Ethereum Recovers To $2,800 As Exchange Outflows Near $1 Billion

Over the past day, Ethereum has recovered to $2,800 as linked data shows that whales have been withdrawing money on a large scale in exchange.

After the price crashes, the Ethereum exchange flows out

According to data from the Market Intelligence Platform Intotheblockinvestors reacted to the latest collapse of Ethereum prices by flowing out of the exchange.

The link chain indicator of correlation is “Exchange NetFlow”, which can track the net amount of cryptocurrencies entering or exiting wallets associated with all centralized exchanges.

When the value of the indicator is positive, this means that the holder stores the net amount of coins into these platforms. As one of the main reasons for investors to move to exchanges is for sales-related purposes, this trend may be a bearish signal for asset prices.

On the other hand, the indicator is negative, indicating that the outflow is greater than the inflow and the net number of tokens is exiting the exchange. Such a trend can indicate that investors are accumulating, which can naturally be bullish on ETH.

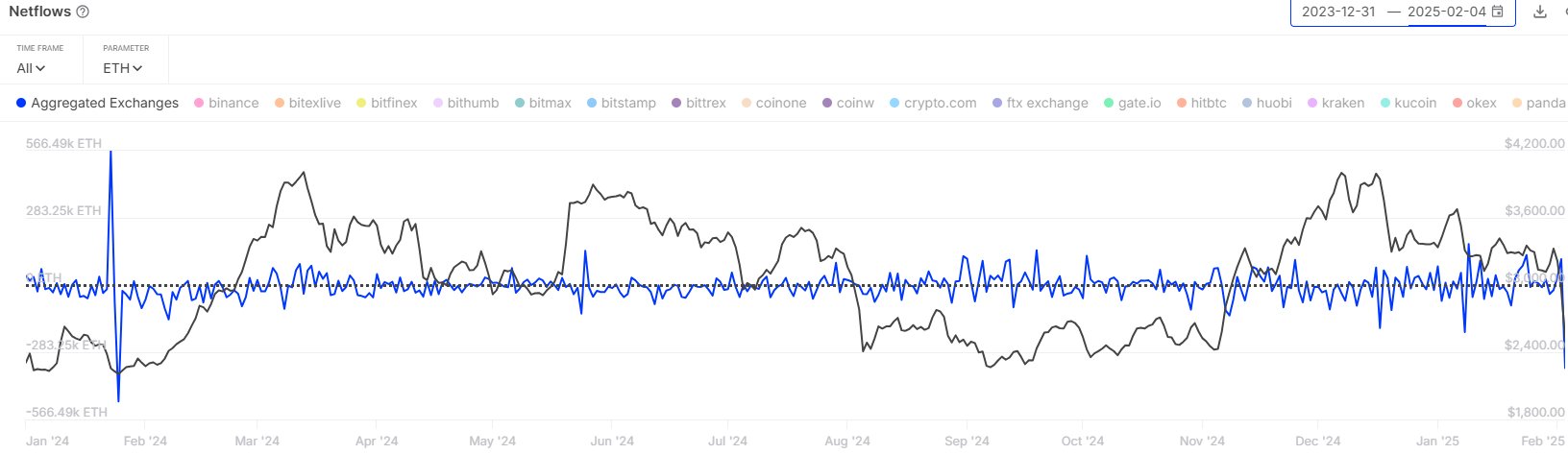

Now, here is a chart showing the trend of Ethereum swapping NetFlow over the past year:

As can be seen in the above image, Ethereum Exchange NetFlow observed a huge negative spike yesterday after the asset price crash.

Overall, investors pulled 350,000 ETH from the exchange during this outflow frenzy (at the current token exchange rate, worth approximately $982 million). “This is the highest amount of net withdrawals since January 2024!” Pay attention to the analysis company.

Considering the time of outflow, it seems that they may be whale Hope to buy Ethereum at a cheap post-crash price. Investor accumulation in turn helps cryptocurrencies reach their lowest points and recover to a certain level of recovery.

Now, the switching network may be paying attention in the coming days, as upcoming trends may also affect ETH prices. Naturally, the continuation of outflows will be a positive signal, and the increase in inflows may produce bearish results.

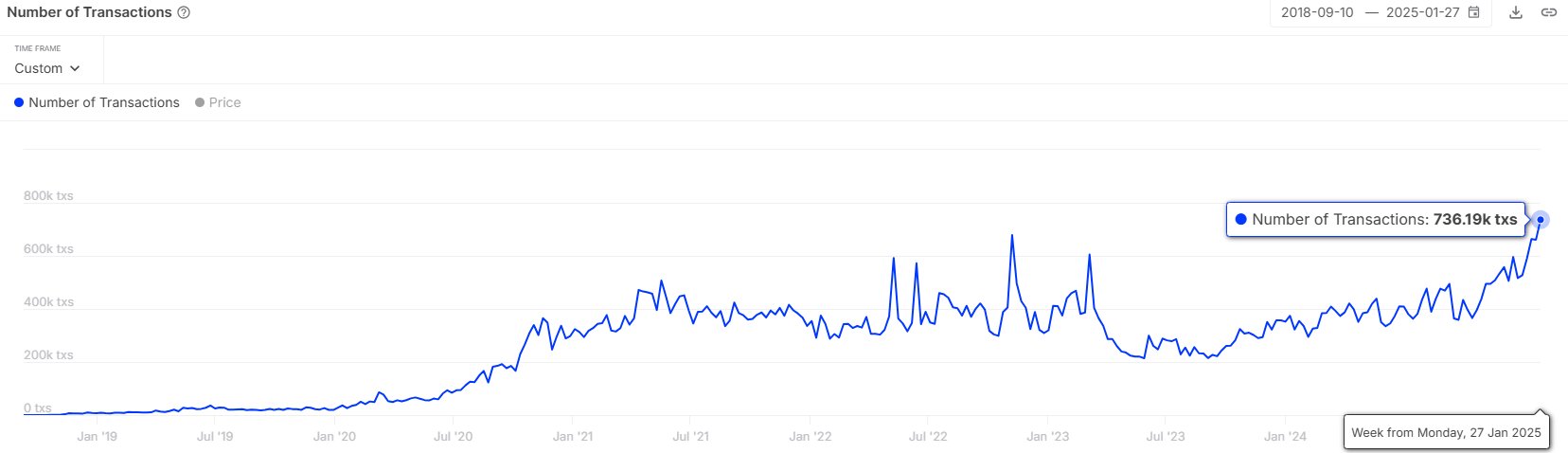

In some other news, the second stabler who has crossed the market cap, USDCIts transaction volume has risen recently, as Intotheblock pointed out in another X postal.

“USDC is becoming more and more popular, with daily transactions increasing by more than 119% last year!” said the analyst firm. Stablecoins can ultimately act as fuel for volatile assets such as Ethereum, so the increase in activity associated with them may bode well for the market.

ETH price

At the time of writing, Ethereum’s float is around $2,800, down more than 11% over the past seven days.