Panic Or Opportunity? Dogecoin Whales Liquidate 100 Million Coins

The crypto market is focusing on large-scale Doge transactions. The whale has moved 100 million thresholdsabout $25.42 million, donated. The move raises questions about whether the sell-off is coming, or that’s just another typical shift in holding.

Whale activity attracts attention

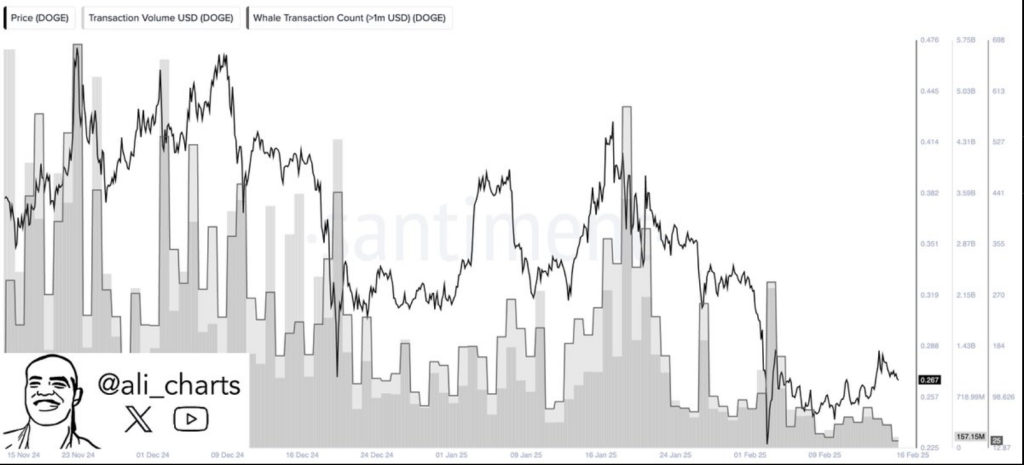

When a major cryptocurrency holder transfers a large amount of holdings to the exchange, it usually means they want to sell. The Governor’s price may drop as a result, which will lead to smaller investors’ responses. However, cryptocurrency expert Ali Martinez noted that whale activity has declined overall, indicating that major investors have not acted positively for the time being.

Whale Activities #DogeCoin $ DOGE The network has dropped by nearly 88% since mid-November! pic.twitter.com/6x4cih3mf8

– ali (@ali_charts) February 17, 2025

Doge’s current market performance points to ambiguity. As of writing price It is $0.255622; the intraday high price is $0.257605 and the low price is $0.250725. These volatility means that the trading range is quite limited. However, if the more important holder decides to sell their shares, volatility may increase.

Market sentiment remains split

According to some businessmen, whale transfer is a bearish signal, while others believe that unless other coins occur, their effects may be negligible. Dogecoin has a history of sharp response Whale Sports;However, the total sales pressure this time seems to have been surrendered.

Continuous discussion on potential Doge Exchange Trade Fund (ETF) is another important factor that affects emotions. If the ETF gains momentum, it may attract institutional investors and potentially offset any sales pressure on whales. Nevertheless, the market is currently in a state of assumption as no official approval or timetable has been announced.

The road ahead of Dogecoin

Despite the movement of whales, the price of the threshold remains stable, but it may drop further if market sentiment changes. If the Governor’s price drops below $0.25, it may pour further, which may lower the price further. On the other hand, strong buying activity may be a barrier to further reduction.

Investor choice

The whale movement reminds us of the speed of the retail trade market dynamics. Some may decide to keep their position because they hope that possible catalysts like ETFs will raise prices, while others take a more cautious approach and look for an increase in whale activity before deciding what to do next. sign.

Featured images from Medium, charts for TradingView