Bitcoin Holds Steady Amid NASDAQ Decline, Analyst Calls It ‘Extremely Bullish’

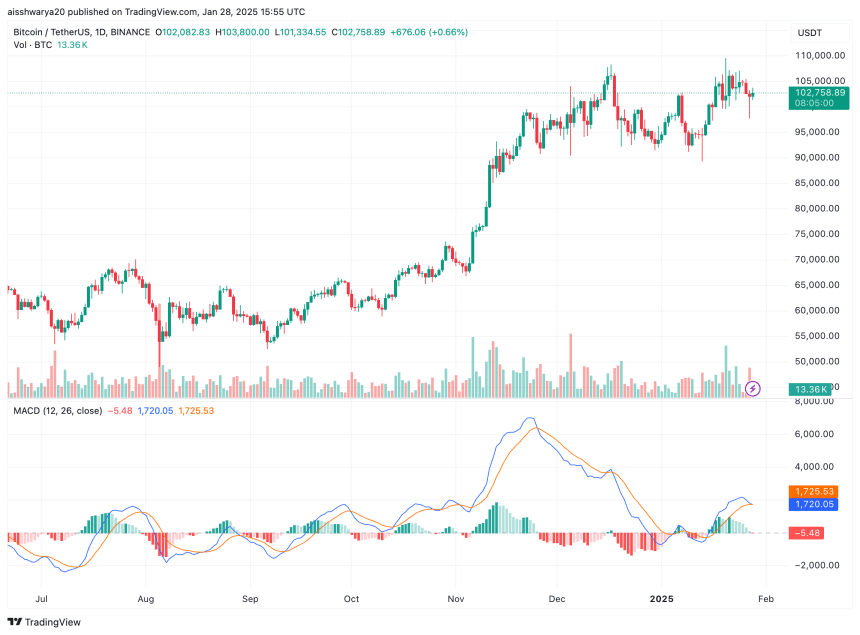

Yesterday, Nasdaq fell 3 %, because China’s low -cost AI model Deepseek triggered shock waves in the technology industry, triggering a huge sales of American chip manufacturers. Although Bitcoin (BTC) also dropped to a low of $ 97,777, flagship cryptocurrencies have recovered most of the losses since then, exceeding the key price level of more than $ 100,000.

Although Nasdaq is sold, Bitcoin remains strong

The elasticity of Bitcoin in the stock market is “extreme bullish”, explain Bitwise’s European research director Andre Dragosch. They emphasized that in the past two days, the leading digital assets have performed better than Nasdaq, and currently show limited downside risks.

It is worth noting that since it fell to $ 97,777 yesterday, BTC has received nearly $ 5,000, and the transaction price at the time of writing is $ 102,758. In contrast, the S & P 500 Index’s last transaction yesterday fell 1.5 %.

Related reading

Different investors have further proved the separation between BTC and the stock market. According to the current “fear and greed index” in the stock market Sit up In 44/100, investors continued their fear after yesterday’s market downturn.

Instead, the index’s reading of the cryptocurrency market is 72/100, indicating a sense of greed for digital assets. However, this may also indicate that the cryptocurrency market lags behind the stock market and may be further reduced when the stock market is seeking stability.

At the same time, Keith Alan shared postal On the X, the short -term sluggishness of BTC is regarded as an opportunity to tilt and increased his BTC position. Allen pointed out:

The core of the $ 97,750 should not shake your confidence in the operation of the Bitcoin Bulls, but it should remind you that when the market surpasses the publicity, it is deeply corrected and it is likely to develop.

Similarly, experienced encrypted traders and analysts Rekt Capital shared The opinion of the current price momentum of Bitcoin shows that it is “relatively early” during the parabolic stage of BTC. Historically, the average of about 300 days on average at this stage, while BTC is currently 82nd.

Is there no BTC top?

Although BTC reached the highest historical highest historical (ATH) of $ 108,786 on January 20, some analysts believe that cryptocurrencies have not reached the top level. According to the analysis of StockMoney Lizards, by November 2025, the peak of the BTC cycle may reach $ 400,000.

Related reading

The further rally of BTC seems to be reasonable because “whale” start Since Donald Trump’s in office, cryptocurrencies have been accumulated. other predict It is recommended that the BTC may reach a peak of $ 249,000 under the Trump administration.

From a long -term perspective, BTC may be as high as 1.5 million US dollars according to Grathn the law of Metcaoff. At the time of release, the transaction price of BTC was $ 102,758, an increase of 1.1 % in the past 24 hours.

Charts from unsplash, charts of X and TradingView.com