 47.3% in 2025, stepping in with the decline in foreign demand. But a new player joined the market in the form of Stablecoins, which ruled about $200 billion in the treasury to back their dollar fixed tokens. According to Consorti, this stability requirement: “The long-term interest rate can be reduced. The proliferation of stablecoins and the use of Treasury bonds as reserve assets means they operate like a brand new foreign central bank.”

He believes that stable bacteria effectively ensures new demand for the treasury, helping the U.S. government offset the decline in foreign participation and maintain its borrowing needs. White House AI and Crypto Czar David Sacks publicly responded to this view, saying Stablecoins helps maintain liquidity in U.S. debt.

At press time, BTC traded $95,645.

Featured Images created with dall.e, Charts for TradingView.com