XRP Forms A Bullish Pattern In 4-Hour Chart – Analyst Expects $4.20 After Breakout

XRP is currently at a critical moment. It broke its historical highest level eight days ago and is at a critical level. Despite the inherent volatility of the market, the price action is still strong, which has inspired the optimism of investors and analysts. As a broader encryption market enters the bullish stage, XRP has attracted people’s attention in the next major rally.

Related reading

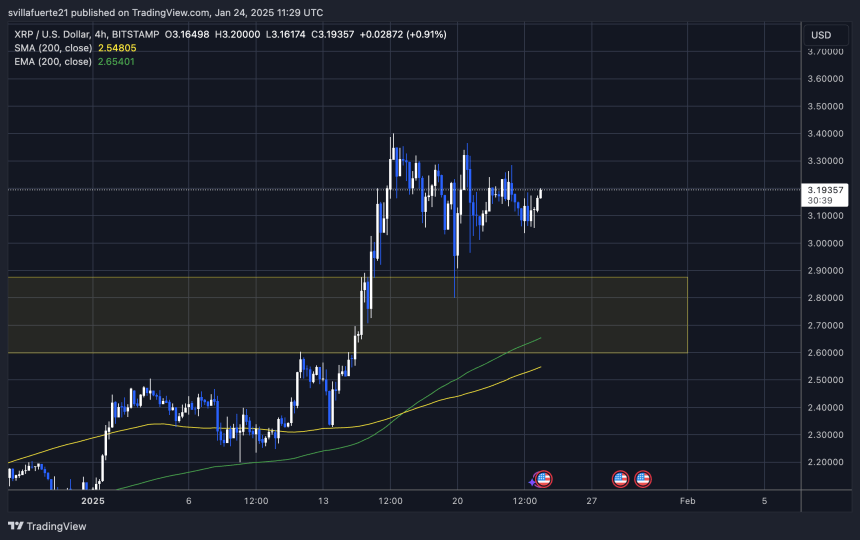

Market emotions are becoming more and more positive, and analysts predict the huge change in price discovery. Among them, cryptocurrency expert Carl Ununefelt shared an interesting technical analysis on X, emphasizing the bullish setting of XRP. According to the girl, the price of the bullish five -corner flag mode is formed within 4 hours, which is a classic indicator of potential rising continuation. This model shows that XRP is consolidating before major breakthroughs, which may push prices to unknown areas.

With the development of excitement, investors are paying close attention to check whether XRP can maintain its momentum And use the market environment. Looking at the breakthroughs of The Blulish Tennant can confirm the trajectory of XRP’s new milestone, thereby enhancing its position as one of the most dynamic assets in the market.

XRP is about to enter the price discovery

XRP is about to enter the price, because a broader crypto market signal is a rally for bullish. After a strong pump in early November, the price action of XRP was still flexible, and it would be optimistic about the great growth in the next few months. With the decisive phase of the market, XRP continued to stand out, becoming the biggest competitor for investors and businessmen to change their life returns.

Famous encrypted analyst CarluneFelt Share deep technical analysis on XHighlight the bullish setting of XRP. According to RuneFelt, the price of the bullish pentagram is formed on the 4 -hour timetable, which is a classic indicator for potential rising continuity. Based on this settings, RuneFelt set the target target to $ 4.20 in the next few weeks, which is consistent with the more expectations of the rally within the market.

The bullish triangle flag shows that XRP is consolidating before the next major action. If the model is established, the breakthrough can push XRP to the unknown field, which confirms its position as a leading asset in the market cycle.

Related reading

With the development of the market for the potential explosion, XRP’s interests are good, and this motivation can be used. With its strong price action and favorable technical settings, XRP may provide a lot of returns. When XRP prepares for the next step, investors and traders are paying close attention, which may be a key rally.

Price test critical level

The current transaction price of XRP is $ 3.19, and the highest increase in history before last week has risen. The recent price action highlights the strength of the XRP in this bullish stage to attract investors’ interest. However, assets have entered a short merger stage, which may prepare for its next actions.

In order to keep the bull’s momentum and rise, it is important to recover the resistance level of $ 3.25. More than this trademark may re -ignite the purchase pressure and pave the way for the new historical highest point. To achieve this goal will strengthen the bullish structure and consolidate XRP as one of the best assets of the market.

Instead, holding a support level of $ 3.05 is equally important to confirm the current trend. This level has become a key defense route, and the collapse below may indicate weakness, which may lead to deeper correction and lower testing areas.

Related reading

As an XRP merger, investors are closely monitoring these key levels. Breakthroughs of more than $ 3.25 or strong defense $ 3.05 will provide a more obvious direction for the next step of XRP. In the future, it will determine whether the XRP can maintain its bullish momentum or face the temporary backwind.

Featured images from Dall-E, chart of tradingView