Fidelity’s Timmer Predicts What’s Next

Jurrien Timmer, global macro macro director at Fidelity Investments, discussed in a report released on Tuesday how the economic landscape of the shift affects markets, central bank policies, and the trajectory of Bitcoin and gold. As the S&P 500 hit new highs and so-called “Trump Trade” reversal course, Timmer offers subtle insights into fiscal policy, inflation, and the role of risky assets in the “Limbo” market environment .

Trump’s effect

wood observe The first six weeks of 2025 brought unexpected market action and an unusually high “noise to signal ratio”. The main market expectations in the year are “higher yields, stronger dollar and better than U.S. stocks” – a sudden change. “It seems that 2025 is looking to be in a higher yield, a stronger dollar and a consensus trade that outperforms U.S. stocks has become the opposite,” he noted.

Timmer highlighted Bitcoin’s rise to prominence at the end of the year-end rally, and remains at the top of the three-month return ranking, followed by gold, Chinese stocks, commodities and European markets. At the lower end of the table, the dollar and the treasury are lifting behind.

Related Readings

Despite the 500-year record level of S&P, Timmer calls it the “digested period” after post-election optimism. He explained that the market under the title index is much worse in decisiveness. According to Timmer, the equivalent weighted index is still on hold, with only 55% of stock trading above its 50-day moving average.

“Emotions are optimistic, the credit spread is narrow, the Equity Risk Premium (ERP) is in the 10th category, and VIX is 15 years old. The market seems to be for success.” Timmer stressed that despite 2024’s Revenue growth was steady at 11%, but the revisions seemed boring and there were open questions about what could happen if long-term interest rates rose to 5% or above.

The most critical part of Timmer’s analysis is Fed policy. He pointed out the recent CPI Reportas the core inflation rate of 3.5%, is 3.5%, as a close relative indicator, indicating that the Fed will remain suspended. “It’s almost consistent now that the Fed will put aside for some time to come. In my opinion, this is completely correct. If neutrality is 4%, I believe, given the possibility that “3 is a new 2” the Fed will Should be above this level.

He warned of the possibility of a “premature pivot”, reviewing policy errors during the period 1966-1968, when tax cuts were too early to eventually allow inflation to gain a foothold.

Timmer believes that as the Fed is clearly on the sidelines, the next market driving force for interest rates will come from the long term of the curve. Specifically, he saw tensions between two situations: one with endless deficit spending and rising maturity premiums (striking equity valuations), and the other with emphasis on fiscal discipline, which could curb long-term bonds. Rate of return.

Timmer also noted that the claims of the unemployed weekly may be more focused given how government spending under the new government affects employment data.

Related Readings

Timmer points to potential bullish patterns – the head and shoulder bottom in the Bloomberg Commodity Point Index. Although he no longer sees this as a clear shift, he notes that commodities are still in a wider secular uptrend and that reinvesting interest may be seen if inflationary pressures remain higher or the fiscal situation remains loose.

