Avalanche Shows Signs Of Recovery As Key Indicator Flashes A Buy Signal – Details

Since mid-December, Avax has faced ruthless sales pressure, with its price dropping by more than 60% and removing all proceeds from the November 11, 2024 rally. This sharp decline puts investors on the edge, aggravating fear and uncertainty as the avalanche reflects bearish trends across the wider cryptocurrency market. Suspicion of Avax’s potential to recover and generate huge gains has begun to take over the market sentiment, which has led many to question whether it can rebound in the near term.

Related Readings

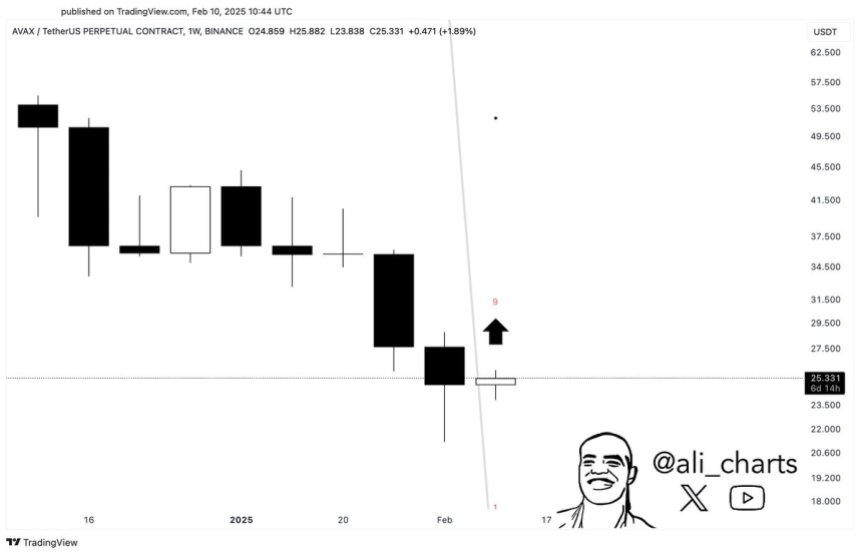

However, in this uncertainty, there are signs that the avalanche may be preparing for turnaround. According to key indicators shared by top analyst Ali Martinez, the avalanche shows signs of a promising rebound. Martinez stressed that a key technical indicator flashed a purchase signal on the weekly chart, providing a glimmer of hope for the recovery of the rally. The signal indicates that Avax may be approaching the bottom, which can mark the beginning of a new bullish phase if market conditions remain consistent.

As The market remains volatileall eyes are staring at the avalanche to see if this buying signal can translate into a sustained upward momentum. Investors are cautiously optimistic, hoping that Avax will overcome current challenges and restore its bullish potential.

Avalanche indicator signal is potential trend reversal

The Avax was trapped in a state of indecision as the Bulls didn’t recover the $27 record and the Bears struggled to push the price further. The tug-of-war reflects the broader uncertainty in the cryptocurrency market, putting the avalanche at a critical moment. Analysts have diverged on Avax’s next move, with some predicting a massive recovery rally, while others expect a continuation of bearish trends to sweep the market since mid-December.

Top analyst Ali Martinez via Share Technical analysis of XTThe hat reveals promising signs of an avalanche. Martinez stressed that the TD sequence indicator is a widely used tool to identify trend depletion and potential price reversals, flashing a buy signal on the weekly chart. This is important because the weekly signal has more weight and often indicates the possibility of long-term reversal.

If the bulls take advantage of this signal and push the price higher than the resistance level of $27, it could trigger a wider recovery phase. On the other hand, as bears try to regain control control, inability to maintain current levels may lead to further consolidation or downward movement.

Related Readings

The next few days and weeks will be crucial for the avalanche as price action will validate bullish signals or enhance current bearish sentiment. Investors are closely monitoring the meaning of the $27 level and the TD sequential signal as it can mark the beginning of a long-standing Avax recovery rally.

Avax prices merge between key levels

Avax traded at $25.6 after a few days of hesitation and consolidation in the narrowing range, stuck at the $27 resistance level below the $23 support zone. This close range reflects the ongoing uncertainty of the bulls and endures control struggles, the wider market.

The Bulls face key tests at the current level. They need to hold the $25 support zone and build momentum to push AVA to the critical $28.7 resistance level. Breaking and retrieving this mark as support will confirm the trend reversal, which indicates the beginning of a potential recovery rally. A successful breakthrough above $28.7 may attract more buyers and lead to higher price levels.

However, sales pressure remains a major risk to AVAX. If the price loses its support level of $23, it is a bearish trend that has dominated since mid-December. Failures below this range may put Avax into lower demand areas, with $20 being the next critical support level.

Related Readings

The days that follow will be critical for the avalanche, as prices must return to higher levels to change the bearish narrative, or risk drops further as the market is struggling with ongoing fear and uncertainty.

Featured images from DALL-E, charts from TradingView