Bitcoin To $181,000? Mayer Multiple Reveals When BTC Will Become ‘Overbought’

According to Meyer multiple, Bitcoin has not been bought. This is the level that BTC needs to break through to enter this field.

Bitcoin Mayer multiple is currently worth 1.37

In a new postal On X, analysis company GlassNode discussed the latest trend of Bitcoin Meyer. this”Miye Dudu“Here is an index that tracks the ratio between the spot price of BTC and its actual price 200 -day mobile average (MA)Essence

As GlassNode explained,

200DMA is a widely recognized tool for macro bulls or bear market prejudice. Meyer multiples the gap between BTC and this long -term average.

When the value of the Meyer multiple is greater than 1, the price transaction of cryptocurrencies is higher than its 200 -day mobile average. On the other hand, lower than this level means that the asset is lower than this historical level.

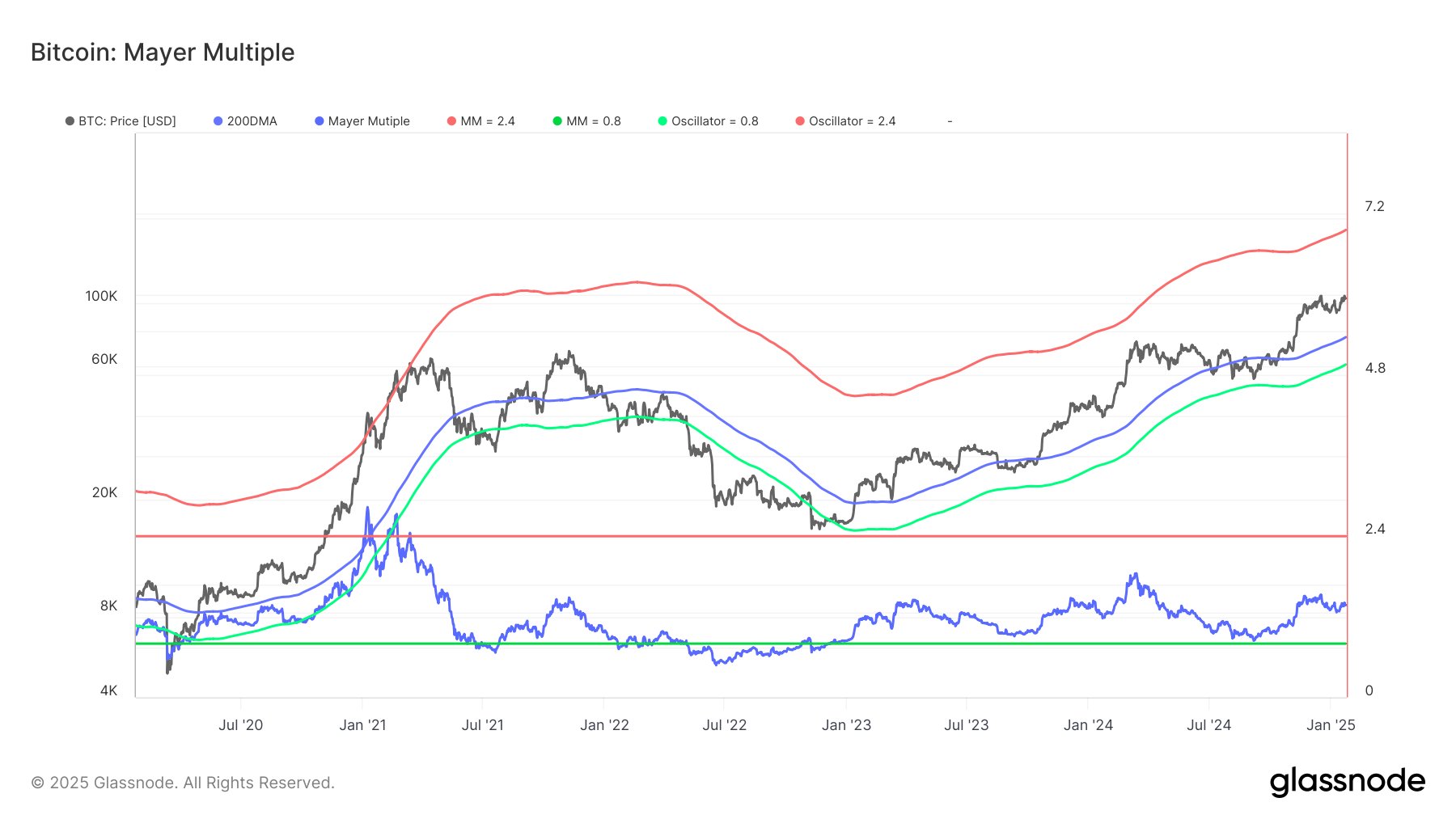

Now, this is a chart shared by the analytical company, showing the trend of Bitcoin Meyer multiple in the past few years:

As shown in the figure above, the current value of the Bitcoin MAYER multiple is 1.37, which means that there is a significant distance between the asset and the 200 -day moving average.

In the chart, GlassNode also emphasizes three lines, of which BTC spot price assumes that the Meyer multiple is equal to historical related values. The green level (bottom) corresponds to indicators with a hypothetical value of 0.8.

Bitcoin is usually lower than this level. The line is currently located around $ 60,000, which means that the asset must fall below the line to reach the bottom area.

Red level (top) is currently at $ 181,000. According to this price, the Meyer multiple of cryptocurrencies will reach 2.4. Exceeding this level usually means that the asset is being bought. The analysis company pointed out: “Although the BTC is higher than the 200 -day moving average, it is still far from the super -buying area.”

If Bitcoin must exceed the level of $ 181,000 in the current cycle, it must break through this level. However, whether the asset will completely break through the level of this cycle or whether it will be touched before this situation will be observed.

The last line in the chart (the blue line in the middle) is the 200 -day mobile average of the asset. In other words, Meyer multiple is exactly equal to 1 line. BTC in merge Last year.

Bitcoin price

As of writing this article, the price of Bitcoin was about $ 106,600, up nearly 2%in the past 7 days.