Agglayer Testnet Launch Drives 30% Spike In POL Market Cap

In the fourth quarter of 2024, Polygon (formerly Matic) experienced significant hybrid performance in key metrics, mainly due to the launch of the testnet of its interoperability protocol, Agglayer.

This new initiative aims to facilitate cross-chain token transfer and messaging, enhancing various features and integration Blockchain network.

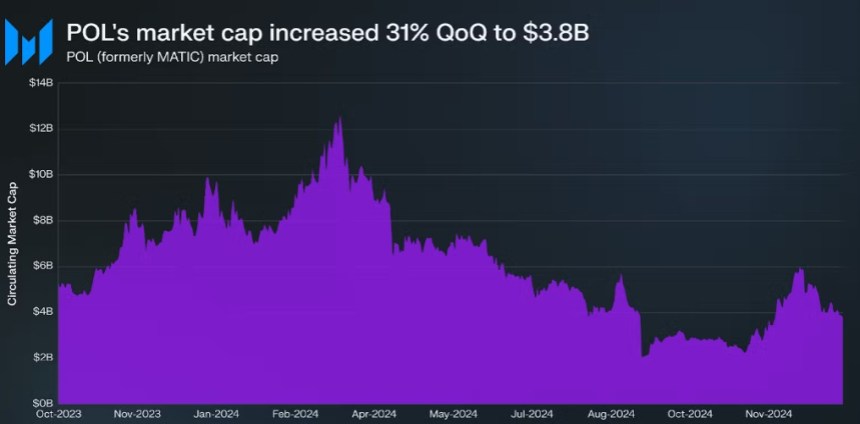

Multilateral market cap is US$3.8 billion

according to By leveraging the proof of zero-knowledge (ZK), Agglayer promises secure communications and asset transfers, positioning itself as an innovative development similar to the early Internet TCP/IP, coming to market intelligence company Messari.

Agglayer aims to unify different blockchain chains by summarizing proof, validating chain state and Ethereum (ETH) transactions. Its key features include unified seamless asset connectivity and pessimistic bridges Proof mechanism This prioritizes safety.

These advances can enable low-latency coordination and secure interoperability, allowing developers to focus on project design without worrying about the burden of liquidity.

Related Readings

Despite these promising developments, Pol’s journey in 2024 is still turbulent. Achieving a historical high Market value The subsequent quarterly declined sharply of the $12.9 billion in Q1, and by the end of the third quarter, the market cap dropped to $2.9 billion, marking a quarter-quarter (QOQ) decline of 47.2%.

This downturn is partly due to the ongoing transition from Matic to POL, which temporarily allocates market capitalization between the two tokens.

However, as market conditions began to stabilize in the fourth quarter, the migration of Matate tokens (total of 1.38 billion) caused POL’s market value to increase by 31%, and by the end of the quarter, POL’s market value increased by $3.8 billion.

It is worth noting that 88.1% of the total supply has transitioned to POL, cementing its position as the largest Ethereum 2-tier token with market capitalization.

Defi and NFT markets struggle

The promulgation of EIP-4844 on Polygon POS Mainnet in Q1 2024 introduced spots, resulting in significant changes in the cost structure of users. This update results in a lower Transaction feesfell to just $0.01 in the fourth quarter.

However, despite the reduced cost, the total transaction volume of polygon networks fell by 2%, while the sharp drop in active addresses was 39.4%, with an average of 523,000 users per day.

The reduction in activity may be mainly attributed to the downturn in the gaming sector, which was previously an important driver of user participation. The average daily game active address dropped to 54,000, marking a 66.7% drop in QOQ.

Related Readings

Polygon’s Defi landscape is also facing challenges, with Total Value Lockdown (TVL) ending the fourth quarter with a price of $871.5 million, a year-on-year QOQ of 4.9% and 2.6%. This decline causes polygons to slide from the top 10 network TVL To the twelfth.

Additionally, NFT activity on the platform suffered losses, with average daily trading volume falling to $822,500, down 38.4% QOQ. Average daily NFT sales fell to 21,000, a staggering 41.5% decline.

The gaming sector, which was previously the fastest growing region within the polygon, continued to struggle in the third and fourth quarters, largely due to slowing down in the popular champions.

The price of POL also faces outstanding challenges, with the 67% recorded tokens down 67% as it currently trades at $0.30.

Featured images from dall-e, charts from tradingview.com