Dogecoin Repeating History? This Setup Led To 150% Gains

A new technology chart shared by crypto analyst Cas Abbé (@CAS_ABBE) on X is showing the repeated bullish pattern in Dogecoin’s price action. The 3-day chart highlights three different decline channels in Dogecoin history – in Q4 2023, another in Q3 2024, currently in early 2025, which is at the main price of over 150% Before soaring.

Dogecoin’s 150% Breakthrough Mode is back

Abe write a letter By X: “Doge is currently in a bullish down channel, similar to Q4 2023 and Q3 2024. In both cases, the breakout resulted in a 150%+ pump.” This chart illustrates Dogecoin’s second quarter 2023 How the descent channel was formed in the descent channel, then broke out in late December of that year and gathered more than 150% in the following weeks.

A similar formation appeared in Q3, with Dogecoin trading again on a tight downtrend line before pushing along the upper boundary of the channel. The breakthrough has produced another considerable price transfer, again over 150%.

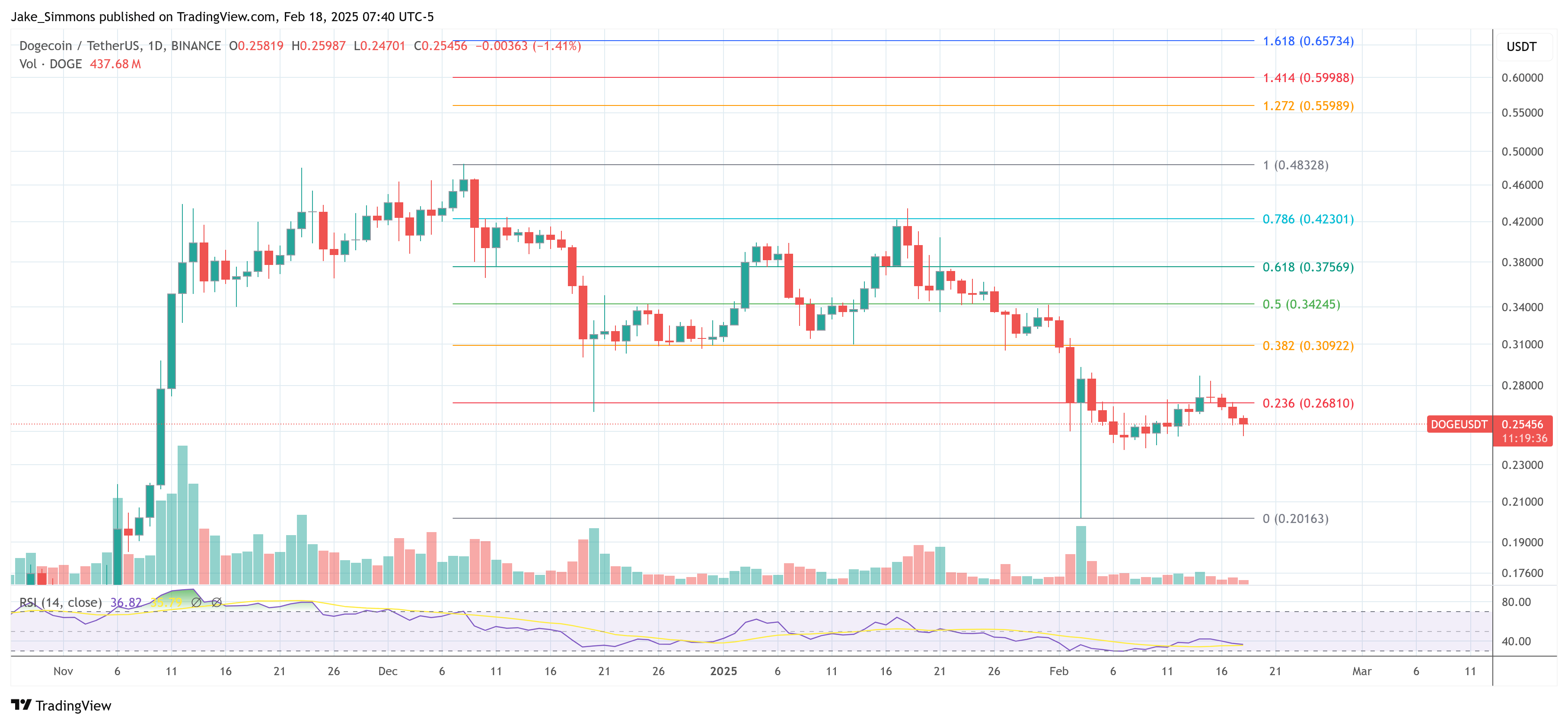

Now, Abbé points out that Dogecoin appears to be reflecting past settings and trades in what he thinks is a “bullish landing channel.” Price action over the 3-day time frame shows Dogecoin bounced between parallel trend lines falling from the highest $0.36 to the lowest $0.24.

If this pattern follows the same trajectory as in 2023 and 2024, Abbé shows that once the token decisively breaks the resistance of the channel, there is a potential for significant upside potential. Governor’s price is currently at the lower end of the channel, which may mark Purchase Opportunities. However, disadvantages may invalidate past bullish settings.

