McCann’s Meme Street Revolutionizes Meme Coin Investing. $MEMEX Likely to 100x as a Result.

Joe McCann is the founder of a hedge foundation with over 25 years of experience and has made some interesting research in terms of Memi Coin Investment. His flagship fund (The Technology Master Fund) ranks third in the world in terms of cumulative returns of 12 months. As of March 2024.

As the world jumps into the trend meme coin, McCann developed a very unique way to catch bulls with its horns. He merged traditional Wall Street risk mitigation methods and the madness of the meme market to build a new “meme street” investment spirit.

McCann believes that one of the key skills for traders is to stay as uninterested as possible, especially when the market is saving. If not, it can lead to very poor transaction decisions.

In addition, seeing the Memecoin market full of joy, it is difficult for investors to grasp their ideas. Here, risk measurement and systematic approaches like Meme Street come in handy.

What are the rules of Meme Street?

The biggest difficulty for trading institutional investors in trading meme coins is liquidity. That’s why McCann only has a lot of exposure in blue chip meme coins. These are the largest cryptocurrencies in at least 90 days, with a market cap of more than 1B.

Another rule on Meme Street is to limit exposure across the entire fund to just 2% of coins that are not part of the top 20% of cryptocurrencies’ market capitalization.

Once these basic rules are established, McCann continues to analyze The best meme coins Just like any other asset class that uses technical analysis and data.

McCann’s $ Bonk Trade

In 2023, McCann observed that the Stabecoin Fund flowed from Ethereum to Solana. Now, Solana hasn’t scored more than $30 for most of 2023. The shift in funds could have helped $SOL maintain its resistance and see prices soar, and that’s exactly what happened.

Now, investors will use this game to park their funds in high beta coins to achieve huge risk rewards. The challenge is to find out which asset investors will sit there. McCann puts his bet on $bonk, which saw a massive rally in Q4 2023.

The exit position is also crucial. Now, since Bonk is still in price discovery mode, there are no technical indicators that recommend exit. To address this, McCann began looking at the live order flow to see if there was any slowdown in Solana’s inflow.

McCann builds a system that can identify large amounts of flows into a specific asset, such as Solana, and then uses this information to decipher whether that traffic can be attributed to accumulation or distribution. If the data suggests distribution trends, it is safe to exit the meme coin trade.

McCann’s prospects for 2025

McCann is bullish against Bitcoin and Solana in 2025, mainly due to increased institutional interests. As part of its strategic reserve, several countries have been actively purchasing $BTC. Solana, on the other hand, is a cheaper, faster, and easier user-friendly Ethereum alternative.

But he also has a cautious attitude towards those who want hype to gain fast. McCann believes that the period of easy money is over and only strategic traders can survive in 2025.

Investing in Meme coins is not necessarily super risky, especially when a systematic investment approach similar to Meme Street is being launched for Meme Coins. Enter Meme Index ($MEMEX).

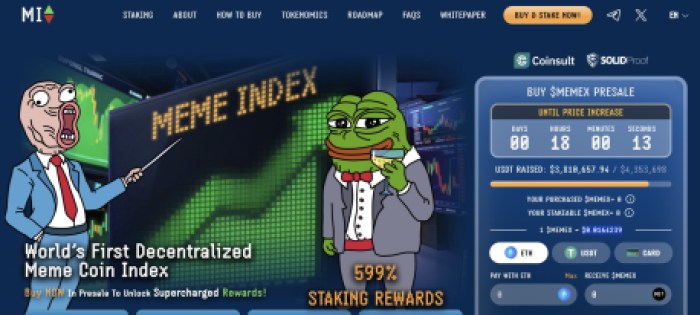

What is $MEMEX?

Meme Index ($MEMEX) brings good old stock market concept to Meme Coins. It offers a total of four different meme coin baskets, each with different volatility, risk and profit potential.

Depending on your risk appetite and analysis (for example, slow market means you should make a safer investment), you can choose one or more $ MEMEX basket.

Here is a short summary of the four indexes provided:

- Meme Titan Index: Contains good meme coins with market cap of over $1B. Great for risk aversion and new meme coin investors.

- Meme Moonshot index: Meme coins will exceed $1B with a market cap of more than $1B. This provides a balanced combination of risk and reward.

- Meme mid-cap index: Coins with market capitalization of between $50 million and $250 million. It is more risky than the above two risks, but more meaningful.

- Meme Fanatic Index: Encryption that may explode. A very volatile index that is only for real adventurers.

Needless to say, these meme coin baskets, even the most risky meme crazy baskets, greatly reduce the risk of diversifying by diversifying your investments in a variety of coins.

So if the meme coins perform less well, you are unlikely to go bankrupt. Because the others in the basket will still make sure you end up turning green.

Why can $MEMEX become the next cryptocurrency up to 100 times?

As McCann said, the current market conditions are not screaming bullish, meaning “buy and Hoddle” may not be effective under bullish conditions. Such an era requires wise investment. What exactly is it $ MEMEX Bring to the table.

Additionally, due to its volatility and skeptical investors who dare to enter the meme coin space, we say the pump and the reduced nature would see $MEMEX as an opportunity to eventually step into Meme Coins.

For more information, please check it out $MEMEX’s White Paper and X Feed.

Meme Index Currently in Presale, more than $3.8 million has been raised. If you enter now, you can get $1 MEMEX for just 0.0164239 $0.0164239, but as the price rises for the next 18 hours, hurry up. If this is your first cryptocurrency pre-sale, see How to Buy $MEMEX.

As always, we urge you to do your own research before investing in hard-earned money. After all, in the short term, cryptocurrency and member markets are very volatile and unpredictable. In addition, this article cannot replace professional financial advice.