Ethereum Price Could Be Primed For Another 100% Move After Printing Capitulation Candle

Ethereum’s Price action The past seven days have led to the establishment of a surrender candle that may be emitted in another surge In the next eight to twelve weeks. This surrender candle caught the attention of crypto analyst TED Pillow, who pointed to the interesting repetitive surrender pattern of Ethereum.

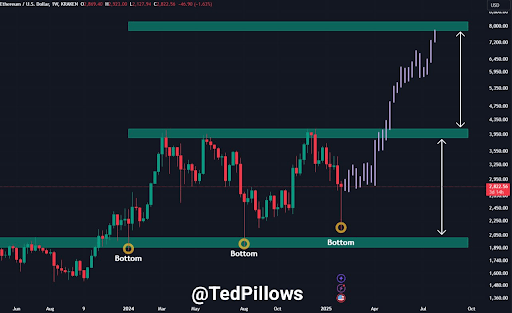

According to technical analysis by TED Pillows, Ethereum printed a capitulation candle in early 2025, just like the first quarter of 2024 and the third quarter of 2023.

Surrender Candles and Ethereum Historical Model

Tedpillows analysis points There have been three major votes in the price of Ethereum over the past two years, all resulting in a large number of price rebounds. In particular, these surrenders took place over the weekly candlestick timeframe, with Ethereum prices witnessing enormous sales pressure throughout the week. However, competition for historical prices shows that these votes often mark the bottom before large price rallies.

Related Readings

The first of such votes occurred in 2024 in the first quarter, and ultimately led to a 100% rally over the next three months, with Ethereum price reaching $3,950. The second surrender occurred in the third quarter of 2024, resulting in a similar increase. As Ethereum experienced another moment of surrender in early 2025, analysts suggested repeating the pattern. He believes that Ethereum has once again formed a market bottom and set up a stage For radical upward movement.

100% price increase and potential peaks for Ethereum

If Ethereum follows its previous trajectory, the next eight to twelve weeks could bring a big upside, even if the leading Altcoin is currently struggling around $2,700. 90%-100% pumps will drive Ethereum prices after recent surrender Key resistance levels in the past and above its current all-time highest level.

Related Readings

Tedpillows analysis shows that Ethereum’s final price target may be as high as $8,000 after the surrender. However, it is likely to encounter a clear resistance of $3,950, a level that triggered rejection levels in past surrender cycles. If Ethereum strives to break through this barrier again, a temporary callback may occur before any sustained movement is higher.

At the same time, on-site Ethereum ETFs attracted a large amount of inflows Although Ethereum prices have dropped. Institutional investors appear to be taking advantage of the decline and increasing their ETH holdings in hopes of a broader market rebound.

Click on Ethereum ETF Already recorded $513.8 million has flowed in over the past six trading days, and BlackRock has led the fee through the acquisition of $424.1 million in ETH. This steady accumulation of institutional holders suggests growing confidence in Ethereum’s long-term potential and could lay the foundation for an estimated 100% surge in the next eight to twelve months.

At the time of writing, Ethereum traded at $2,725, down 4% in the past 24 hours.

Featured images from Unsplash, charts from TradingView.com