Record-Low Bitcoin Volatility: A Magnet For Institutional Investors?

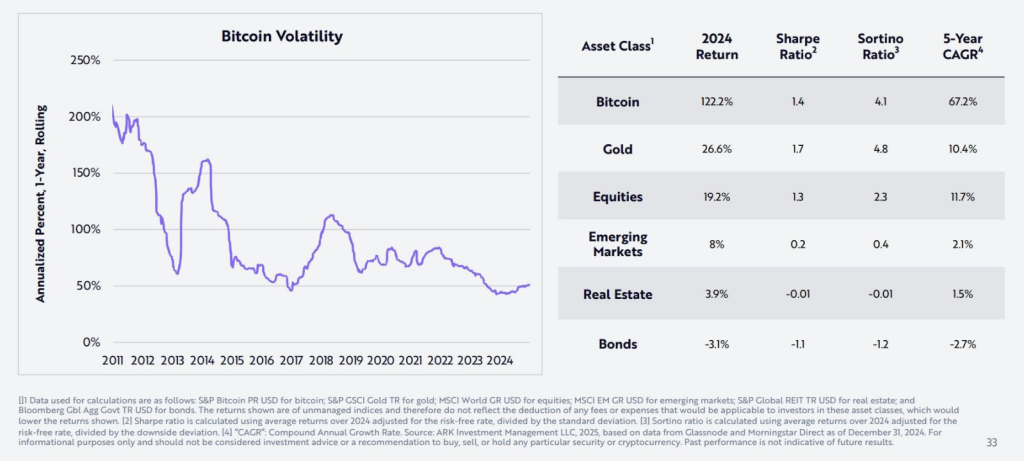

Bitcoin’s market behavior has changed dramatically volatility Falling to an all-time low. This change shows that the market is maturing and attracting more institutional investors who have previously avoided their volatile price volatility.

Bitcoin 3-month volatility drops to new lows

According to the recent Data from the Glass Festivalthe cryptocurrency’s three-month realization that volatility has dropped to its all-time low. The days of 80–100% price fluctuations that jaw witnessed are over. As volatility remains below 50%, Bitcoin is still moving in a fairly stable direction today. This new discovery of stability is not only a brief moment, but also a reshaping of the entire market structure.

Institutional strength and country step up

Net inflows of $40 billion were introduced to the United States Bitcoin ETF The market has completely changed. In addition to countries that invest in Bitcoin, BlackRock’s iShares Bitcoin Trust (IBIT) is the first to lead this institutional push.

The market’s reaction is fascinating: Bitcoin is not a typical peak and trough, but rather shows a “steady staircase” development approach, with price surges scattered during consolidation.

The impact of whales on market dynamics

An interesting trend can be seen in recent data: One hundred new wallets added in February, which contained at least 100 BTC units, while nearly 138,000 smaller wallets held a decline in holdings.

This development provides important insights into market sentiment. New traders who have joined in the past six months are selling due to short-term market volatility, but large investors are often called “whale,” During the price decline, Bitcoin was carefully accumulated.

A new era of crypto investment

For long-term investors, the current status of Bitcoin provides a fascinating story. Even the price of flagship digital assets Reduced by 0.10% The latest data shows that in one day to $97,547, its risk-adjusted returns still outperform the returns of most other asset classes.

Bitcoin’s annual volatility has dropped to an all-time low, while its risk-adjusted returns remain better than most major asset classes pic.twitter.com/pbpascbczv

– Expand. (@cryptounfolded) February 5, 2025

Analytics unfolds that Bitcoin still performs well even as annual price volatility hits its lowest ever. The combination of strong profits and risk reduction makes institutional investments very good and could lead to the next stage of Bitcoin’s growth in the financial sector.

Key changes Cryptocurrency The world is the transition of Bitcoin from highly unpredictable investments to a more reliable option. If big investors continue to invest money and large holders continue to buy more, Bitcoin may start to become a reliable financial asset.

Featured images from DALL-E, charts from TradingView