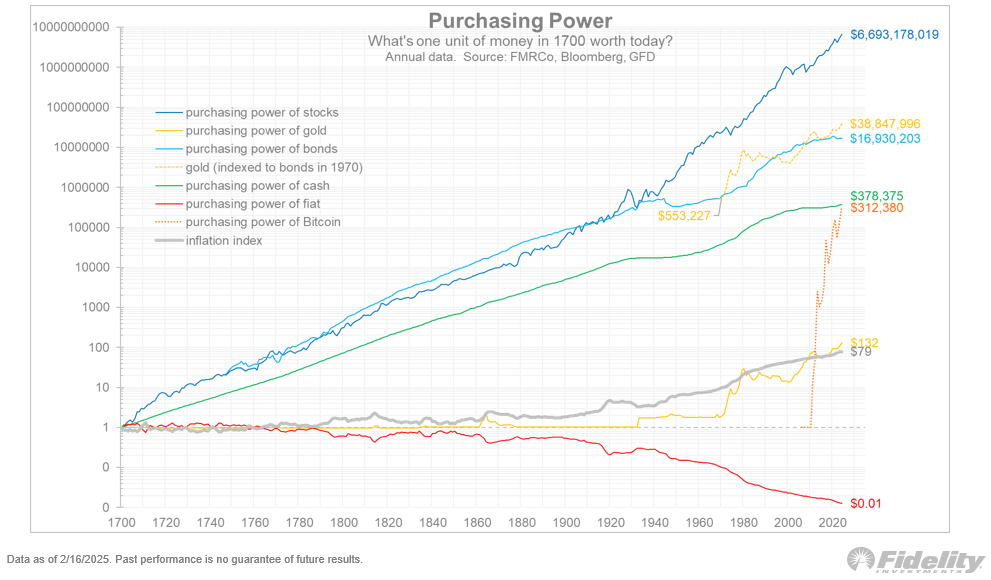

He noted that gold medals have been the “big winner” in recent years, with the expectations of those who performed well: “Since 2020, gold has produced nearly the same returns as the S&P 500 while having lower volatility. I think , in a regime where bonds can be damaged, gold remains an important part of a diversified portfolio.”

Timmer believes gold has tested the critical $3,000 level amid rising global money supply and falling real yields. Historically, gold has a strong negative correlation with actual output, although Timmer believes that the recent power of metals may also reflect fiscal rather than monetary dynamics, especially in the geopolitics of central banks in China and Russia. need.

Bitcoin and Gold

Both gold and Bitcoin’s performance “caused a lot of conversations about currency inflation” according to Timmer. However, he distinguishes between “the quantity of money” (the supply of money) and “the price of money” (price inflation).

“The purpose of this exercise is to show that over time, the growth of traditional asset prices cannot be explained by currency depreciation alone (which is some of the favorite pastimes of Bitcoin),” he wrote.

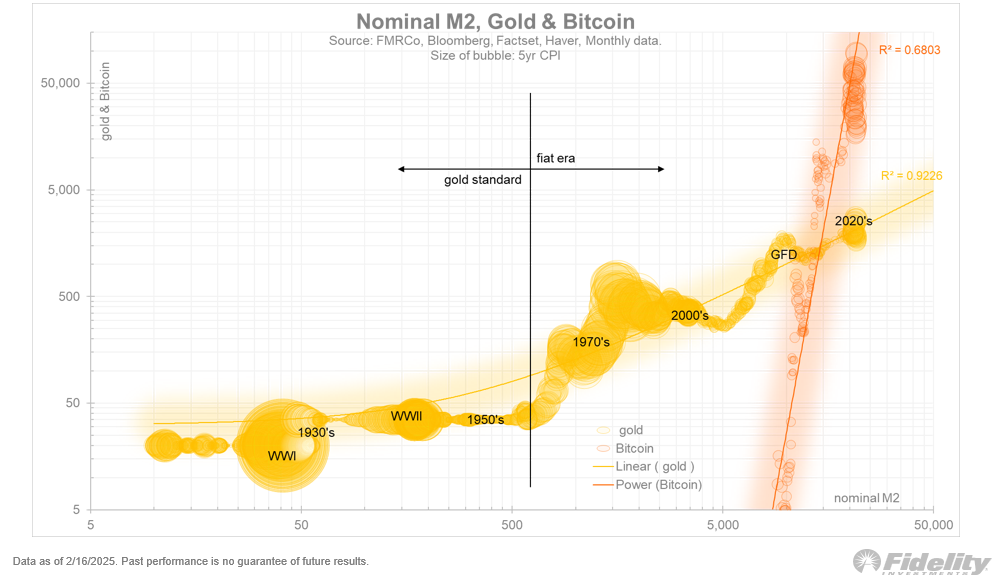

Timmer’s chart shows that consumer price inflation (CPI) lags behind the growth of money supply despite nominal M2 and nominal GDP for more than a century. He warned that adjusting asset prices only for M2 could lead to misleading conclusions.

Despite this, his analysis found that both Bitcoin and gold Closely related to M2although in a different way: “It’s interesting that there is a linear correlation between M2 and gold, the power curve between M2 and Bitcoin. Different players on the same team.”

Timmer highlights Gold’s long-term performance since 1970, noting that it actually maintains the value created by many bond portfolios. He sees gold as a “held against bonds”, especially if sovereign debt markets remain under pressure from fiscal deficits and higher long-term interest rates.

Timmer’s notes highlight that Bitcoin’s outstanding performance cannot be isolated from gold or the broader macroeconomic environment. Investors may be forced to reassess the yields of midwifery and policy makers struggle Traditional 60/40 portfolio Model.

