Bitcoin STH Realized Profit Reveals Strong Support Level – Time For A Breakout?

As market efforts to confirm its next move, the short-term price direction of Bitcoin remains uncertain. Analysts and investors are split, with some calling for a new all-time high, while others expect to resell pressure to lower prices. Prices have been consolidating in a narrow range over the last twelve days, exceeding the $94,000 demand level and resistance faces the $100,000 mark.

Related Readings

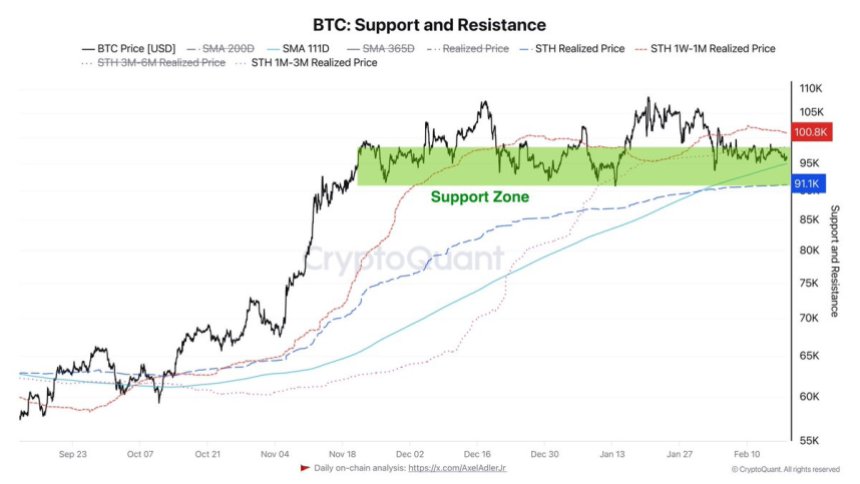

Key data from CryptoQuant shows that the formation of BTC’s nearest support zone is between $91,000 and $95,000. The range is enhanced by two key technical indicators: the 111-day simple moving average (SMA 111D) currently at $95,000, while the short-term holder (STH) realizes a price of $91,000. These levels suggest that BTC trading is higher than historically important support areas, and short-term holders have become aware of their profits or losses.

and Long-term structure remains bullishinvestors are becoming increasingly impatient as BTC fails to recover key resistance levels. If Bitcoin can launch more than $100,000 in the next few days, analysts are expected to focus on price discovery. However, the loss of about $94,000-$95K support could trigger increased sales pressure and correct lower demand areas more deeply.

Bitcoin prepares for decisive moves

Bitcoin’s recent merger phase has sparked speculation about potential breakthroughs, with many analysts showing that the market is witnessing calm before the storm. Although the short-term direction remains uncertain, the long-term bullish structure remains intact, and many hope that BTC will soon move towards a new historical climax.

Crypto Analyst Axel Adler Shared Key Encrypted data on xstressing that Bitcoin’s nearest support zone is about $91,000-$95,000. This range is important because it matches the 111-day simple moving average (SMA 111D) at $95,000, while the short-term holder (STH) at $91,000. These levels represent areas where short-term holders have historically realized profits or losses, which is crucial to maintaining bullish momentum.

In terms of resistance, Adler notes that Bitcoin faces a critical supply zone between $98,000 and $101,000. The region is defined as the total exit price of the holder, which has a holding period of one week to one month, of $100,800, a holding period of $100,800 and a holding period of $98,200.

Related Readings

As BTC continues to trade within a narrow range, investors are paying close attention to these levels for certainty breakthroughs. The push over $101K could trigger rally, entering price discovery. Although losing support at a price of $91K may lead to further disadvantages.

BTC Bulls face big test

After nearly two weeks of horizontal movement within a narrow range, Bitcoin is trading at $95,600, both directions fluctuating less than 4%. This extended period of merger puts traders on the edge as they await decisive action in both directions.

In order for BTC to maintain its bullish structure, it must maintain the $95,000 level. This price point is consistent with technical support, and a break below it may mark strong sales pressure. The Bulls face important tests at this stage as they must defend this support and launch a push that exceeds the critical resistance level.

To confirm the breakthrough, Bitcoin needs to recover the $98,000 mark, and ultimately requires $100,000 in the psychological sense. Successful moves beyond these levels will provide the momentum needed to challenge all-time high prices and re-enter price discovery. However, not holding the price of $95K may trigger downside action, while BTC may test the support zone close to $91K.

Related Readings

As Bitcoin consolidates its synthesis, traders remain cautious, watching the spikes of quantity and increasing buying pressure to confirm the next price movement. The days that follow are crucial to determine whether BTC resumes its upward trend or faces further corrections.

Featured images from DALL-E, charts from TradingView