What Happens Next Could Be Game-Changing

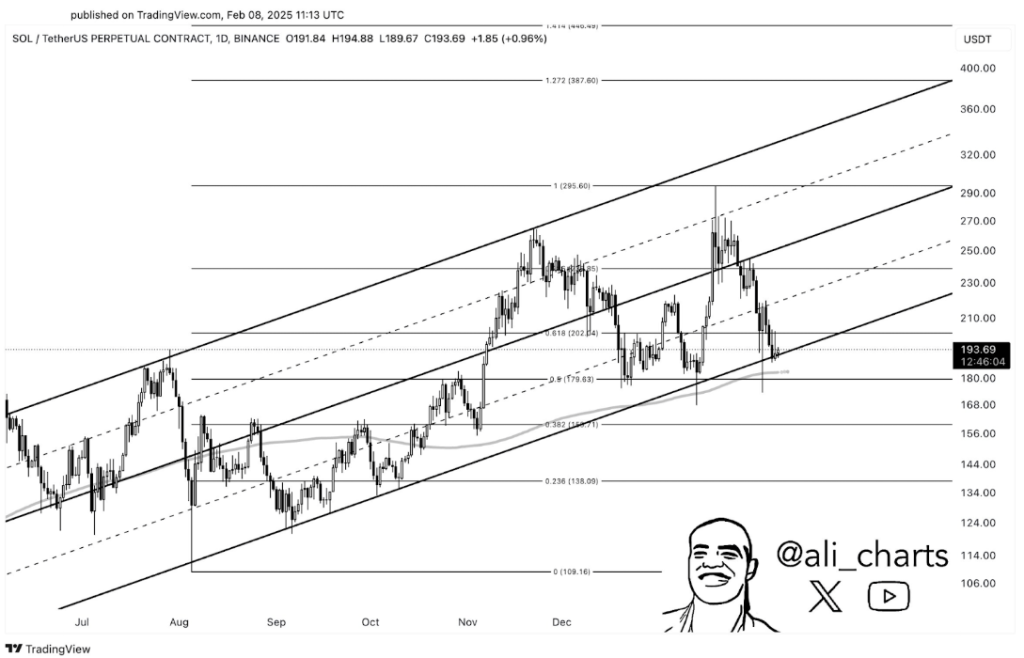

Crypto analyst Ali Martinez highlights the critical moment of Solana’s price action Key Support Levels In parallel passage. His technical analysis is based on the SOL price action of the daily candlestick time range, indicating that Altcoin has been trading on the upstream channel since July 2024.

It is worth noting that the formation of this lift channel and higher highs stand out as Solana continues to push a new historical climax.

Now, Martinez notes that holding is above the critical support level Strengthen Altcoin’s uptrend Going to the upper trend line of support channels.

Related Readings

Analyst’s technical prospects: a level of support that disrupts

exist Martinez’s analysis, Solana trades at $193 as it dropped across the board last week. It is worth noting that this decline Solana has reached the lowest trend in this upward channel. Therefore, analysts point out that SOL’s actions can determine its next major move from here.

If Solana manages to exceed this support level, the uptrend can restore strength and the channel will still work. In this case, Solana will still be expected to push towards the upper end of the channel, which will target the stock price of about $387. On the other hand, if the support fails, a deeper correction can be made on the table.

image From X: ali_charts

Solana Price Action: Roller Coaster ride to $293 and then return

SOL is one of the best performing cryptocurrencies in the current crypto cycle, with its price soaring to its new all-time high on January 19.

The rally is driven mainly by a wave of interests After the release The official Trump meme coin on the Solana blockchain adds momentum to Altcoin’s already bullish trend. But, since then, Solana has experienced joy 30% drop It’s only since its highest level.

Solana has managed to rebound slightly from the lower boundary of its ascending channel since the analysis period. Solana is currently trading at $204, meaning its deal has grown by about 5.7% since Martinez highlighted the key support zone.

This reversal suggests that the Uptrend channel is still in play and Solana can continue to push upward until it reaches $389. Interestingly, this price target on the upper end of the channel is strengthened by the Fibonacci expansion indicator.

Related Readings

The indicator extends $109 from the Solana low in August 2024, while the target share price of $389 is at an extension level of 1.272. The fact that Solana’s January peak also matches the 1.0 Fibonacci level is enhanced by the fact that this expansion is important.

Despite this recovery, the bullish momentum remains Not fully confirmed yet It has a strong breakthrough itself. Solana is still possible Retest the lower boundary Use channels again before setting up a more decisive uptrend.

Featured images from Fortune, Charts from TradingView