He stressed that although past expansions in money supply have often stimulated inflation, the relationship is not always one-to-one. In Timmer’s view, Bitcoin’s rapid rise may reflect the market’s perception that fiscal issues (just monetary policy) drive asset prices. He concluded: “It can be seen from the dotted orange and green lines that Bitcoin increases the same value as the creation value that has spent more than 300 years overnight.”

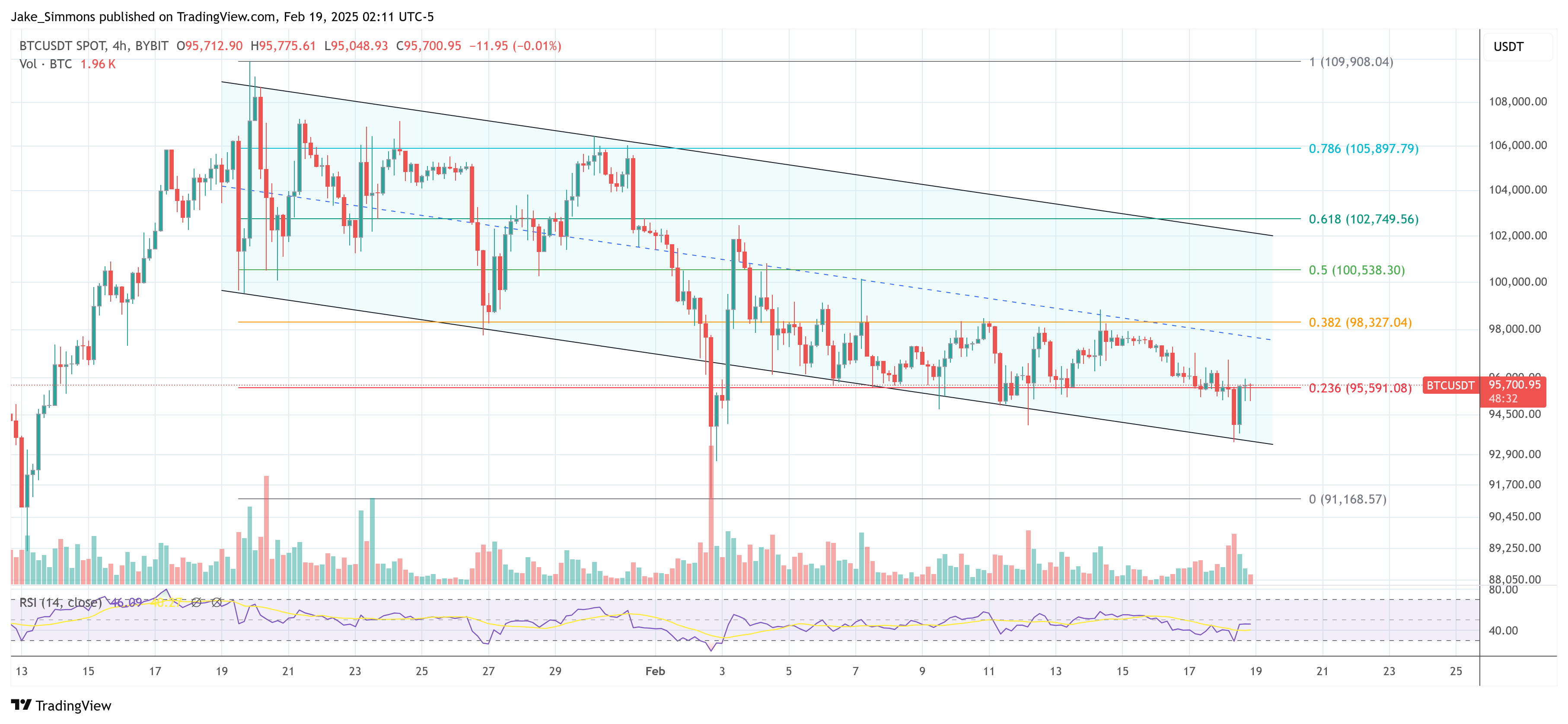

At press time, BTC was trading at $95,700.

Featured images from YouTube, charts from TradingView.com