Bitcoin Blasts Past $98,000: Is $100K Next, Or A Trap?

Bitcoin has surpassed $98,000 Thursday, exacerbating a heated debate among traders about whether the $100,000 milestone hits again, or that the current rally is vulnerable to rapid corrections. Behind the scenes, market observers point out that open interest (OI) and add leverage, with the focus being the driving force driven by leverage.

Bitcoin rally or a trap?

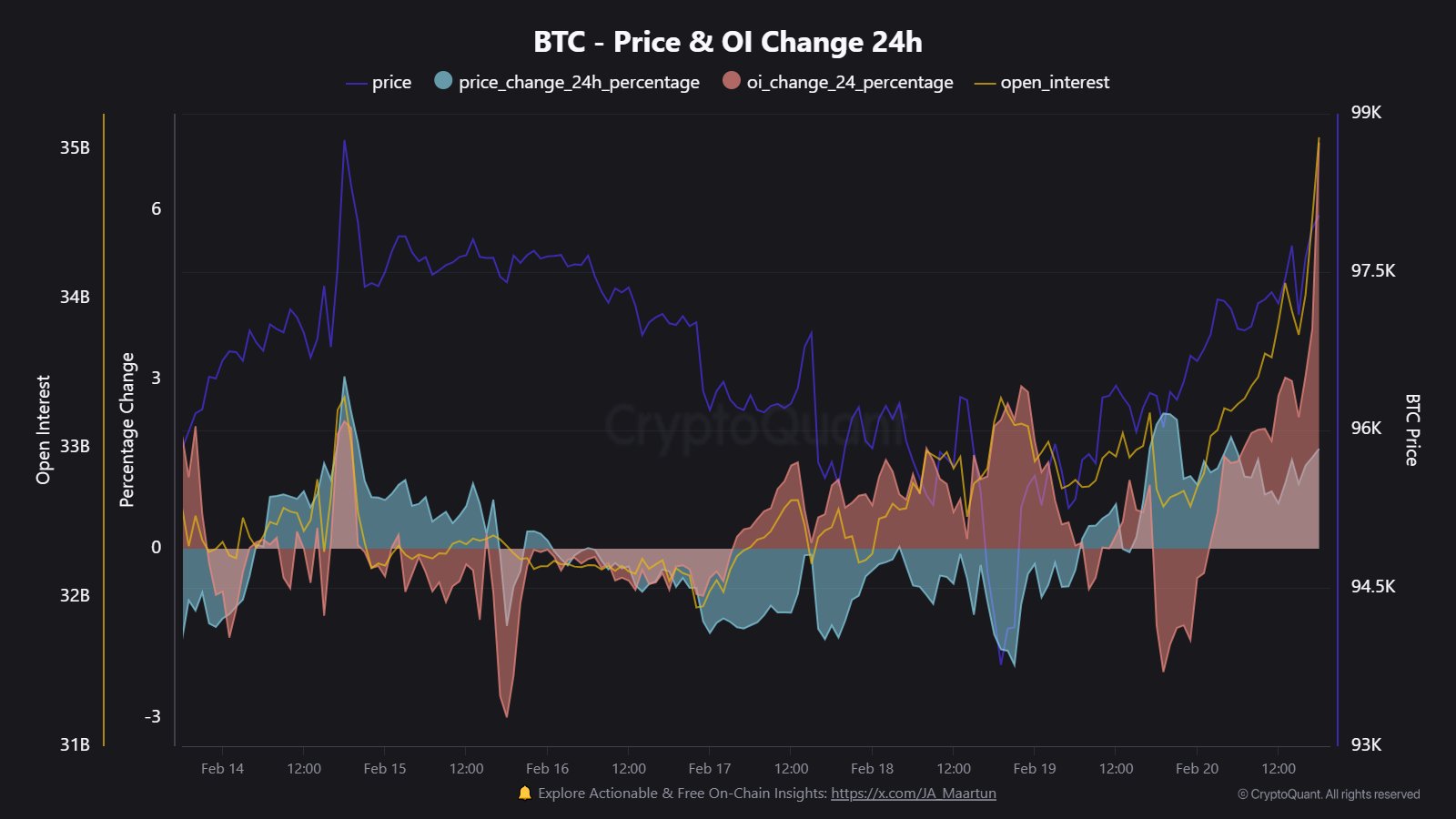

Implicit community analyst Maartunn (@JA_MAARTUN) warned of a “leverage pump” and pointed out that Bitcoin’s OI gained $2.4B in 24 hours. Through X, he wrote: “Utilizing the Drive Pump: Open-ended Interest in Bitcoin increased by 2.4b (7.2%) over the past 24 hours.”

Confirm these observations, famous crypto commentator General Byzantine (@byzgeneral) Highlight The important role of fresh long positions in driving price increases: “There are a lot of fresh desires on BTC, which makes the price higher. It’s a little interesting to note that the back of these Degen Longs that are here are now cancelled.”

