Ethereum Short Positions Surge 500% In 3 Months

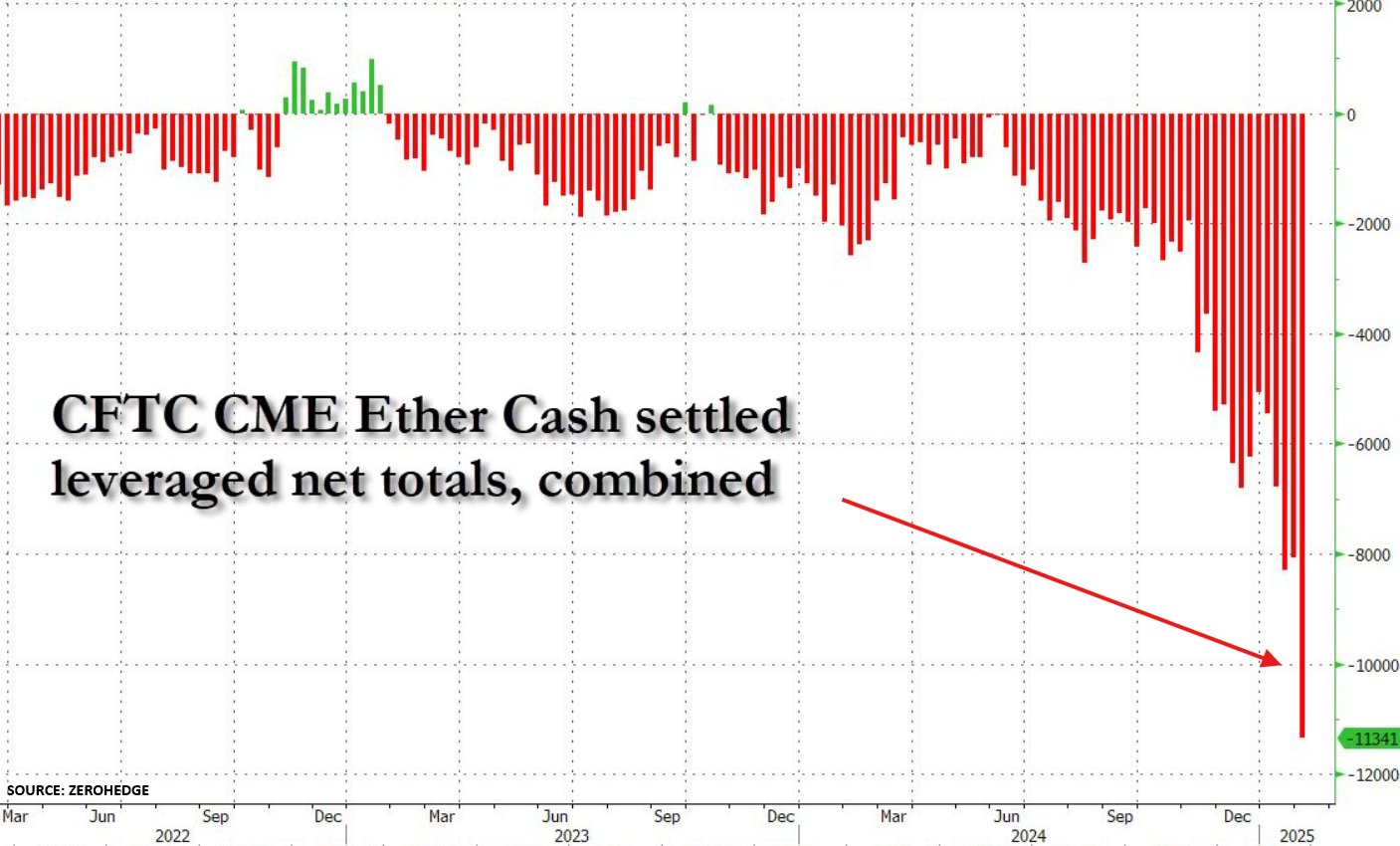

Ethereum (ETH) is the second largest cryptocurrency reported in market capitalization, facing unprecedented short selling of hedge funds. It is worth noting that ETH’s short positions have soared 500% since November 2024, indicating a higher put option on digital assets.

Institutional investors lose confidence in Ethereum?

According to the recent postal In Kobeissi letter, Ethereum’s price is witnessing a growing number of challenges as the recent rapid surge in temporary positioning in cryptocurrencies. It is worth noting that ETH short positions rose 40% last week, while their positions have risen 500% over the past three months.

It is worth mentioning that this is the highest level of Ethereum in Wall Street funding ever. Earlier this month, the cryptocurrency market showed this bearish position in ETH, as digital assets crashed 37% in 60 hours in a trade tariffs proposed by Donald Trump against Canada, China and Mexico.

Related Readings

Interestingly, the high level of capital inflows to Ethereum Exchange Funds (ETFs) in December 2024 is high. In just 3 weeks, ETH ETF Attracted More than $2 billion in new funds, with a record weekly loss of $854 million.

However, the status of hedge funds on ETH shows that they are not very confident about the short-term price outlook for cryptocurrencies. There may be several factors that can play a role in the diminishing interest in ETH by institutional investors.

For example, ETH is currently trading below its current all-time highest (ATH), with $4,878 recorded in 2021. By comparison, Bitcoin (BTC) has a great 2024, hitting multiple new ATHs and directing one. The market value is almost six times Bigger Compared to ETH.

Kobeissi letter attributes ETH’s current bland price performance to potential “market manipulation, harmless crypto fences, perceptions of Ethereum itself”. However, market commentators pointed out that this excessive bearish outlook could temporarily squeeze ETH. They added:

This extreme positioning means that big fluctuations like February 3 will be more common. Since the beginning of 2024, Bitcoin has grown 12 times that of Ethereum. Will a brief squeeze narrow this gap?

Eth Short Squeeze starts Altseason?

A brief squeeze of ETH may Send It costs up to $3,000, or even $4,000. However, according to For experienced crypto analyst Ali Martinez, ETH must defend a $2,600 support level to climb higher.

Related Readings

Recent reports suggest ETH may have been bottompave the way for a trend reversal and rising. Another report from Steno Research suggestion The ETH may outperform BTC in 2025 with a potential target of up to $8,000.

That is, there are still concerns about the Ethereum Foundation Throw down eth. At press time, ETH traded at $2,661, up 0.1% over the past 24 hours.

Featured images from Unsplash, charts from X and TradingView.com