No $200K Bitcoin? Brandt Explains Why It’s Unlikely This Decade

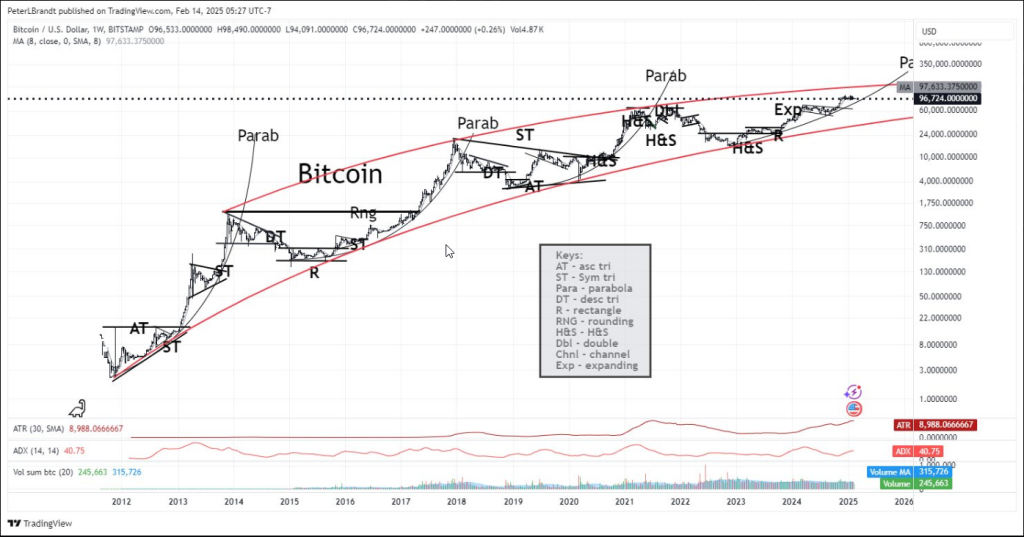

Experienced trader Peter Brandt dismissed optimistic forecasts after Bitcoin’s recent increase to $97,000.

His latest technical analysis shows that the most prominent cryptocurrency may have difficulties when it exceeds the $200,000 Threshold by 2030.

Bitcoin showed a different performance, growing 0.17% daily and down 2.85% over the course of the week, prompting the forecast.

Related Readings

The protracted path to six numbers

Bitcoin will face major challenges in undermining the $100,000 psychological barrier. The 8-week moving average is $97,633 and has been refusing to move upwards, bringing up cryptocurrencies with obvious resistance.

Come to this idea from the crazy world of thoughts – an idea, not a deal

Unless Bitcoin escapes speed through the parabolic resistance line, BTC cannot trade more than $2 million at the end of this decade. The only reply. No interest in repairing pic.twitter.com/7a5n7gliw8-Peter Brandt (@peterlbrandt) February 14, 2025

The average true range (ATR) is 8,988, both supporting the average directional index (ADI) of the strong trend, showing an increase in volatility under current market conditions.

Historical Patterns depict a cautionary story

Since 2012, Bitcoin has developed a unique model that has attracted the interest of technologists. Within the red upward channel, cryptocurrencies have been bounced between two key trend lines that are used as price barriers.

Bitcoin tends to sharp corrections and parabolic movement trends, especially attractive. Market veterans have raised their antennas due to the striking similarities between this gathering and these previous cycles.

Red flags for increased trading volume

These numbers tell an interesting story about how people participate in the market. The current set will likely be unstable as Bitcoin’s 20-cycle count is 245,600, compared to other breakthrough phases.

It can be challenging to maintain a long-term upward trend without a significant increase in trade volume. This weak volume has been an increasing concern for analysts watching Bitcoin’s next big move.

Related Readings

Support and Resistance: Drawing of Frontlines

The future of Bitcoin depends on the key price levels that may determine its fate. There is strong support in the range of $60,000 to $70,000, while a solid resistance zone is between $100,000 and $120,000.

If the situation worsens, Bitcoin may revisit the lower boundaries of its long-term channels, about $40,000 to $50,000.

Brandt’s analysis shows that by 2030, Bitcoin’s trajectory reaches $200,000 is suspicious, without a significant breakthrough in the boundary above the parabolic trajectory.

The veteran businessman stressed the need for sustained momentum and the ability to exceed key resistance levels to achieve such valuations.

Featured images from Pixabay, charts for TradingView