House prices at new high ahead of stamp duty change, says Halifax

BBC Business

Getty Images

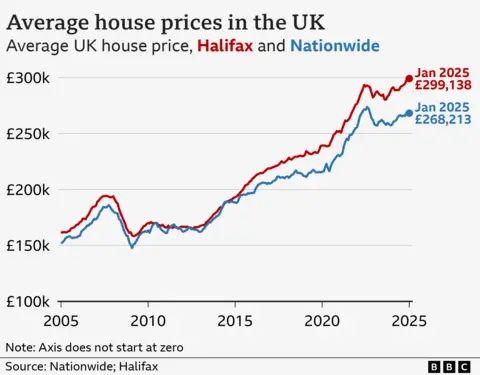

Getty ImagesHalifax said the average property price in UK house prices reached another record high, Halifax said.

The UK’s largest mortgage lender, part of Lloyds Banking Group, said property values in January were recycled in January after a slight decline in December.

The annual growth rate of prices slowed to 3.0%, the weakest since July 2023, but Halifax said the market showed “notable” resilience.

Amanda Bryden, head of mortgage loans at Halifax, said there was a lot of demand for new mortgages and loan growth, which could be increased by first-time home buyers before trying to close the deal. The transaction is completed before stamp duty.

In the budget last October, principal Rachel Reeves said the reduction in stamp duty rates in England and Northern Ireland will end in April next year.

The changes will mean homebuyers will start paying stamp duty for properties over £125,000 instead of over £250,000 at present.

First-time home buyers currently do not pay stamp duty on homes up to £425,000, but will drop to £300,000 in April.

“As things are affected, mortgage rates may hover between 4% and 5% in 2025 under the influence of global financial markets and domestic monetary policies,” Ms Bryden said.

Jonathan Hopper, CEO of Garrington Real Estate Discoverers, said Thursday’s lower interest rates will help homebuyers and people remanage.

“Currently, price inflation is centered around North England and Wales.”

“Other places, price increases are much more modest, and sellers need to carefully price the home or risk being pending.”

Where is the price rising the fastest?

London remains the most expensive place to buy a home in the UK, where the average property price is £548,288, an increase of 2.8% from the same period last year.

Real estate prices in Northern Ireland are at the highest annual price of 5.9 per cent, with the average property now at £205,473.

House prices in Wales rose 3.6 per cent compared to last year, with property values on average £227,397.

In England, the Northeast replaced the Northwest, which saw the strongest annual price growth, with value rising by 5.2% to £178,696.

House prices in Scotland generally rose by a lower rate, up 2.4 per cent, with the average cost of property at £210,690.

“Currently, price inflation is centered around North England and Wales.”

“Other places, prices are much more modest, and sellers need to carefully price their homes or risk seeing them not selling on the shelf,” said Jonathan Hopper, CEO of Garrington Property Finders. risk. ”

Halifax home price data is based on its own mortgage, which does not include buyers who buy cash or buy a deal. Cash buyers account for about one-third of home sales.