In addition to short-term market sentiment, what is conquered for meme-based cryptocurrencies also suggests that Dogecoin’s decade-long presence in the cryptocurrency landscape is evidence of the coin’s endurance. “I know there are fewer meme emotions, but $doge has been in this space for ten years and will continue to be here. The $1 threshold is the realistic goal of the cycle,” he noted.

Although there is no guarantee that history can copy itself accurately, Abbe’s chart emphasizes the consistent technical structure before Dogecoin’s The past moves sharply.

Purchase signal confirmation?

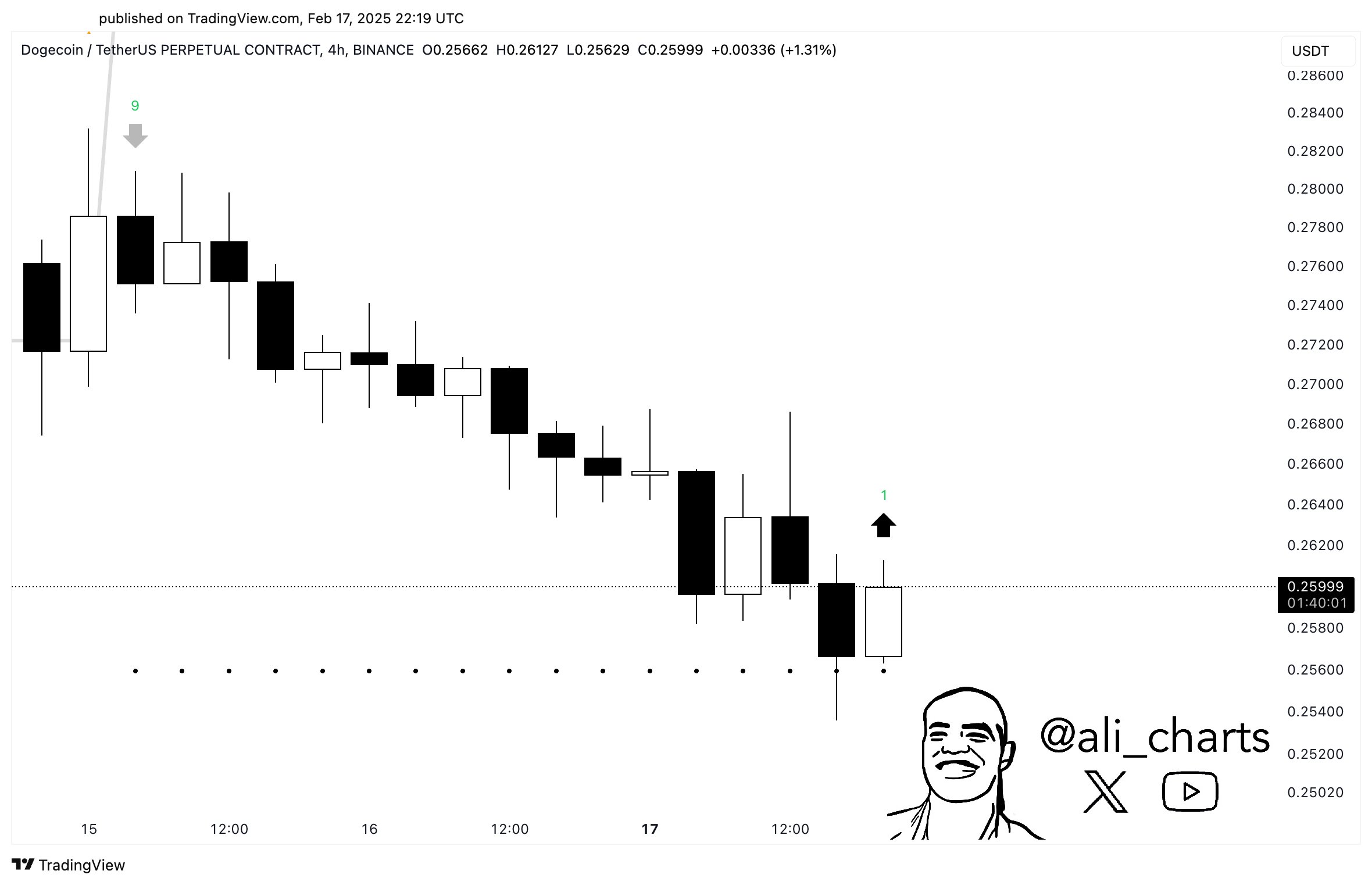

Meanwhile, another analyst, Ali Martinez (@ali_charts), propose Shorter view. Martinez said sharing his thoughts through X, saying the TD order indicators on the 4-hour chart are displayed Buy SignaL, usually implies an imminent change in momentum.

“Dogecoin may be preparing for the rebound, as the TD sequence light flashes the purchase signal on the 4-hour chart!” Martinez wrote via X. The TD sequence is followed by the technology trader, which is able to time the local price up and the bottom time.

However, one user questioned Martinez’s comment, noting that analysts mentioned the “death cross” between the MVRV ratio and the 200-day moving average yesterday. Martinez highlights the natural ebbs and flows of all markets: “Tell me assets that are moving in one direction in one direction.”

At press time, Doge’s trading price was $0.25456.

Featured Images created with dall.e, Charts for TradingView.com