Analysts at Alpha Dojo (@alphadojo_net) echo The cautious sentiment highlights the significant gap between open interest based on futures and spot-driven purchases: “BTC continues to wear out while OI is steadily rising, but there are few on-site purchases. BTC is now approaching the upper end of the range again. Some seem to be Market participants try to enter SellerPlan to bid $2 billion. ”

While the prospect of a big buy may drive the market, they warn that without fresh catalysts such as “short-term narrative or positive news,” BTC currently appears to be difficult to sustainably exceeding the $100,000 trademark. ”

Bob Loukas, a well-known crypto analyst if Explain a cyclical framework for Bitcoin price movements and point out that the market may be approaching the end of a weekly cycle, and the beginning of another cycle: “We are about to complete the weekly Bitcoin cycle, like I shared last That’s 6 weeks. In the context, there are only 5 cycles per week since the 2022 bear market low. (Average 6-month events). There are 4 actions in these cycles 90-105%. One person does not do a lot of things ( June to September 23). ”

Asked if this marks an imminent market top, Loukas clarified: “I mean we’re about to start a new market. Cycles always start at lows.” His comments suggest that while cycle transitions are imminent, But it does not necessarily equate to the peak of the market, which may mark the beginning of a new uptrend.

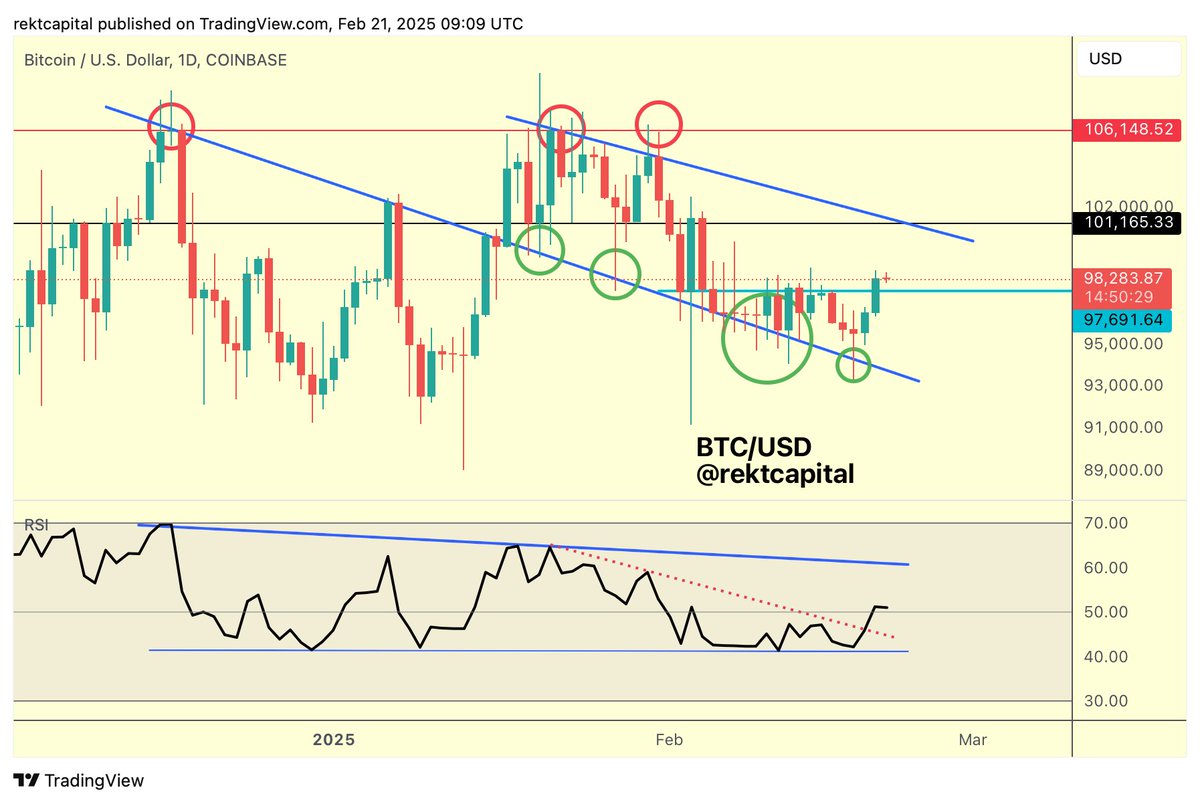

Technical analyst Rekt Capital (@RectCapital) emphasize The importance of Bitcoin’s close-up over the $97,700 threshold every day suggests that successful retesting in the area may pave the way for relocations over $100,000: “ Bullish Difference Has translated into a recent breakthrough move. With the recent daily closing price above $97,700, Bitcoin will now try to retest the level to support trend continuation. ”

He further elaborated on Bitcoin’s Relative Strength Index (RSI) channel, which suggests that breakouts above a series of lower highs may mark the speed of the next leg: “Bitcoin’s price continues to be retested over time as time goes by: Blue trendlines are supported. RSI continues to maintain its channel bottom. Recently, RSI has broken a series of lower highs, indicating that RSI may be ready to rise to the top of the channel.”

Looking ahead, the obvious $97,700 support can confirm Rekt Capital’s bullish outlook: “Close over $97,700 per day is successful (light blue). Any dip that falls to $97,700 will constitute a retry. Reopening after the outbreak The test is $97,700, and the new support will be fully confirmed to position the BTC rally at $101,000.”

At press time, BTC was trading at $98,645.