Crypto Traders Wrecked As Tariffs Spark $2 Billion Liquidation

With the beginning of February, cryptocurrency investors went to digital asset space CollapseAs a result, more than 2 billion US dollars of cryptocurrency liquidation and Bitcoin prices fell 90,000 US dollars.

Related reading

Analysts attribute the current turbulence of the cryptocurrency department New tariff President Donald Trump implemented questions on Canada, Mexico, and China, and questioned the long -term impact of tariffs on digital currencies.

2 billion USD encryption liquidation

Trump said in a statement that the United States is paying attention to its three largest trading partners, Canada, Mexico and China. This measure has issued this measure Shock waves in cryptocurrencies Community.

Market observer believes that Trump’s announcement has exacerbated the collapse of the entire cryptocurrency industry, and the industry has seen a large amount of liquidation between virtual currency.

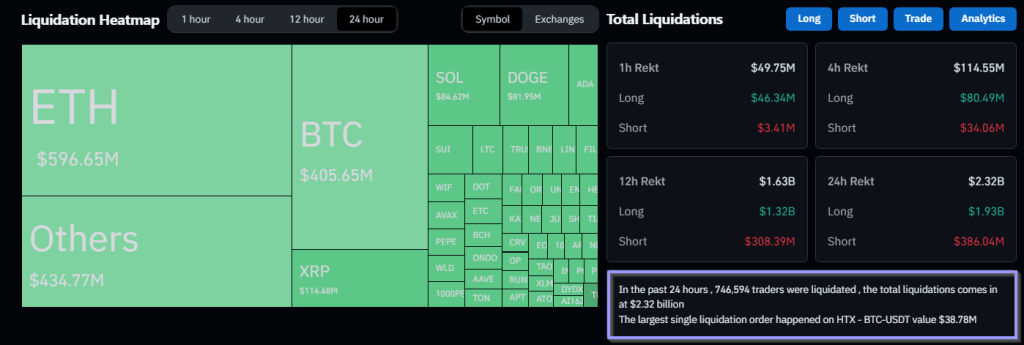

Source: Coinglass

According to coinglass Cingdom of more than 2 billion U.S. dollars The US President announced the 24 -hour record after the new tariffs planned.

The data also shows that after the trader found that he was in a turbulent market after the tariff announcement, the price of top cryptocurrencies fell. Bitcoin plunged to $ 95,200According to Coingecko, the minimum price of the eldest son cryptocurrency has been within three weeks.

at the same time, Ethereum fell down About 2,800 US dollars have eliminated the benefits that have been obtained since the beginning of November.

“In the short term, we have bottomed out. The market businessmen have used this tariff news cycle to eliminate the desire of use, and now there is almost no liquidity worth promoting prices.

Tariffs may trigger inflation

Analysts said that many investors are worried that new tariffs will lead to inflation, which may affect the point of view of digital assets.

Chris Weston, head of PepperStone research, said: “Encryption is indeed the only way to express risk on weekends, and in such news, cryptocurrencies resort to risk agents.”

Nick Forster, the founder of DEFI Derivative Tool Agreement Derive, believes that Trump’s new tariffs are more likely to promote inflation and inhibit the emotions of cryptocurrencies.

“We have seen signs of market fluctuations, because after these tariffs and wider economic uncertainty, the 30 -day hidden volatility of BTC has increased by 4 % to 54 %.”

The founder of the DEFI derivative tool agreement added that he hoped that this volatility would continue, because “more negative catalysts may be launched in the next few weeks.”

Bitcoin prosperity?

Jeff Park, the head of Alpha Strategies of Bitwise Asset Management, proposed that Bitcoin prosperity may be a potential positive impact of the Trump tariff policy.

Related reading

Parker explained that the new tariffs may weaken the US dollar and create a favorable situation, which may promote the growth of Bitcoin. It is said that as tariffs increase, this will affect domestic consumers and international trade partners. This may cause foreign countries to make foreign countries. Residents walked towards foreign residents to the BTC to deal with currency depreciation.

Charts from Getty Images, Charts of TradingView