Solana’s Market Woes Continue With A 32% Monthly Drop

Solana’s recent price action has caused anxiety in the digital currency market. The once revitalized blockchain has dropped significantly due to a widespread downturn. Solana Local tokens (SOLs) have dropped 32% over the past four weeks, down 10% for Bitcoin and 15% for Ethereum. As the network was affected by the meme currency madness, this caused investors to roll up and therefore suddenly sold out.

Related Readings

Meme Coin Mania Turns into Disaster

Solana has always been the center of explosive meme coins growing. Although initially sparked trading volume and interest, it has since resulted in serious negative impacts. Carpet pull The network’s failure in its initiative reportedly resulted in losses of more than $26 million. Many developers give up the project immediately after raising funds, giving investors valuable tokens.

This issue escalates at an astonishing pace. In 30 days, the Solana ecosystem lost at least 12 meme coin plans. The price of tokens has dropped due to the surge in failure, which also negatively impacts investor sentiment.

Solana is over

Worse than FTX crash$Libra,,,,, #Melania Changed everything

🧵: This is what happened, what is next… pic.twitter.com/mo6tmbpift

– Xremlin (@0x_gremlin) February 17, 2025

Is Solana in trouble?

Crypto Trader Xremlin recently announced on X “Sorana is over.” Down it with FTX crashes– Worse. He noted that Solana’s recent surge in popularity has been driven by speculation and the rise of meme coins.

Much of this activity stems from low trading fees, attracting traders to platforms such as pump.fun. However, many of these tokens are seen as pumps and lowering schemes, which adds to negative sentiment in the Solana ecosystem.

Hope it?

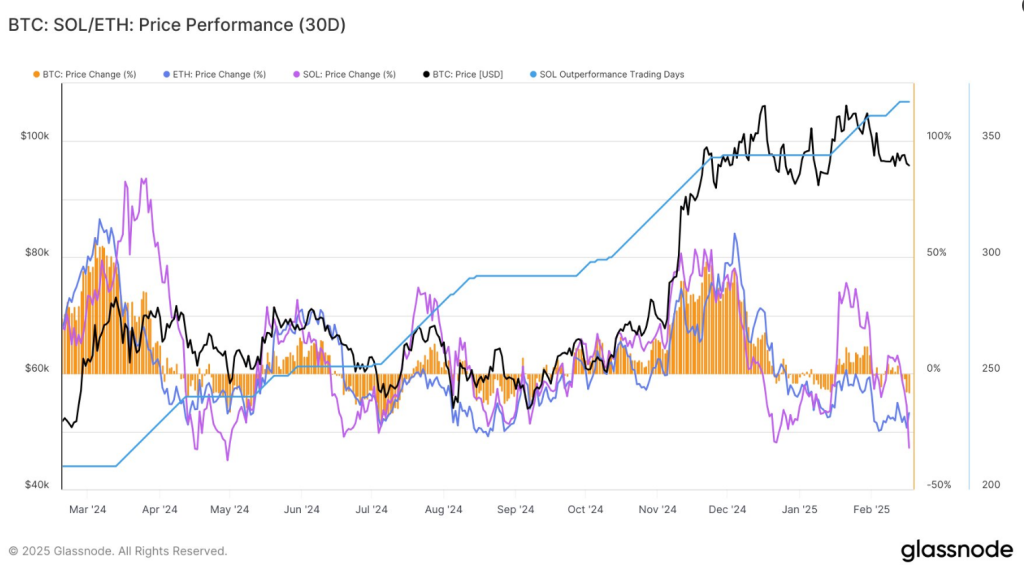

at the same time, Glass Festival data It shows that Solana has surpassed Ethereum since 23 of 49 days at the beginning of the year. Still, Solana showed greater sensitivity to market declines.

Since the beginning of this year #solana Superior performance #Ethereum 23 of 49 days. However, $ sol As of February 17#eth:-17%, #BTC:-8%) https://t.co/7p1xfardld pic.twitter.com/ge7wav4hbi

– Glass Node (@GlassNode) February 18, 2025

Negative impact on the network

Solana’s attractiveness as a low-cost, high-speed blockchain attracts businessmen interested in leveraging speculative businesses. Proliferation Meme Coin However, this similar scam has caused serious concerns.

Currently, many analysts warn that Solana has the potential to become a breeding ground for pumps and lowering programs rather than promoting sustainable ecosystems.

Congestion issues on the network are also another big problem. Because meme currency is so popular, the system’s transaction speed and occasional fees drop. This frustrated some users and made many wonder if Solana could maintain peaks in activity without slowing down.

Related Readings

Bitcoin and Ethereum show elasticity

Bitcoin and Ethsereum Solana caused the latest downturn when she was in trouble, causing relatively little damage. Bitcoin fell 10% last month, while Solana fell 33%. Even though it’s still better than before, Ethereum, which has been under sales pressure, has dropped 17%.

In times of uncertainty, investors are gradually attracting established assets. Compared to Solana, Bitcoin and Ethereum are able to avoid the chaos of meme coins implosion to maintain higher levels of market confidence.

Featured images by Gemini Imagen, charts by TradingView